Take the arrest of an Iranian-born Turkish citizen during a jaunt to Disney World. Factor in the irrepressible Rudy Giuliani, who briefly served as the arrested man’s lawyer. Add a dash of Turkey’s authoritarian leader, Recep Erdogan, a favourite of President Donald Trump. Mix in a massive leak of more than a million documents from a British offshore shell company provider.

And don’t forget to include a Miami cameo.

What you get is a lesson in how Iran’s national oil company and its subsidiaries hopscotch the globe, with the help of intermediaries, in search of tax havens that help it try to wriggle free from the grip of crippling U.S.-led sanctions.

The glimpse comes from a cache of leaked documents from a British offshore provider, Formations House. The massive data set of communications, incorporation certificates and other documents was leaked to journalists, and after months of collaboration, news organizations across the globe are collectively publishing stories starting this week under the title #29Leaks.

The name is a nod to the address of Formations House at 29 Harley Street, an upscale neighborhood in London. Similar to the 2016 Panama Papers, the leak of documents again shows that when the veil of secrecy surrounding offshore services is pierced, the light that shines in is often revealing.

The documents were given to journalists by the anti-secrecy group Distributed Denial of Secrets, or DDoS. It did not describe how it obtained the documents, and has said it will make them public after investigative journalists have finished their review.

When news outlets collectively asked questions, Charlotte Pawar, who took over Formations House in 2014 after the death of her stepfather, Nadeem Khan, while he was awaiting trial for facilitating money laundering, said that the information was stolen. Rather than promote public transparency, she said, DDoS tried to extort her. She did not provide evidence to support that claim.

“Based on this fact, you are therefore also party to extortion attempts and crime,” Pawar charged.

Among the Formations House curiosities is that many of its employees used European-sounding names like Oliver Hartmann but were actually outsourced agents working with customers electronically from Pakistan. Hartmann was actually Syed Rizwan Ahmed, a Pakistani from Lahore who admitted it when reached and was directly involved in the Iranian oil shell company activity.

A former Formations House employee, who spoke on condition of anonymity, said at its height dozens of Pakistanis worked under false identities on behalf of Formations House.

The false identities are important in the context of Iran, a neighbour and geopolitical rival of Pakistan and a country that successive U.S. administrations have tried to isolate because of its nuclear ambitions.

The Formations House documents provide a more detailed view of the accountants and lawyers who help Iranian oil interests set up in tax havens offering secrecy for sale. This is not illegal by itself. Offshore shell companies in these places can have legitimate uses such as keeping private the details of merging businesses. However they are sometimes also used to hide illicit fortunes garnered through corruption, smuggling and fraud.

Devil in the details

Included in the voluminous Formations House documents is a register of shareholders in an offshore company called Naftiran Intertrade Company Ltd, or NICO. This list of shareholders was attached to an email from December 2014, declaring the state-owned National Iranian Oil Company as the overarching shareholder and having complete control over NICO. Also attached was a register of NICO directors listing five Iranian nationals.

NICO, the gasoline import arm of the state oil company, came to renewed international attention in March 2016 after the arrest at Miami International Airport of Reza Zarrab. He flew to Florida to visit Disney World and on that trip was charged with conspiring to evade U.S. sanctions through an elaborate gold-for-gas scheme between Turkey and Iran, and using global banks to process transactions on behalf of Iran.

Prosecutors contend that Zarrab and a co-defendant, Mehmet Hakan Atila, who was a director at Turkey’s Halkbank, schemed to help Iran skirt U.S. sanctions by trading Turkish gold for oil and natural gas. Using companies across the globe, they facilitated $20 billion worth of transactions.

“High-ranking government officials in Iran and Turkey participated in and protected this scheme,” [it said in] the Justice Department in October 15, 2019 statement announcing charges against Halkbank, which incriminated Zarrab. “Some officials received bribes worth tens of millions of dollars paid from the proceeds of the scheme … and to help shield the scheme from the scrutiny of U.S. regulators.”

Zarrab pleaded guilty in October 2017 and turned against Atilla, who was convicted on Jan. 3, 2018, and after serving a total 32 months behind bars was returned to Turkey and has since become the head of the Istanbul stock exchange.

Shortly after his arrest, Zarrab, who is married to a Turkish pop star and has citizenship in Iran as well as Turkey, implicated Turkish President Recep Erdogan as having approved the operation. Zarrab was represented briefly by Rudolph Giuliani, who has since become President Trump’s personal attorney. Zarrab was also a focus of Special Counsel Robert Mueller III’s prosecution of Trump adviser Lt. Gen. Michael Flynn for lying under oath the FBI. Mueller looked at Flynn’s lobbying for Turkey.

