The seemingly bland news that Chinese property developer Poly Global has its eye on a major Sydney property with a $260 million price tag was published like a standard press release in The Australian‘s commercial property section this week.

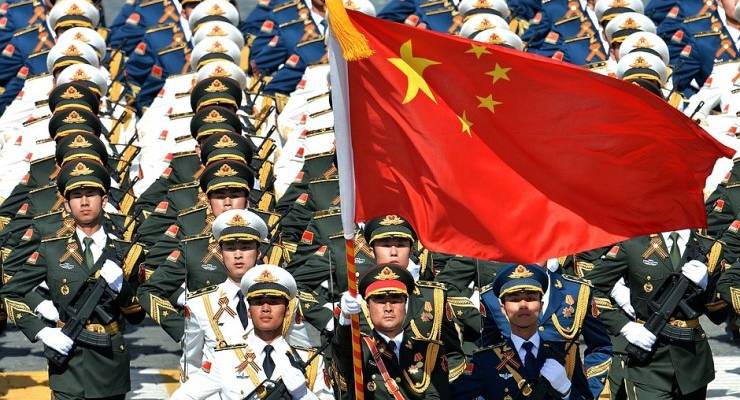

But anyone with even a passing knowledge of China’s 102 state-owned enterprises (SOE) will have pulled up with something of a start. The China Poly Group Corporation, the ultimate parent of Poly Global, is one of Beijing’s most powerful and opaque companies, widely regarded as being controlled by the People’s Liberation Army.

The group also owns manufacturer Poly Technologies, one of China’s — and the world’s — biggest and most notorious arms dealers, supplying regimes in Zimbabwe and Myanmar.

Poly Group is set apart from other large Chinese companies by its opaque system of control by former senior military officers. Analysts believe it only nominally reports to the state-owned Assets Supervision and Administration Commission of the State Council, the arm of government that controls the major SOEs.

Poly Technologies has been described as the pillar company of the Poly Group. Its other main arm is Poly Real Estate, which formed Poly Global to operate initially in Australia before expanding. It was reported as having $62 billion in global revenue in 2017 and a $2 billion pipeline in local projects by 2018.

Poly Australia executive director Steve Wang told The Australian Financial Review last year that Australia “is a very important market and a global expansion pad. Our experiences gained here we can share with our American and UK businesses.”

Poly Global’s expected Sydney investment comes at a time when a range of big Chinese property players — like Wanda Dalian, Anbang and Fosun — are pulling back from Australian and global property markets, which look increasingly risky. As Wang told the AFR, Poly is instead “stepping up” investment.

Poly Group consists of a bewildering web of subsidiaries, listed companies and local branches that span an increasing range of sectors including mining, fishing and entertainment firms. Poly Auction has emerged in recent years as the world’s third largest auction house, with headquarters in Sydney and Melbourne.

Not all are seem so benign: according to reports, US intelligence suspected China Poly Ventures Company of delivering equipment to Pakistan’s missile-making National Development Centre in 1999. The US government also sanctioned Poly Technologies in 2013 for allegedly violating sanctions against Iran

Poly Group’s subsidiaries, including Poly Global and Poly Sydney, might argue they have nought to do with the organisation’s arms-dealing corner, but they cannot escape the fact that they share a parent company acting at the behest of Beijing.

So next time a seemingly innocent Chinese company comes charging in for a deal worth a quarter of a billion dollars, it might be a good idea to look under the hood and figure out if you want to do business with an inscrutable, unaccountable group that trades in weapons.

It might not be a Beijing conspiracy, but one never knows.

They are going to need somewhere for their troops to live.

‘ . . . it might be a good idea to look under the hood and figure out if you want to do business with an inscrutable, unaccountable group that trades in weapons’ such as Rolls Royce, BAE Systems, Lockheed Martin, Boeing . . .’.

It’s hard to fathom such sinophobia. There is information of genuine interest here, but the tone is hysterical scare-mongering. Is it now turn to worry about yellows under the bed?

It is better to raise the alarm whilst they are under the bed before they get into bed with you then push you out

Exactly RfP. Are to get a weekly sermon on the evils of those sneaky yellow devils ?

“… biggest and most notorious arms dealers, supplying … “ Saudi Arabia, Israel and anyone else not on the arbitrary sanctions list. Competition in the arms business is so sordid.

For the sake of full disclosure let’s have a nationality leader board of all Sydney commercial wall estate. My bet is on the UK. Rule Britannia.

Pretty crazy that there exists corporations that make money doing awful things in order to enrich the worst people you can think of. Hope there aren’t any others! Well, I got a patrol to resume.