Do people actually save more money if they work from home?

The simple answer is yes.

People are more likely to save more money (and time) if they work from home, especially during the coronavirus lockdown.

Consider how much money you spend on takeaway coffee, lunch, transportation and your close-to-the-office gym membership when working from your workplace, to just name a few expenses.

It’s human nature to want what you can’t have so while there may be bothersome elements to office life, many of us may feel prepared to do anything to get back to our early morning commutes, water-cooler conversations and meetings that could have been an email.

Let’s take a moment to look at the positive side of working from home, especially for those who find themselves needing to move their work life to their home life because of the coronavirus pandemic, as opposed to doing so by choice.

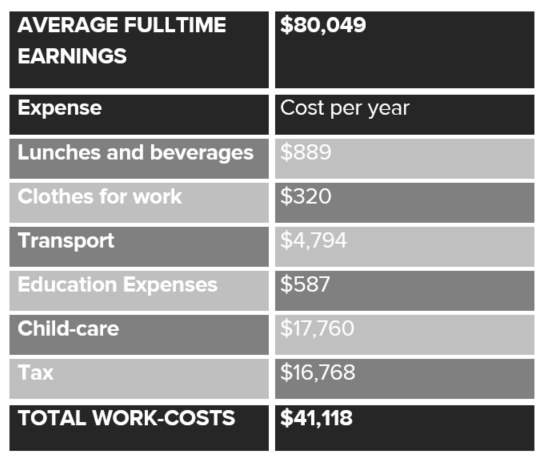

According to McCrindle, the average Australian spends a whopping 51% of their average gross annual income on costs associated with work.

This data is based on an Australian who makes $80,049 per annum per year, and who requires childcare and transport to work.

This example shows the average worker could be spending $3426.50 a month on costs associated with simply going to work.

Can you save more money if you work from home?

Consider if you can save more money by working from home by adding:

Weekly costs

- How much you spend on takeaway coffees per week

- How much you spend on lunch out per week

- How much you spend on fuel for your car to get to work per week

- How much you spend on public transport to get to work per week

- The cost of childcare each week

- Any other costs that you pay due to your work life, such as gym membership, house cleaning, garden maintenance, pet care or grooming.

Yearly costs

- How much money you spend on clothes (solely) for work each year

- How much you spend on upskilling for work each year

- Your yearly tax deductions.

Formula:

Multiply your weekly expenses by 52 and then add all variables to your yearly costs. Then add how much you can claim in working from home tax deductions.

Once you have gotten this far, deduct the additional expenses you are now spending while working from home, such as buying new furniture and an increase in your grocery bill.

Finally, deduct annual leave and/or yearly sick leave and you will be left with how much you could save in one year of working from home.

Obviously, none of us want this to go one for a year, so divide by 12 to find monthly savings, and divide by four to calculate weekly savings.

The majority of us will find working from home is indeed saving us a lot of money. We might feel even more motivated to save if we put this money into another account to mind for a rainy day.

While most of us would prefer to be out, about and back to normal, you can take solace in the fact you are saving money if your job is in a safe position.

Numbers from Mckinley Plowman are not far off from McCrindle’s, which report:

- Singles under 35 spend, on average, $849 per week

- Couples under 35 spend $1572 per week

- Couples with kids spend $1800-$2100 per week

- Those over the age of 65 spend just under $900 per week.

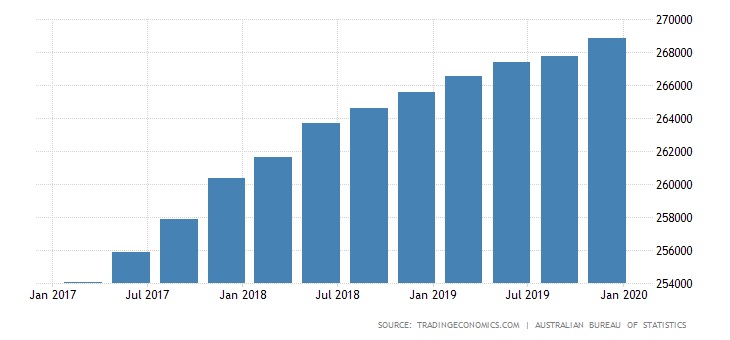

According to Trading Economics, consumer spending has been steadily increasing since 2017.

This modelling does not take into account that consumer spending is likely to fall due to unemployment rates, a loss in consumer confidence and the impending recession. However, for now, if you can, make your personal savings a project to focus on and take comfort while we are living through uncertainty.

“Obviously, none of us want this to go one for a year.” Um, I do, I’m loving it. I get to sleep more, commute less (zero), eat cheaper and healthier, get up later, save on clothes, transport and showers, wear comfortable clothes, work in the garden in the evening and still have time to cook feasts. Every day feels longer as time slows down. No wear and tear on the office clothes, motor vehicles and reduced spending on socialising. I can still interact with those I care about and have an ironclad excuse to avoid people who annoy me. I could do this for YEARS!

Working from home doesn’t bother me too much. Thing I get more things done due to less distractions I usually get working in an open office.

To be fair though I think there are people who are still spending on childcare while working from home. Some jobs need the focus it takes without having to mind children at the same time.

I would suggest once the restrictions are lifted, though many workers will be inclined to work from home, adjustments will need to be made, especially in regards to young children and their care.,…

Childcare looks like the highest outgoing in the article, in regards to ensuring that some sort of structure will need to be established (in this brave new world of working from home), many people if they find themselves in this situation are probably going to most likely still need to factor in some sort of/level of childcare to their outgoings per year, as trying to work & balance childcare would be a nightmare & cause ongoing high levels of stress in the home and also there may be issues around productivity..

I would imagine many people will need to or are going to sit down & re-examine their outgoings/ costs, to not only pare back said costs but also to work out how best to manage their working/home life balance, which for many could be an interesting challenge…