The mid-October, six-count indictment against Halkbank for fraud, money laundering and sanctions-evasion was tied to NICO and the state oil company. Prosecutors said that bank has been the “sole repository of proceeds from the sale of Iranian oil” to Turkey and also cited Zarrab transactions involving NICO.

Halkbank caught the attention of the top Democrat on the Senate Finance Committee, Oregon’s Ron Wyden, who has written to Treasury Secretary Steven Mnuchin asking if President Trump sought to help the bank avoid sanctions. Wyden has crusaded against offshore service companies and the anonymous shell companies they provide.

“Just like we’ve seen in the Halkbank scandal, entities are eager to exploit the secrecy afforded by anonymous shell companies to evade U.S. sanctions on Iran, undermining our national security,” Wyden said in a statement on the Formations House leak. “Ending anonymous shell companies would make it easier for law enforcement to ‘follow the money’ when investigating complex financial crimes like sanctions evasion.”

A grand jury indictment against Zarrab in 2017 also listed a number of transactions that aided Iran, including some that benefited both the National Iranian Oil Company and NICO.

The leaked Formations House emails obtained show that NICO has repeatedly switched domiciles for more than a decade, and with the help of its Swiss partner-firm, Naftiran Intertrade Co (Sàrl), tried to circumvent U.S. and international sanctions aimed at curtailing Iran’s nuclear program.

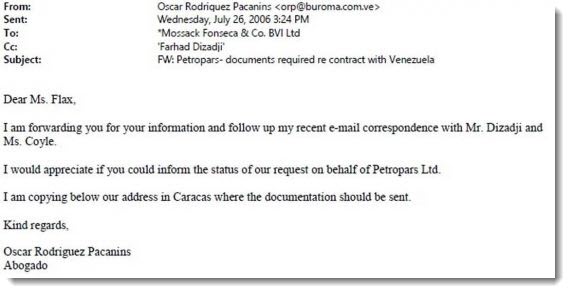

NICO also appeared in the April 2016 Panama Papers, the massive leak of documents from offshore legal services firm Mossack Fonseca, a now-defunct Panamanian law firm and corporate services provider. Documents in the Panama Papers show the firm actually resigned from some of Iran’s oil-related shell companies as early as 2010 – before global sanctions took effect in 2012 – and the Formations House documents suggest a hand-off of sorts.

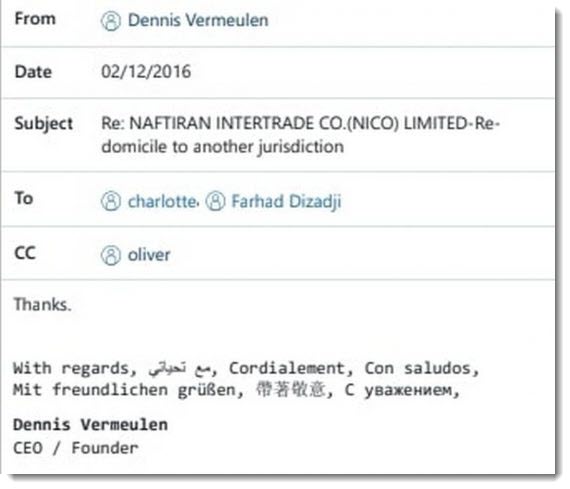

The new documents show a chain of communications between a Dutch offshore services provider, Dennis Vermeulen of INCO Business Group, Formations House employees Oliver Hartmann (aka Syed Rizwan Ahmed) and Charlotte Pawar, and Farhad Dizadji, owner and senior partner of London-based accounting firm Roberts & Partners.

A Formations House document dated August 19, 2014, attached to one of the emails, declared Roberts & Partners as NICO’s agent “in respect of all matters concerning the Company and its administration.” The document is signed by Mohsen Paknejad, then the managing director of NICO. Two years later, Paknejad became deputy director of the state oil giant.

Roberts & Partners is shown working with Iranian oil shells in the Panama Papers too, suggesting Iran’s oil company has long worked with middlemen to cloak its international presence.

“We have acted, and will continue to act, in accordance with applicable laws and regulations, including in relation to sanctions,” Dizadji, speaking for Roberts & Partners, said in response to questions from the Herald and McClatchy. He declined to discuss details.

The relationship between NICO and INCO Business Group, the Dutch firm, is unclear although emails suggest that INCO’s Vermeulen was acting as their agent along with Dizadji from at least 2014 to 2016.

Pawar, who took over for her late, criminally charged stepfather, declined to discuss Iran and her company, Formations House, with specificity, but noted that British firms can work with Iranian individuals or companies “where their industry is outside any embargoes.” NICO at the time was under sanction, however, and Pawar noted “this specific client was handled by an agent in [the] Netherlands, where all paperwork and documents were legalized.”

