The private sector has been the major beneficiary of a large rise in aged care spending in recent years, evidence from the Productivity Commission shows.

The PC has begun releasing its annual Report on Government Services, which examines expenditure on services and its effectiveness. The first tranche of the report, on community services and housing, was released on Thursday.

Its aged care report sheds light on a sector that was the subject of a scathing interim report by a royal commission last year, which savaged the sector’s failings in caring for Australian seniors.

Total aged care funding reached $20.1 billion in 2018-19, up from $18.7 billion in 2017-18 and $18 billion in 2016-17, PC data shows, with around 70% of funding going into residential aged care.

This has fuelled an increase in the total number of residential aged care places from 180,000 in 2010 to 213,000 now.

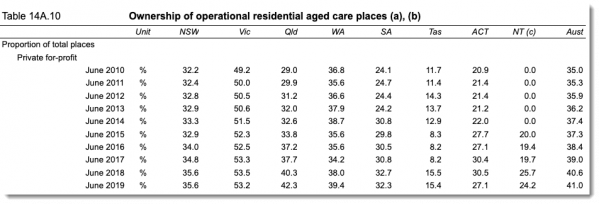

These have increasingly been places owned by for-profit service providers.

In 2010, according to PC data, around 35% of residential aged care places were run by for-profit providers. In 2019, that had reached 41%. Religious providers have fallen from 28% to 23.4%, while the other two major sub-sectors — community and charitable — had both maintained or slightly increased their share.

Over the last decade, the Commonwealth has invested heavily in home care to try to reduce the costs associated with residential care.

Home care packages have expanded from 73,000 in 2015 to 107,000 in 2019, with the package requiring the most complex level of home care, level four, expanding the most. That level now forms 28% of home care funding compared to 20% in 2015.

Level three packages have also increased from just 5% of all packages to 19%, indicating that while successive governments have tipped more money into home care, much of its has been absorbed by seniors with more complex needs.

But the spending has been successful in reducing residential aged spending below what it otherwise would have been: the number of residential care places per 1000 population has fallen from 86 to 76 since 2010.

Private sector providers have also reaped the rewards of this increased funding: just 10.3% of home care packages were provided by private providers in 2016; that has now doubled to 20.9%.

Religious providers have fallen from 32% of home care packages to 23.9%; charitable providers have also declined slightly, while community sector-provided places have grown slightly to 19%.

Private sector growth was especially strong in NSW, where 27.3% of home care packages are now provided by private sector operators, and Victoria where the proportion of private places has nearly tripled to 17%.

Since 2016-17, the number of complaints about home care package providers has soared from 690 to over 1500, despite the number of home care packages only increasing 33% in that time.

What has been good for private sector aged care service providers hasn’t necessarily been good for senior Australians.

The public should be told exactly how aged care providers spend the government subsidy. Do they spend the subsidy on providing nursing care, meals and activities for residents in aged care homes or on sports cars for their executive team? We need figures showing exactly what per cent of government subsidies account for the profits within the aged care industry.

In a single word, this article can be summarised – gouging. Yet again, proof, if any was needed, that were services are privatised, but the funding is or remains nationalised the industry sector is flooded by spivs, rentiers, corporate psychopaths and cheats. The current funding and service provision model virtually guarantees that profit-focused players enter the market, not because they care about your parents or mine and want the best for the aged, but because of a ready supply of cash that is essentially not tied to performance. In other words, a bad service provider collects, virtually, as much cash as a good service provider and the government really has totally inadequate control over the level and quality of services being provided.

Occasionally, there is a bit of noise (aka an inquiry or a Royal Commission) and outsiders get to engage in a bit of moralising about how the system is failing and those who are on the receiving end of poor services and their families get to show how the current model is a disaster, but governments have let the genie out of the bottle and there is now no way to reverse that.

Like health care generally, costs will continue to rise and the quality and availability of services will continue to decline. It is staggering the extent to which service quality is so inelastic. The bureaucrats seem to think that more funding equals better outcomes, but the real outcomes are very different.

A simple analysis of where the money actually goes will be rather revealing – who is getting wealthy? In the health sector, many doctors continue to accumulate wealth (not GPs as a rule, but specialists have long been gouging the system, simply because they can do so with virtual impunity) and I know several married specialists whose combined incomes are well over $1.0 million annually. Corporates (e.g, BUPA, but there are others) and the greedy owners of aged care facilities put in place the usual strategies for slashing costs – reduced staffing (including hiring many immigrants to maintain a bigger pool of workers so that labour costs can be kept as low as possible) and poor quality food and services – in the name of maximising profits.

This methodology is one that plays out repeatedly as governments let more and more services pass into private hands and in general, it is axiomatic that either regulation is poor, or policing of regulation is inadequate, or both.

Royal Commissions are just a cost of doing business these days, Illfares……

Privatise an essential service and the money goes out of the service and a lot of fakery takes its place. For example how much money has been wasted on dodgy job providers when the old CES did a number of other important things to boot, including refer wage theft and list dubious vacancies as such.

This !! But did we ever expect anything else from r this government ???

Always covered by the invisibilty cloak of “Commercial in Confidence”.

The invisibility cloak of ‘commercial in confidence’ reminds me of the privacy act that protects/prevents the agency from disclosing how the corpse came about, due to the protecting of the privacy of the corpse..

The waiting length for home care is approx 18 months from application date , last year 16000 people died waiting for funding approval, this I think is their plan, and funding is conditional on a large annual payment from the recipient that goes straight to the contactor.

Keep an eye out Bernard for the next big scandal in waiting. In Vic various disability services are simultaneously being privatised and having funding transferred to NDIS. Also a lot of the long standing staff are getting voluntary departure packages.

Facilities will soon be run more than ever by inexperienced and inadequately trained staff. Bickering is breaking out everywhere over who’s paying for what and how. Extended families are being leant on or cajoled into forking out.

The writing is clearly on the wall that these services will have overall funding and standards lowered. It’s also hard to work out now quite which branches of government are responsible for oversight. I hope I’m wrong, but a perfect storm looks to be brewing.

Well Mark, here we are, 6 months later, and Victorian Aged Care is an absolute cot case with massive numbers of Covid-19 cases and deaths.

Your forecast was spot on.