Scams are everywhere these days. The sensational trial of US faux-heiress Anna Delvey is getting a lot of press, as is the AFL “footy friendships scam” — but sadly scams are now so prevalent that it is only the most outrageous ones that are newsworthy.

You need only open the junk folder in your email account to find a dozen attempts to hoodwink and delude you. Just this week, a stranger called Mavis Wanczyk pledged to donate $5 million to me, “from part of my Powerball Jackpot Lottery of $ 758 Million Dollars”.

And that’s not counting all the phishing scams from organisations purporting to be my bank, telco or utility provider. With the end of the financial year accelerating towards us, tax scams will soon be in ascendance and many Australians will fall into their grip, losing millions. Most victims will stay silent about it too. Scams remain under-reported because victims are ashamed of their involvement in their own deception.

A booming business

According to Scamwatch, Australians lost almost half a billion dollars to scammers last year. The figure is up by 44% on 2017, and still only counts those scams the Australian Competition and Consumer Commission is aware of. The average amount people reported losing was $6000.

Scams hit people of all ages, but older people report losing more money than young people (this probably makes sense since they tend to have more money than young people).

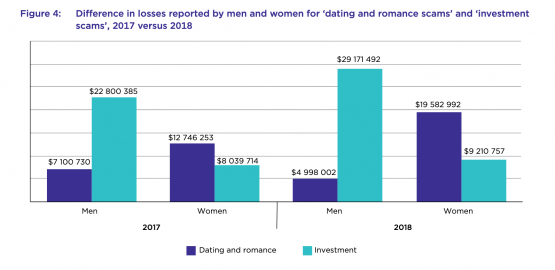

According to the ACCC, the two most costly types of scam are to do with romance and investment. Both deceive the victim at a hopeful moment in their life. Men are more likely to lose money to investment scams, while women are more likely to lose money to romance scams, as the next chart shows.

One victim of a romance scam describes meeting someone on Instagram, who they believed was a US Army captain:

I fell in love with him and trusted everything he told me. He first asked for money in relation to a precious box containing cash and gold that came into his possession during his mission in Syria. He told me that if he could get the box safely back to the US then he could retire and then come to be with me.

The victim lost $30,000 while funding what they believed were various expenses the “Army captain” faced. They eventually reported their story to the ACCC, which published it as a warning to others.

The law

While most scams are illegal, prosecuting scammers is extremely difficult. Many scammers are based overseas and their crimes are in other jurisdictions. Instead of fighting in the courts, the ACCC is working with the major banks to help reduce impersonation of their communications, and to help reduce payments to scammers through their systems.

As this crackdown gains traction scammers are increasingly demanding payments in online gift cards and cryptocurrencies. At this time the primary tool at the disposal of the ACCC to combat scams is “education, awareness raising and engagement with the public”. But scams will always evolve to stay one step ahead.

Scams are a particularly horrible crime because they rely on the victim’s involvement in their own fleecing. Scams exploit those two very human qualities — trusting and wanting. Wanting something — money, home repairs, love — makes you vulnerable. Trusting someone who promises to bring it to you is the next natural step.

While we can all keep an eye out for warning signs, it is ultimately impossible to completely protect yourself. A person who neither wants nor trusts is barely part of society. As savvy as we may imagine ourselves to be, we are all vulnerable to a scam that is sophisticated enough.

What do you think should be done to combat scams in Australia? Send your thoughts to boss@crikey.com.au. Please include your full name.

We all have stories. My slightly demented and bewildered mother paid $500 to some people who came to her front door to steam clean her sofa and armchairs, in 1998, so it’s hardly new.

I get daily phone calls from someone with an Indian voice advising me about solar panels, being cut off from the NBN tomorrow (it’s not actually in my area yet), and faults with my computer.

One time there was this Indian-accented man on the phone, purporting to be from Apple Technical Dept to talk about my Apple computer (I use a PC, not Apple). I asked him how it felt to be working in a job where he was trying to fool people with lies and false promises. He protested that he was genuine. I replied that I knew he was not. He said “Fuck you, mate”, and hung up. Win to me.

Good luck to them demanding cryptocurrencies from me. I wouldn’t even know where to start!

“Scams hit people of all ages, but older people report losing more money than young people (this probably makes sense since they tend to have more money than young people).”

It may also be that they are less technically literate.

An offer over the phone to fix a computer problem they didn’t know existed, for instance, would sound reasonable.

Though my mum always answers such calls with “what computer?”.

“I fell in love with him and trusted everything he told me. He first asked for money in relation to a precious box containing cash and gold that came into his possession during his mission in Syria. He told me that if he could get the box safely back to the US then he could retire and then come to be with me.”

The story the scammer told sounds to me like theft, at a minimum, and possibly a warm crime (“Unlawful wanton destruction or appropriation of property”, https://en.wikipedia.org/wiki/War_crime).