In the face of coronavirus, Australia has a great economic weakness. We depend on population growth to drive our economy ever onward, and our population growth is about to be greatly diminished in the COVID-19 era.

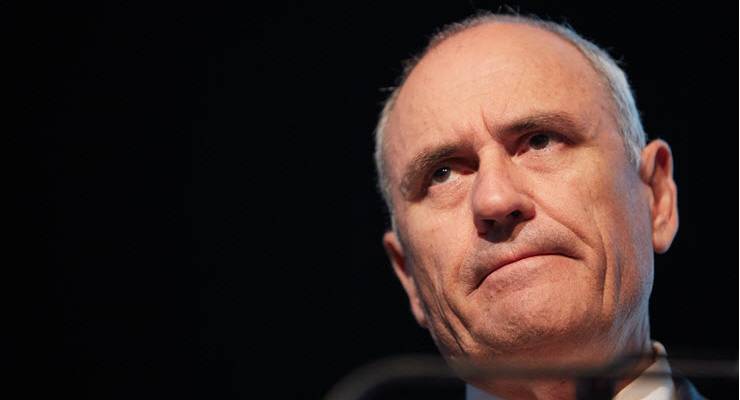

It was Ken Henry who explicitly put population growth at the centre of Australia’s economic architecture. The former Treasury secretary proclaimed his three P’s framework — productivity, participation and population.

These three have powered Australia’s many years without a recession, but one of the P’s — population — was doing an outsized share of the work.

Indeed, an economist in the US Federal Reserve System has urged the world to take Australia’s impressive record of economic expansion “with a grain of salt”.

“Looking at just GDP growth doesn’t paint the whole picture,” wrote Paulina Restreppo-Echavaria in 2019. “Australia has had three recessions since 1991 when looking at GDP per capita, the most recent one being from the second quarter of 2018 to the first quarter of 2019.”

Australia’s unusually high rate of population growth has for years helped compensate for our absence of impressive productivity growth. That population growth has recently been more about migration than births.

Bringing new bodies on shore creates both new workers and new demand, in a virtuous cycle that propels our economy forward. Until the music

stops. The record player has surely stopped now. Not only are foreigners unable to arrive in Australia, but our existing population of students, temporary workers and tourists is leaving in huge numbers.

According to acting Immigration Minister Alan Tudge, around 300,000 such people have left the country since February.

This presents an enormous hit to our economy. Fewer people buying from supermarkets and shops. Fewer people available to work in the jobs that need doing. And, perhaps not least, fewer people paying rent to landlords.

Property is of enormous relevance to Australia. We saw in 2018 how weakness in the property market reverberates through the economy, and we saw how eager the Reserve Bank was to prevent that from happening again. But now, with the housing market under attack from lower population growth and from a weaker economy they find themselves with no more rate cuts to offer.

Australia has economic strengths. Our relatively strong fiscal position and our high workforce participation rate, for example. Our linkages with Asian countries who have defeated the virus will come in handy as well.

Our swift and apparently almost total defeat of the spread of coronavirus is also a huge advantage. Except, of course, that being corona-free means we will need to erect high walls against the rest of the world. It will remain difficult to come to Australia for a long time, whether to work or study or visit.

As such, hanging on to the foreign visitors we do have seems important.

One of the most frustrating things in watching this great outmigration is the knowledge that it is in part a result of policy. By excluding so many temporary workers from the JobKeeper and JobSeeker programs, the government punched a hole in the population.

From a political perspective, this is perhaps understandable — the politics of having foreigners working as unemployment rises may be difficult. But that political perspective doesn’t have to drive policy. Ireland, for example, extended a €350 per week payment to foreign temporary workers who lost their job. (Scott Morrison invited Australia’s equivalent group to go home.)

Tourism

Few people discuss tourism when they talk about migration. But tourists account for a large number of the people who sleep in Australia on any given night. We’re a popular destination — around 800,000 people come here every month to visit, meaning that on any night, around 300,000 tourists are present.

Tourists spend heavily while they are here, making tourism one of Australia’s big export earners. They also occupy real estate — real estate which is now desperately seeking alternative customers. Airbnbs are being taken off the tourism market and offered for long-term rental. Some hotels are being used as quarantine stations and the rest must surely be considering whether they can convert themselves to apartments.

But tourism flows both ways, and with coronavirus ravaging the globe, Aussies are stuck home. This turns out to matter a lot. We go overseas more than foreigners come here — at a rate of almost 900,000 trips a month. Foreign Minister Marise Payne confirmed that 300,000 Australians had returned home in the period since March 13. More are still trying to make their way back.

