Australia, we have a dairy problem. We love dairy farmers too much.

Charities and politicians vie to demonstrate who can do the most for dairy farmers. Supermarkets have even sold special high-price milk that supposedly helps farmers.

But our touching concern for the farmers has a tendency to distract us at key moments. Such as last week, during the sale of Lion Dairy & Drinks to Mengniu Dairy.

Lion Dairy & Drinks, which owns 11 Australian processing plants plus brands Pura Milk, Big M, etc, has been owned by Japanese company Kirin since 2008. They’ve been trying to sell it for some time, and offering successive price cuts on the business. Last week it finally effected a sale for $600 million to Mengniu, a Chinese company based in Inner Mongolia.

Mengniu Dairy is listed in Hong Kong, but a large minority ownership chunk still rests with a Chinese state-owned consortium.

Barnaby Joyce argued the deal should go through only if it came with a floor price for milk. I nearly fell off my chair.

The acquisition of Australian-based food manufacturing by Chinese owners is a topic of potential strategic relevance. Which is why it was so disappointing to see debate around the acquisition focus almost solely on dairy farmers.

Foreign ownership

Theoretically, owning an asset in Australia does not confer on the owner a right to harm Australians, nor a right to harm the national interest. This is the basis for permitting foreign investment in Australia at all.

What’s more, foreign investment often brings economic advantages. Nobody believes all the ideas and money we need to develop our country can be found here.

Often we benefit from foreign ideas and ways of doing business. This is easily seen by the introduction of Aldi to Australia. That company had new approaches and was able to expand the economy and benefit consumers.

The other thing foreign companies bring is abundant capital. An example of this is Singaporean companies building new apartments and, back in the bubble years, Japanese companies building hotels.

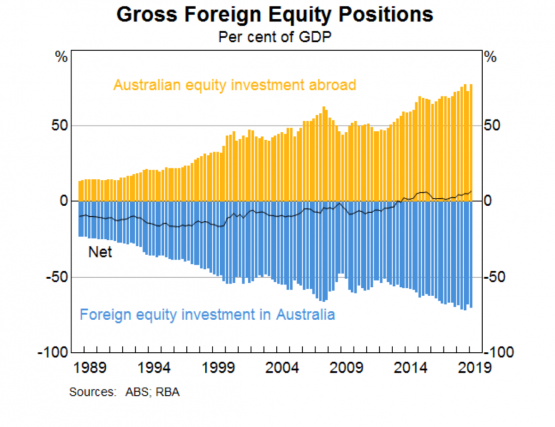

Australia should not be seen as a “victim” of foreign ownership. In fact, since 2013 we own more foreign equity than foreigners own Australian equity, as the next graph shows.

So we get a lot from foreign ownership and the laws apply no matter who the owner is. In theory it should be open slather, right?

The Foreign Investment Review Board’s “national interest test” reminds us the theory does not always apply. Sometimes, apparently, ownership of assets creates circumstances that could undermine us.

Recent points at which the national interest test have been applied include prohibiting the takeover of the Australian Stock Exchange by its Singaporean counterpart, sale of farming lands owned by S.Kidman and Co to a Chinese consortium, and sale of GrainCorp to US company ADM.

Australia’s national interest test is famously ill-defined, a fact that annoys the World Trade Organisation (WTO) greatly. It makes the application of the test extremely idiosyncratic. But it was not applied in the case of Lion Dairy & Drinks.

China

Lion Dairy & Drinks is already foreign-owned. Japanese ownership has not harmed the national interest in any apparent way. And foreign ownership in our dairy sector is well established. Parmalat is Italian. Fonterra is from New Zealand.

But China may be different. These other companies are mostly simple capitalist enterprises. A Chinese company is certainly capitalist, but never quite so simple. The question of when it could be pursuing Chinese state goals is murky.

What’s more, the China we are dealing with may be different from the China of three years ago. The prospect of major strategic tensions between the West and China is heightened by five big developments.

First was President Xi Jinping making himself president for life in 2018. Second is the mass incarceration of Uyghurs in concentration camps. Third is the conflict in Hong Kong. Fourth is the trade war with the USA. Fifth is recent allegations that China has been attempting to get its agents elected to our national parliament.

In 2019, China does not appear as quite the stable, economy-focused entity it once did. A possible era of great power competition is developing. Journalist Martin Wolf has compared conditions to the era prior to World War I.

But according to a 2015 study by ANU academics, the idea that Chinese foreign investment is a Trojan Horse is overblown.

“A foreign state that means to harm Australia will undoubtedly find more effective methods than through expensive and highly publicised investment projects,” the studies authors noted.

So does China owning things on Australian soil give the Communist Party power over us? Or could it be the other way round? Are we strengthened by their economic outreach? In the most extreme conflict scenario, geography matters. Local assets can be controlled locally. But if it comes to that, all is already lost. Most of our analysis should focus on milder scenarios.

These are extremely challenging questions, and the answers are not simple. But it is these uncomfortable questions we should be addressing as more parts of our economy move into Chinese hands. Not settling into the familiar and comfortable groove of worrying about dairy farmers.

Is Australia taking the right approach to foreign investment? Send your thoughts to boss@crikey.com.au. Please include your full name for publication.

This is how an ANU a health economist recently summed it up:

“Market reality for farm businesses facing climate change and globalisation. It is more profitable to turn it into milk powder and send $2 billion worth to China instead of supermarket shelves of $1 milk. It’s called value adding but it’s not value adding in China where valuing adding baby formula marketing is destroying breastfeeding and it’s not value adding when it is essentially exporting our water in the middle of drought and an increasing likelihood of drought due to climate change.

But where are the policies for industry adjustment and regional policy?

The federal and NSW governments are just looking after their billionaire mates not regional communities or future oriented businesses.”

It’s weird watching Cousin Jethro talk out of the other side of his mouth – as weird as watching Murdoch’s rags crying crocodile tears – over the treatment of dairy farmers now.

* Which government was it that opened the gates to such exploitation when they deregulated the dairy industry? Which rags supported the deal?

* When the grocery giants cut prices and squeezed the nuts of dairy farmers under the premise of “lowering the cost of living” (while maintaining their own company profits) – what did Jethro’s Coal-ition and their Murdoch cheer-squad do?

SFA is what they did.

….. And they think farmers didn’t notice?

The way China manipulated the market against Bellamy’s – cutting off imports of their products, lessening the value of shares – then coming in with shovels to clear up?

“What’s wrong with that?”?

If any fool thinks foreign ownership is good for the host nation, try buying Chinese companies/business or farms in China, they`re not as stupid as us, they know once they own these assets and especially under this government all the profits go to them and they are even allowed to import their own cheap workers.

If we weren’t so stupid it would be fine. We’d pay slightly more to buy milk from producers who look after the land and pay farmers properly. Like Country Valley in Picton or Norco (which I believe is still a farmer owned co-op) or any of the other new, smaller producers giving you a local product.

Price the externalities

I notice, according to Wikipedia, Mengnui Dairy has its registered office in the Cayman Islands. I wonder how much company tax they will pay in Australia.

The homeland of so many great Australians!

When you talk about introducing innovations into the industry, this is definitely a thing. They will bring in fully shedded cows that never go outside, never walk in the open, just be fed hay in big sheds.

Personally I think this is appalling, but there’s nothing that can be done to stop it.