Victoria’s state budget is out and the Andrews government has big, bold and laudable spending plans. Stimulus is needed and so the state is going into debt. It will pile up over the next four years to a number that might once have seemed huge: $150 billion.

The budget is full of good ideas, not least of which is the construction of 12,000 affordable and public housing dwellings. It will cost $5.3 billion and the state will issue bonds to pay for it.

People don’t care about debt nearly so much any more. Joe Hockey’s debt and deficit disaster line is like something from another era. We are better informed about the merits of stimulus in an emergency, and much more chilled about the repayments now that interest rates are so fabulously low.

Debt has had its image rehabilitated rather completely and very rapidly. Two intellectual currents have buoyed it.

The first is mainstream. A very respected economist named Olivier Blanchard published an academic paper in 2019 suggesting that when interest rates are lower than average growth rates, debt may be sustainable long term.

The second is fringe. The modern monetary theory (MMT) movement argues that governments can print money to fund their expenditure, the only limit being inflation. It rejects the need to tax to spend.

These two currents found each other in 2020, combining with a powerful need to stimulate economies and leaving the world’s governments much deeper in debt than when 2020 dawned.

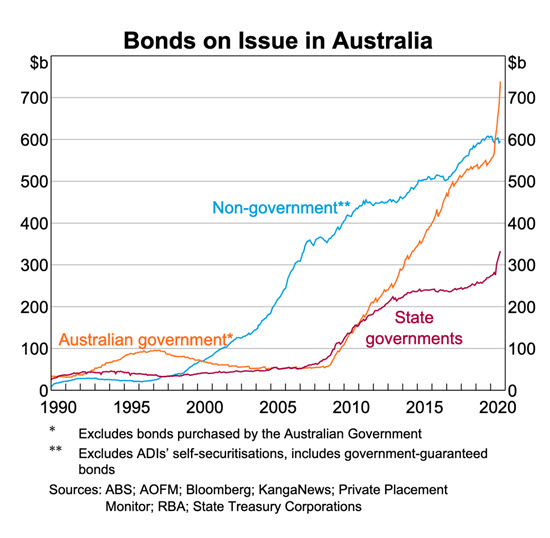

Australia’s federal government has led the way, shedding its skin as fiscally conservative to reveal the big-spending Keynesians beneath. As the next chart shows, the Commonwealth government is borrowing much more than the states. With their lead to follow, how can a state government do anything but spend up big?

Dan Andrews and Victorian Treasurer Tim Pallas have tried to throw the kitchen sink at Victoria’s predicament. “[Now] is the time to borrow in order to rebuild,” the Victorian budget papers say. The budget includes billions in grants and tax deferrals — and, of course, big infrastructure spending.

Spending is the right thing to do. But even the right choice can come with risks. Debt could still come back to bite Victoria. It raises the question: should we really be as sanguine about state debt as we are about federal debt?

The precepts of MMT are one of the intellectual currents that has swept away the old debt aversion. MMT’s theories depend on the debt issuer owning the money printing press. We Victorians may be parochial but we don’t have our own currency. Yet.

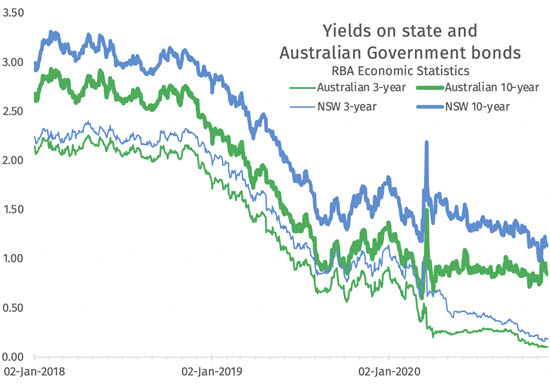

States always borrow at a higher interest rate than the Commonwealth, as the next graph illustrates.

States can’t print money. But worse than that, they can’t even tax properly. The big lever for states to reduce debt is cutting spending. Kennett did that and Victorians hated him for it.

Both income taxes and GST are out of the hands of the Victorian treasurer. And there’s pressure to reform stamp duty too. If theory turns out to be wrong and you do need to levy taxes to pay back debt, Victoria has few options.

Pallas was heard lamenting Victoria’s GST share during his budget speech

“Victoria has been short-changed due to a new and crippling GST policy. It is yet another impost during one of our most challenging years on record,” he said.

That serves as a reminder that the state does not control the levers that bring in its revenue. That’s a little concerning if debt does need repayment. Credit rating agency S&P has Victoria on a triple-A rating, but with negative outlook. This budget could spark a reassessment.

For now, state debt is probably not an issue as the Commonwealth is borrowing so spectacularly too and therefore has a stake in deflating some of the debt away, but if state debt lingers longer on the balance sheet than federal debt — or mounts higher — it’s not necessarily the case it will be benign forever.

Re the last para: One thing I resented Kennett for was his apparent belief that maintaining a Triple A Credit Rating was more important than the well-being of Victorians.

In fairness a high rating can be useful to all for benefit of accessing lower interest rates on any debt (repayment), public and corporate. However, Kennett suggested a few years ago that Victoria should borrow while interest rates are so low for investment in infrastructure e.g. public transport (a rate of just CPI would be attractive globally due lower interst rates and perceived stability of Vic).

The ‘debt’ obsession in Australian political and other media, although moderate by global standards and compared with peers, is also libertarian messaging to voters i.e. focus upon costs, taxes, prices etc. which then require more efficiencies (decline in state services/support) and/or lower taxes….

Once MMT becomes mainstream, (and it’s close) there is going to have to be a total rethink regarding Federal/State relations. States are incurring (real) debt (albeit at such low rates as to be un-concerning) currently to solve problems that are not of their making.

“the Commonwealth… has a stake in deflating some of the debt away…”

Is that a typo? Inflation makes old debts much easier to repay, not deflation.

Pallas has shot the Vic Labor Party in the foot by imposing a tax on electric vehicles. If anyone ever wanted to know why they should vote Green rather than Labor, then this is it in a nutshell. Labor just doesn’t understand the fundamentals of economics and the environment and despite all the miracles that Dan has achieved this year, this one piece of stupidity will hurt Labor more than anything Murdoch et al can do.

Unlike Victoria, I’m pleased the federal government only has a small debt.

Very funny, Bill!