Last week the business world cheered as Apple became the first American company to be valued by the market at US$2 trillion (the first global company worth US$2 trillion was actually oil giant Saudi Aramco, but that is generally forgotten).

The celebrations when companies hit valuation targets is one of the many mystifying parts of market capitalism (or whatever you call the West’s cronyist system of government).

We don’t celebrate the price of milk hitting $2 a litre or petrol hitting $1.50, but for some reason we celebrate at the prospect of wild asset price inflation. Yet well-known investors like Gene Munster claimed Apple breaking through $2 trillion was “a poll position in investors’ minds. When you cross the milestone first, it’s a signal of leadership.”

The reasons for Apple’s share price inflation make the adulation even more perplexing. The US market hit a COVID-19 inspired bottom on March 23 when the S&P 500 dropped to 2237 — extraordinary liquidity efforts by the US Federal Reserve (read: money printing) coupled with huge fiscal stimulus led a huge rebound to 3397 now, a near 50% increase.

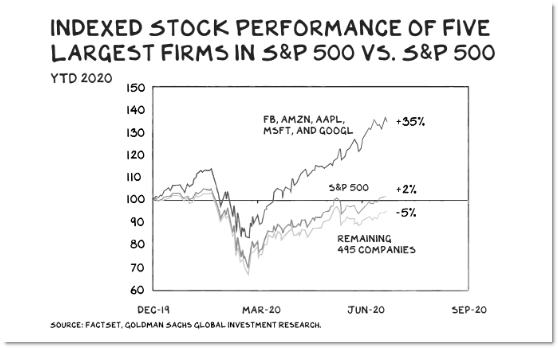

But it was no equal opportunity rally. Almost all the rise can be attributed to the “FANG+” shares — the group of tech companies led by Apple, Amazon, Facebook, Google and Netflix (as well as Ali Baba, Baidu, Nvidia, Tesla and Twitter). The FANG+ index is up by more than 50% and explains almost all the increase in the general market.

Marketing professor Scott Galloway produced this graph back in June which tells the story (hint: it’s got worse since):

Let’s go back to Apple. There are two ways a company’s market value increases: either it lifts earnings, or investors value each dollar of earnings more than before (this is known as “multiple expansion”). Over the past decade, Apple has had an average price-earnings (PE) multiple of about 15.

Last year Apple’s share price spent most of the time around the US$175 mark, which meant the market thought Apple was worth about US$750 billion. Apple’s share price in recent months has jumped to $499, giving it a market cap value of US$2.1 trillion. That rise was largely driven by investors bidding up the price of shares, rather than the company actually making more money.

As a result, Apple’s PE multiple is now 37. Apple has been bid up by investors for two reasons. First, the big tech companies have soaked up most of the excess liquidity that has been pumped into the market. As we noted, take out the big tech companies and the market has barely rebounded at all.

But Apple has not only benefited from the Robin Hood-led speculator driven bubble in tech. A second phenomenon has also happened: the market no longer considers Apple a hardware business which makes phones and iPads, but rather a business that gets more and more revenue from recurring sources, like the App Store and Apple Music. (Companies might get a one- or maybe two-times multiple on revenue for hardware sales, compared with 10 times for recurring software sales.)

While business journalists and speculators fawned over Apple and its chief executive Tim Cook (who has somehow been able to generate a scandalous US$1 billion fortune personally), the company was entering a legal fist fight with Tencent-backed Epic Games, the maker of the popular Fortnite series.

In short, Epic allowed users to buy in-game items directly from it (for a lower fee than via Apple), and was promptly removed from the AppStore. Epic, anticipating this, then sued Apple claiming that it’s operating an illegal monopoly.

In its lawsuit, Epic alleged: “Apple has become what it once railed against: the behemoth seeking to control markets, block competition, and stifle innovation. Apple is bigger, more powerful, more entrenched, and more pernicious than the monopolists of yesteryear.”

Like a railroad baron in the 1850s, Apple owns the rails and charges an arbitrary 30% of revenue to users of the app store. This is the very definition of monopoly rent. (As a contrast, banks and credit card infrastructure providers charge between 1% and 3%.)

Apple makes great products and has largely avoided the privacy issues pervading Google and Facebook, but it has become a rampant monopolist which has squeezed developers, damaged competitors (see Spotify) and increased prices for consumers.

This is no cause for celebration.

So much wrong with this article, it’s hard to know where to start.

Apple is NOT a monopolist. There are literally dozens of other technology companies that make laptops, tablets and phones. Apple does produce proprietary hardware and software, as does every vendor. That doesn’t mean they are a monopoly.

Developers who develop apps for Apple devices do not have to sell through the Apple App Store. They are free to make the business decision one way or the other.

Apple has always had a 30% surcharge and this has not prevented them growing their business astronomically. The surcharge is not some recent invention designed to exploit Apple’s recent market success. And, by the way, free markets. Don’t necessarily hold with them myself, but if you’re going to criticise, criticise the system, not individual companies within it.

A 30% surcharge is something of a industry standard. Whether or not it is excessive is another issue, but Android developers face a similar situation with the Google Play platform, as do Windows apps developers with Microsoft. It is dishonest reporting to single Apple out as if it’s the only miscreant.

In-app direct purchases are against the service agreement for ALL Apple developers, not just Epic. Epic knew full well it was in violation of its agreement with Apple before it acted. One of the reasons direct in-app purchases were banned was because unscrupulous developers were getting credulous users such as young kids to run up thousands of dollars of fees on their parents’ credit cards. Convenient for Apple, but the decision to ban wasn’t entirely for its own benefit.

Apple is no angel. There are plenty of valid criticisms that can be levelled at it. Singling it out for what are industry-standard practices, though, is either dishonest or lazy.

Outrage journalism that relies on reader ignorance to generate fury is the kind of second-rate practice I would expect from the Murdoch press. Crikey’s standards continue to slip.

Are you seriously going to defend the ridiculous royalties of phone app stores that have 0 competition on a platform? We aren’t talking about PC, where these fees can be avoided with in house digital distribution. You can’t release an app without using these stores! If your app does not go through channels apple can clip you are off the platform.

At least with Epic vs Valve they just made their own service and the tradeoff was less clicks through the Steam Store. The same applies to the Windows Store, devs are there to get more customers, not there to be on the platform at all.

Phones, and consoles, simply don’t have that option.

Not to mention the fact that the middleware used for most games (Unity 3D and Epic’s Unreal Engine) have lower royalties than these digital distro services. Yeah serving downloads and a barely functional website is totally more work than creating and maintaining middleware and ongoing support for that.

No – I’m not defending the magnitude of the levies at all.

I especially endorse your final paragraph re this organ.

But Apple are doing exactly what Microsoft was accused of, 20 years ago. If they weren’t, they would allow people the option to utilise alternative app sources (as Android does), rather than forcing users onto the Apple Store.

People just prefer to hate on Bill Gates than Steve Jobs.

I hope stories like this help us think twice about the way Apple have colonised our way of life. We shouldn’t use “iPhone” as the default expression for smartphone (same applies to other US corporate defaults, like “Uber” for ride share and now “Zoom” for screen meeting). The ABC should not be telling its listeners to leave reviews on the Apple store. We don’t have to do the master’s bidding, no matter how much wealth he hovers up from the world.

Did you mean “hoovers”? Because that’s the perfect example to show this is nothing new. Plenty of people used to refer to their vacuum cleaners as Hoovers, and their ballpoint pens as Biros.

This writer’s recent self serving rants would have been better had he applied such clarity of sight & critique of motives & practices.