What matters to the cohort hitherto locked out of the Australian housing market? A raging pandemic or record low interest rates? The data tells us loud and clear: the latter.

Lending to first home buyers has never been so high. With fixed interest rates running at record lows of 2.3%, the renting generation is finally keen to shoulder that massive debt. Mortgage brokers may have lost a little bit of business in the investment property crowd but when they show up to a rental property in their shiny suit, they can expect a commission.

Perhaps super withdrawals have also helped the young to finally gather together that elusive deposit. Either way, a new generation is moving into home ownership — for better or worse.

It’s hard to read too much into the first home buyer stats. Too much noise from people using their children to buy ‘their first property’ with various tax exemptions and savings incentives. Better to look at postcodes to get a better idea, but that still requires handling with care.

Agree, ABS data is historical to only June. Wait till the next quarter running into Xmas and the new year on many economic indicators….. once employment security or not rears its head along with property investments with rental market with significantly lower NOM.

Adding to this: FHBs are always there. They tend to fill the gaps when investors dip out. It’s like they re-emerge when not competing head to head with investors. Other similar data shows it has been this way for at least the past 20 years.

Oh goody, house lending is booming.

We are saved (sic!) …OK, hocked.

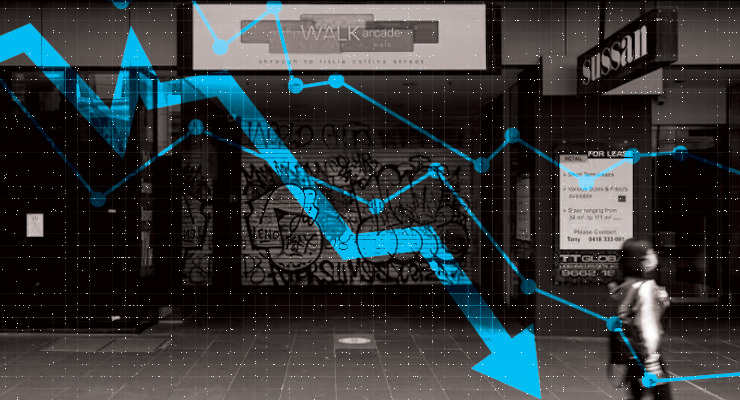

And there is absolutely no historical evidence or even a hint of a suggestion that such rampant borrowing whilst rates are unnaturally low will end badly.

Tick, tick, tick…

I work in finance. I have received calls from borrowers wanting to buy land and build in the names of their children so that they can claim the state and fed gov grants. In one case the child was still in high school.