When first contacted, Vermeulen, of the Dutch firm INCO, told the Herald and McClatchy over email, “We do not work for any Iranian government organization, and have never been in contact with them”.

Vermeulen and his firm “in no way have facilitated any firm with the aim of ‘coping’ with appropriate sanctions,” he said, adding that “we will not, as a matter of policy, communicate with the press belonging to a country outside the Netherlands”.

However, when presented with emails showing his correspondence with Dizadji and Formations House, Vermeulen acknowledged a limited role in contact with Roberts & Partners to ensure a Malaysia-registered company remained in good standing.

Over a period from October, 2012 to June, 2015 – when the documents show Dizadji and Vermeulen were acting on behalf of NICO — European and British sanctions listed the company as an entity “involved in nuclear or ballistic missile activities and … providing support to the Government of Iran.”

The sanctions on NICO, however, amount to a shifting timeline. The European Union sanctions took effect in 2012, followed in early 2013 by the United States. A nuclear deal negotiated by the Obama administration and foreign partners lifted sanctions on NICO and hundreds of other Iranian companies in June 2015, in exchange for Iran submitting to nuclear inspections and monitoring. President Trump reimposed the U.S. sanctions on NICO on May 8, 2018, but European powers have not.

History and hopscotch

The National Iranian Oil Company was formed in 1951 when the Iranian parliament nationalised the oil sector. That was reversed in 1967 and a consortium of global oil companies controlled the industry until the Islamic Revolution in 1979, when the state took the reins of the national oil company anew.

NICO was established in 1991 in Jersey, a tax-haven island off the coast of France that is independent but part of the British commonwealth. NICO also set up an executive services company in London to better “perform its commercial responsibilities.”

But in 2003, NICO’s management shifted on paper out of London to the newly established offshore firm Naftiran Intertrade Co (Sàrl) in Lausanne, Switzerland — where bank secrecy laws at the time afforded great anonymity.

The European Union placed both NICO (Sàrl) and NICO on its sanctions list in October 2012. The following year the U.S. Treasury Department identified NICO as being controlled by the National Iranian Oil Company, “an agent or affiliate of Iran’s Islamic Revolutionary Guard Corps.” Both sets of sanctions listed the address of NICO’s Jersey office.

But Malaysian incorporation documents found in the Formations House leaks show NICO had already moved by then.

In January 2012, ahead of sanctions, NICO re-domiciled from Jersey to Labuan, a Malaysian island off of Borneo that is now a tax haven. The move also meant that NICO had greater geographic proximity to China, India, Japan and South Korea – four of Iran’s biggest oil buyers.

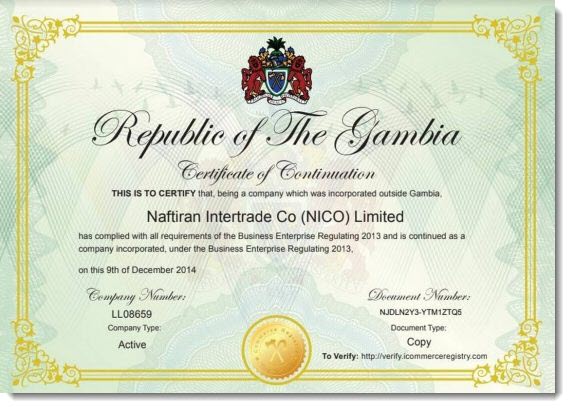

Emails from Formations House show that for over a year, NICO existed as a corporate entity only in the data servers of Formations House in London after it briefly took advantage of Gambian legislation that promoted enterprise zones. It then finally reincorporated in 2016 in the Caribbean island of Nevis, another tax haven.

While the U.S. Treasury Department had identified and sanctioned some of NICO’s related companies as far back as 2012, there is no evidence in the Formations House documents of NICO seeking to hide or change its name as it moved from one country to another.

By constantly switching domiciles, NICO may have sought to ease political pressures, according to a former senior official at the U.S. Treasury Department. The official previously worked on Iran sanctions and international money-laundering investigations and requested anonymity in order to discuss non-public matters.

Nobody home in Gambia

Formations House documents show that between 2013 and 2017 the offshore services company ran a corporate registry in Gambia, using it as a platform to sell companies and incorporate firms in the African country. They sold these companies to individuals who had been convicted of crimes, had financial licenses suspended or had been accused committing financial crimes.

A November 2014 update to UK sanctions declared a freeze of assets belonging to Iranian billionaire Babak Zanjani for assisting the National Iranian Oil Company in its efforts to evade EU sanctions and transferring “oil-related funds through Naftiran Intertrade Company (NICO).” It listed both NICO’s Jersey address and another in Tehran.

