Just look at that red bar in the next graph. That’s how much retail sales fell in April.

Precipitously doesn’t begin to describe it. It is by far the largest result, up or down, in the history of the series. Not even the introduction of the GST twenty years ago — when the entire country knew we could save 10% just by buying a few days in advance — can compare.

The fall in retail is spectacular — the combined result of lockdowns and consumer terror — but it is also transient.

May will likely see the result swing back to positive as lockdowns loosen and the world returns to a somewhat more normal state. Retail will regain some sort of equilibrium.

That reversion to mean is also true of other data from this very unusual period. Records are being set left and right — anyone who pays attention to economic data definitely has ‘record fatigue’ — but the truly shocking numbers should pass quickly.

In time retail figures will return, more or less, to their long run growth path, which you can see in the next graph.

But even as the trends resume in aggregate, the composition will change.

Even when the numbers start to look normal, the real world will not. We will have a different Australian economy and a different Australia. When you have a wound this deep, the healing leaves a scar.

In need of service

Over the last decade or so, Australia’s high streets have seen a transformation. Our increasing wealth means our homes are saturated with goods.

Consumption is therefore turning to services. Local shops are full of medical, wellness and beauty practitioners operating from locations that used to sell goods. Not to mention a burgeoning array of cafes.

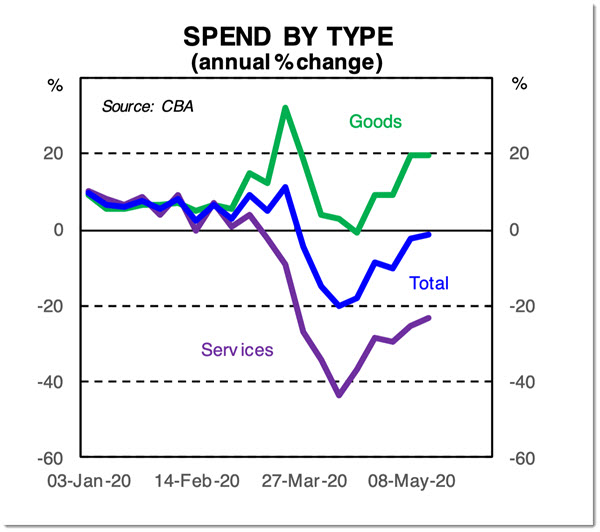

But the massage therapists, coffee shops, physios, hairdressers and other practitioners of well-being voodoo are now suffering greatly. Commonwealth Bank data shows that spending on services has taken a particularly savage hit.

Businesses will go broke. There is no question about it. Insolvencies will be widespread and there will be vacant shopfronts for a long time. Major brands may disappear.

How long can Australia support multiple discount department stores? Or two large, upscale department stores?

Retail spending may come back, but it will be focused in a smaller number of businesses that dominate trade. The need for retail real estate will be greatly diminished, with flow-on consequences for the enormous commercial real estate sector.

Online or off

Australia’s internet retail penetration is shallow. Just 5.7% of all retail trade was online in April 2019, and major retailers like Bunnings have been able to operate entirely offline, at least until recently.

But suddenly, in April 2020, 10% of all retail trade was online. This is a big shift, and one experts believe is likely to stick.

Based on patterns in other countries, KPMG analysis suggests there is latent demand for more online shopping in Australia:

Previously, Australian consumers largely bought more discretionary items online, such as apparel and consumer electronics. Now they are also shopping online for essential items, including groceries, pharmacy products and alcohol. In the post-coronavirus (COVID-19) era we expect most categories to experience an acceleration of online channel growth.

Grocery delivery in particular has seen a huge surge in demand during the pandemic. Once people get a taste of the convenience of delivery, they are unlikely to go back to the aisles — at least not quite so often.

A general surge in acceptability of online shopping is highly likely. In aggregate, retail spending may return to trend, but the fabric of the economy will warp and shift.

Fewer malls, fewer carparks needed, cheaper retail tenancies and less power in the hands of the retail landlords. And on the other hand, more work for Australia Post (which is already handling an 80% surge in parcel volumes), and more demand for packaging materials (music to the ears of Australia’s richest man, cardboard box magnate Anthony Pratt).

The COVID-19 recession will end one day, but its impact on Australia will be forever.

“…more work for Australia Post (which is already handling an 80% surge in parcel volumes).” Well, let’s hope Australia Post spends a bit more money on ‘delivering’ rather than on its CEO’s salary. It is outrageously slower than its competitors.

Boom times for what used to be called oracles, soothsayers and crystal ball gazers. There’ve been two dismal media trends in recent years. One is the rising proportion of commentary to hard news. The other is the rise of speculative pieces rather than hard news. Commentary and speculation is cheap requiring only imagination, a current grasp of the zeitgeist and a computer.

The covid era is made for excusing this downward trend but it won’t fool all the readers all the time. I can read far more informed speculation and commentary for free than I get on paid platforms. Commercial media large and small must figure out how to afford to go back to the future of reporting current events.

Retailers come and go with monotonous regularity. We need an improved economic system rather than rely on high employment low pay junk retailing.

Exactly how is this fantasy going to materialise with >15% unemployment, masses of business failures, rent and loan defaults etc etc that are certain to characterise the next few years? Get real, things are truly f*cked and about to get much worse.

Living on a remote island in Bass Strait, we have to use Australia Post but the delivery time is outrageous at the moment, have been waiting for an Ezibuy delivery since 16th April which normally takes less than a week.

We shop online regularly with department stores like Myer and Harris Scarfe, also Dan Murphy’s, very successfully and cheaply (for freight). There are some suppliers that charge a lot so we don’t deal with them. Bunnings I think answers that description, which would help to explain their position re online shopping.

In this tally of retail sales, where are Australians’ subscriptions to Netflix and others web services/entertainment and online gaming recorded and reported?