Australian tourists, upon their return, should not add to the stock of demand for housing — presumably they have houses here. But keeping us all inside the borders should add to demand for other things — groceries, electricity, downloads, trips to Bunnings, etc. That is some compensation in the short term for the loss of temporary residents, but will do very little to manage the long-term decrease in migration.

Long-term

After the short-term loss of temporary workers, Australia must face a different migration landscape. Net overseas migration to Australia is what they call pro-cyclical, meaning it rises when the economy is strong and falls in the bad times. Net migration almost halved in the global financial crisis (GFC). It more than halved in the 1990s recession, and in the Great Depression it even turned negative. Those were periods without closed borders, mind you — the major factors in place were economic.

So don’t think dropping border controls will reinstate population-driven economic growth.

We can expect a long-term hit to migration flows even if our barriers to international travel were to be relaxed. Australia is stuck, essentially, with a short-term hit to our stock of foreign workers and a likely long-term downturn in the flow of overseas migrants that help keep our country growing.

That is going to make it very hard to grow the economy in a way that will permit us to quickly pay off the debt incurred in this tumultuous period.

When the recession ends and the focus turns to lighting a fire under economic growth we will be leaning very heavily on the other two P’s in Henry’s famous formulation.

Expect, in the next few years, to hear a very great deal more about productivity and participation.

we’re not going to have productivity growth if business continue to underinvest in training. we’ve shifted the cost of learning from employers to future employees, not many 20 year olds can afford thousands a year to get a ticket from a for profit education provider. Businesses have forgotten (or ignored) that a happy, engaged workforce is a productive one, money spent on training the workforce up needs to go back to previous levels and share buy backs and unsustainable dividend policies need to stop

You’ve forgotten to mention what the non productive (even by capitalism’s lowest denominator ) overinflated ponzi property scamming scheme has done to a roof over your head price .

It’s been a real destructive productive debt laden killer to the healthy wealth of the country . But there’s a lot of Ozzie/Aussie mainstream Mumsy n Dadsy ideologues that have conveniently done that too…

So, we’ve been living in a GDP Ponzi scheme driven by population? Does explain why we have had ‘GDP growth with zero growth, if not declining, productivity. From the Abbott ascendency to today it would seem. Thank you LNP lobbyists who only want cheap labour.

Relying on population growth to boost the economy was always a Ponzi scheme, now exposed. Even the economic benefits were dubious, as wealth per capita was basically static and urban Australians were correctly perceiving a reduced quality of life as more people tried to use the roads, the public transport, the recreational facilities etc. A more rational indicator than GDP, such as the Genuine Progress Indicator, shows that SA has done better in the last decade that the rest of Australia, precisely BECAUSE its population has not grown as rapidly as those of other States. It is imperative we don’t try to “snap back” to the policies which have caused the problem, but think about shaping a sustainable future.

Population growth in Australia is long term unsustainable, as it is everywhere in the world. If you doubt this, look at the nexus between population density and Covid deaths in the US. The more urbanised and higher density the location, the higher the number of deaths per million.

But the major problems in Australia are very simple. Soil and water. All our capitals have problems except Darwin. According to Mick Keelty, Murray River inflows have dropped 505 over the last 3 decades. Anything downstream is under threat. Time to look after those who are here and start planning for sustainable land use and we are many many miles from that.

In this article and in many others on the same theme, for example George Megalogenis in the weekend SMH, none look at the costs of that rapid population growth, or that the headline GDP growth covered significant problems. There is good evidence that the high population growth helped to depress wages, that many of the newcomers were subject to appalling wage theft, and that our infrastructure in Melbourne and Sydney, the main destinations, was overwhelmed. GDP growth per se tells us little about changes in our living standards or how we are using our natural, built and social capitals. There is good evidence to suggest that much of our GDP growth has been at the expense of our natural resources.

As well our skilled migration program has possibly been more about bringing in cheap labour than training our own people. Few strategic studies of our workforce seem to have been done to justify some strange additions to the list of occupations (187 of them apparently) with “shortages”.

By all means talk about the impact on GDP of a reduced or falling population but not without talking about how poorly GDP measures how our well being, our incomes and the impact on our natural resources.

Yes Jezza, I like George Megalogenis as a journalist, a good thinker, but the weekend SMH article was crazy, not seeing the wood for the trees. If you’re reliant on an ever expanding influx of migrants, your economy is basically a mendicant state.

I love that you can drive on our roads now,. Even if you’re not allowed to. An ever expanding population to feed GDP is the worst pnzi scheme ever.

George should have called it.