Less than two weeks after that update, on November 25, the Dutch agent Vermeulen wrote to Formations House’s Hartmann/Ahmen asking if a redomiciliation of one of his clients to Gambia would be a problem since his client had “a director from Iran.” While the director or the client was not identified by Vermeulen in any subsequent email, NICO is the only Iranian company mentioned by him in the leaked emails from Formations House.

A Gambian certificate and a memorandum of understanding shows NICO to having been incorporated in Gambia on December 9, 2014 – the same day that it was declared as discontinued from Labuan. The memorandum is signed by Roknoddin Javadi, then-deputy oil minister of Iran and managing director of the National Iranian Oil Company.

An incorporation certificate in the Formations House documents lists NICO’s registered address in Gambia in the urban sprawl of Kanifing, west of the nation’s capital. A #29 Leaks reporting partner visited that Kanifing address and found it houses only a Western Union outlet that has been there since 2012. The landlord of the shop confirmed he had never heard of NICO. Vermeulen’s company also registered at the same address.

NICO’s stay “in” Gambia was short lived. In 2016, Streber Weekly, a blog on international business and offshore banking, published a press release from the Gambian Ministry of Justice stating that the enterprise zone and the decree under which NICO was incorporated in the country were not legally authorized. That press release has since vanished from the Internet.

For NICO, it was again time to move its domicile — on paper at least.

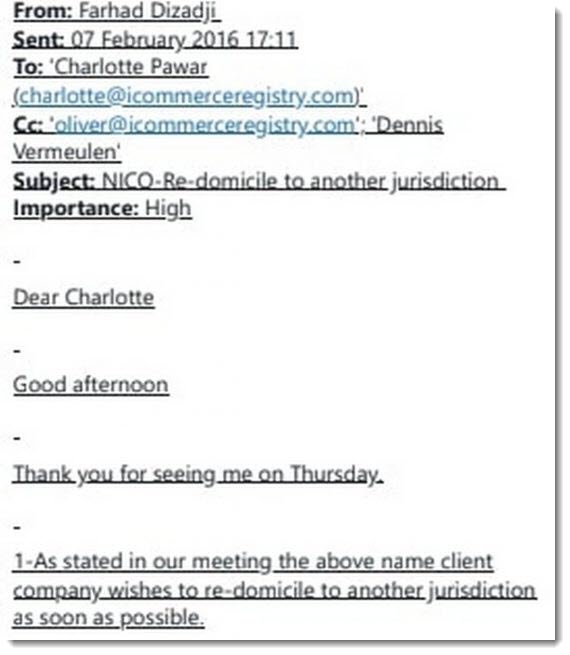

“I would like to have a meeting with you at your office at around 15:00 today … The meeting should not last more than 30 minutes,” Dizadji, NICO’s London-based agent-cum-accountant, wrote to Formation House’s Charlotte Pawar on February 3, 2016. Vermeulen, of the Dutch offshore services provider, was also copied on the email.

Another email suggests that the meeting took place the next day.

“As stated in our meeting the above name client company wishes to redomicile to another jurisdiction as soon as possible,” wrote Dizadji in a separate email on February 7, 2016. He went on to add a list of documents, including a certificate of good standing and an incorporation certificate that would be “required to re-domicile the company to Nevis.”

When McClatchy and the Herald asked Vermeulen about NICO’s multiple domiciles ending in Nevis, he responded he had “not been aware of any redomiciliation to Nevis” and that there had been no “communication related to the relocation of the corporate seat.” The Formations House documents, however, show he was copied on Dizadji’s February 7 email.

Vermeulen and Dizadji continued to correspond with Formations House about NICO’s redomiciliation over the next few months, the emails show.

On July 1, 2016, Vermeulen wrote to Charlotte Pawar asking her to charge an American Express credit card registered under his name for two certificates ordered by Dizadji, owner of the London-based accounting firm. On August 31, 2016, Dizadji wrote to Vermeulen and Pawar asking for a certificate of discontinuance for NICO from the Gambian registry. Later the next month, Vermeulen wrote to Hartmann saying that he was in London and wants to drop by his office to receive the documents.

“I think its good if we could meet anyway, since the press release of the Gambia government. I really trust that you will help us with this certificate asap,” he wrote.

Vermeulen said they never met. He did not respond when asked if he knew Hartmann was not British, but a Pakistani in faraway Lahore.

This story was reported in collaboration with the Organized Crime and Corruption Reporting Project (OCCRP), the journalism training and reporting project Finance Uncovered and London’s The Times.

This article has been republished with permission from McClatchy.

“…and a country that successive U.S. administrations have tried to isolate because of its nuclear ambitions.” No. Those nuclear ambitions were brought under international control by the international agreement that the US and Europe signed up to, which all sides honoured until the US decided to abandon it.