The bloody Aussie dollar just keeps going up. This is not what we need to generate a strong recovery.

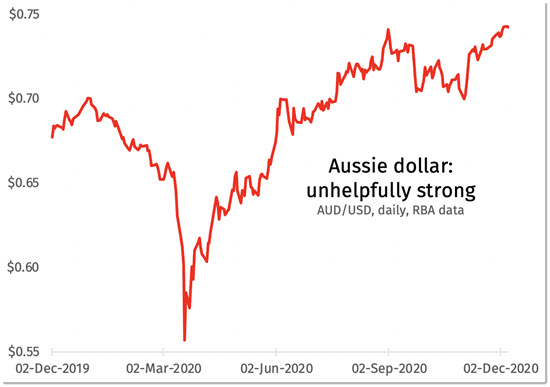

As the next graph shows, the Australian dollar plunged in the depths of the crisis back in March. Since then it recovered to its previous levels around the level of 70 US cents, and after the US election it roared upward even more.

Why? It’s a paradox — one of the kind economics offers up all too often. The strength is partly a consequence of our virus-free status. The Australian economy shapes up as one of the better prospects for growth as we go forward.

But the strength of our currency is also a brake on our economic prospects. It makes the economy weaker than it would otherwise be. Here’s why:

Exporters want a low dollar, because that makes their goods cheaper on global markets. Imagine a milk-powder maker: if the exchange rate is at US$0.50 to the dollar, an exporter can price their milk powder at US$0.50 and earn A$1.

But when the exchange rate rises to US$0.75, they must raise their prices on foreign shelves to maintain their earnings. If they are in a competitive market and they can’t raise prices, they just suffer a fall in revenue. Leave the milk powder at US$0.50 and instead of making A$1 on every sale, they make A$0.67. That hurts. So a lower dollar is an injection of economic strength for our exporters — companies that employ Australians.

They have not all had an easy year. Exports of goods are holding up at around $30 billion a month. But exports of services have nearly halved from $9 billion a month to around $5 billion. They need all the help they can get to employ Aussies and get unemployment falling.

Of course, a higher dollar makes imports cheaper too. When you’re tossing up between Italian tinned tomatoes and Victorian tinned tomatoes, the level of the exchange rate will influence your decision. So its not just exporters who benefit from a low dollar. Companies serving the domestic market will find their sales are stronger with a lower dollar.

For most Aussies, the only real upside of a strong currency is cheap holidays. And in 2020 there hasn’t been much in the way of travel! The Aussie dollar has soared against the Indonesian rupiah as well as the US dollar, but going to Bali right now would be a pretty dangerous choice. Recorded Covid-19 cases in Indonesia are peaking.

What do we do about it?

There is only one major currency against which the Australian dollar has fallen over the last year, and it is the Swiss Franc. The Swiss have experienced a similar situation to Australia, finding their currency surging unhelpfully.

The Swiss National Bank has been doing pretty much everything a central bank can do to keep their currency down. For starters their interest rate is -0.75%. Australia’s official interest rates may look low at 0.1% but that’s almost a full percentage point higher than what you get for owning Swiss Francs.

“The negative interest is necessary at the moment to avert major damage to Switzerland,” the bank chief told Reuters earlier this year. The bank is also selling billions of Swiss Francs in foreign exchange markets to try to keep the Franc down.

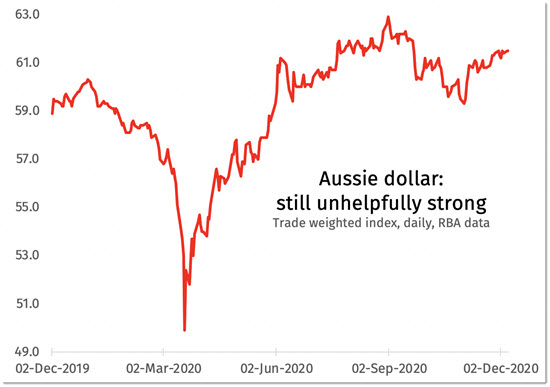

Under questioning from Labor MP Andrew Leigh, Reserve Bank of Australia deputy governor Guy Debelle admitted the dollar was higher against the USD but pointed out it was tracking better on trade weighted terms. As the next graph shows, that is true. There’s a less steep uptick at the end of this graph but the difference is marginal.

Why are official interest rates relevant to the exchange rate? Quick explainer: lower interest rates should deter foreign investors from buying your currency. The exchange rate is just the price of the currency, so lower demand should lead to a lower price — i.e. lower exchange rate. This is why when the RBA cuts rates, we expect the Aussie dollar to fall.

While the Swiss may not have won the war against a higher currency, at least they are fighting it. Which raises the question of whether Australia’s central bank should do more. After all, we are just about the last major jurisdiction in the world with non-zero interest rates. Currency wars are being fought and we’re standing to one side, taking collateral damage.

Yes, the RBA is buying bonds at an unprecedented rate. But so is everyone else. RBA governor Philip Lowe admitted last week that we have to react to what other countries do:

… [We] are in this position because of what other central banks have done. They have undertaken quantitative easing, which has forced down their bond yields, and that has implications for the exchange rate. We are a part of an international financial system and we have to respond to what others are doing.

The question is whether the RBA is doing enough.

The RBA has bought bonds equal to 8% of GDP, while other major countries have bought bonds equal to 20% of GDP or more. (These purchases are made in freshly-created Aussie dollars, so each purchase floods the market with Aussie dollars and should in theory push down the exchange rate.)

Do we need more quantitative easing to give our economy a fighting chance? The more our dollar tracks upward, the stronger the case for it.

the reserve is on its quest for the million dollar median house price..

Do we need more quantitative easing to give our economy a fighting chance?

No we do not. The RBA should raise rates 2%, force the govt to use fiscal policy. This continued fascination with a tool that does not work astounds me. Rates can go to -%5 and if unemployment and underemployment stay high, with no wage growth, the economy will still splutter along, the only people who benefit from cheap money are owners of capital

The RBA has mismanaged the dollar for 15 years now. Our dollar has been gamed by foreign central banks all that time. Instead of taking hard action to force the central banks and the associated carry trade out of the currency, the RBA has done squat.

All the time supported by the dismal science commentators in the mainstream media and Crikey as well. Only in recent months has their collective tune begun to change, all while offering no words of “I was wrong” to support the RBA in letting the central banks run riot in our currency. The rubbish that was written by Gittins, Pascoe, Irvine, Keane on this issue 10 years ago should be rubbed in their faces for the rest of their careers.

All the RBA is good at is inflating bubbles – be it the dollar, houses or mining. And to think the good Doc is the highest paid central banker on the planet.

Pass me the bucket while I puke in disgust at these bovines.

Too true, SM.

Re inflating bubbles, you forgot the sharemarket.

Provide ONE example of what you would describe as a country with a strong economy AND a weak currency. While you are engaged with that question revise the pros and cons of floating exchange rates (if you have access to an authorative text)

I am sorry to say that your articles seem to be intended as clickbait. I await a similar tail of woe when, in the cycle, the dollar declines.

Your 2nd graph has a 4 cent scale. See how it looks with a 50c scale. The first graph is no better. The abuse of data (i.e.) the graphs would have earned a fail in first year to say nothing of the self-serving argument.

An economist would have considered the matter from the perspective of a floating exchange rate in the context of the international environment.

The last thing we need is lower interest rates, unless they force the banks to reduce lending for home loans. House prices remain as probably the biggest imbalance in our economy. Adding any more fuel to that bonfire will see us all go up in smoke.