I decided to buy Bitcoin twice. The first time was in 2019. I chickened out and sold my holdings without gaining or losing much. Last year I bought again, with more resolve.

I’m usually fairly risk averse. But I decided I needed to take a few more risks so 2020 I invested a small amount in a fraction of a Bitcoin. A week later I did the same thing. When I bought in, the price of Bitcoin was a little over $15,000 (although each time I bought only a fraction of one Bitcoin).

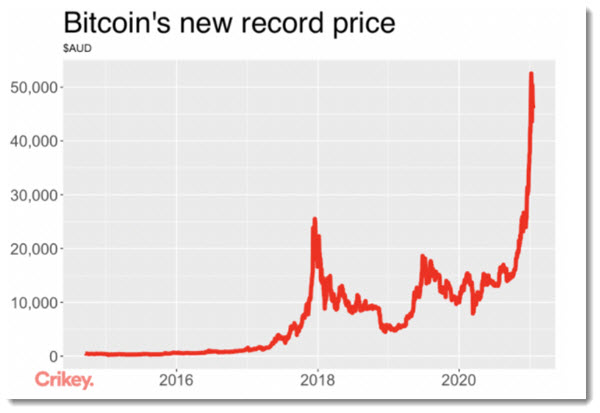

I told myself I would hold for the long run, or at least until the next price spike. I didn’t have to wait long, as the next graph shows. When I sold my fractions a few months later, the price was around $45,000. I had almost tripled my money.

The emotions of it all

I admit I checked the price a lot. As Bitcoin rose I was worried it would go down. I held out as long as I could but sold before it peaked (at over $53,000!). After I sold my worries were not replaced with calm. Instead I worried it would go up even more. I couldn’t shake the feeling that I was going to lose.

A better investor would probably have sold some and kept some. I promised myself I would do that but in the end couldn’t. I feared losing my gains (which at the time existed only on paper) too much. If Bitcoin goes up to $100,000, you can be sure I will be furious at myself!

What’s Bitcoin for?

Do I really believe in Bitcoin? Not really — with one caveat.

Admittedly, I have developed a strong track record of disbelieving in radical new companies that later proved successful. Among the many things I’ve deemed silly are Tesla and Afterpay. Tesla is up 20-fold since I started mocking it and Afterpay sixfold. I even scoffed at Apple’s over-reliance on the iPhone. Those were costly scoffs. If I’d invested in those companies I could be in early retirement.

I believe it’s OK to be wrong as long as you learn from your mistakes. So I decided to invest in another thing towards which I had directed my sober opprobrium. I became a Bitcoin investor.

Well a Bitcoin speculator really, because I don’t really think it’s the future of currency. I do think it might be an object of occasional speculative frenzies. And if there was another speculative frenzy in Bitcoin it would have killed me to be watching from the outside. I wanted to be part of it.

Bitcoin was invented in 2009 by a person or persons unknown, operating under the name Satoshi Nakamoto. Nakamoto published a “white paper” which, if you’re interested, is short, readable and available online. The first words are “Commerce on the internet …” and the paper is devoted to inventing a form of payment.

But Bitcoin hasn’t turned out to be a good way to pay. It has, however, turned out to be a good investment. It’s not used for mainstream payments but is increasingly held as an asset by mainstream investors.

The caveat

The one caveat I mentioned earlier — the one mainstream and sensible reason to invest in Bitcoin — is the possibility that with its limited supply it could be a good investment in a time of inflation.

Over the past dozen years, inflation has been hard to find. House prices have gone up a lot, but consumer prices have not. Conventional economic theory would say the huge stimulus that has hit the economies of the world during the pandemic could drive up inflation — especially combined with disruptions to supply chains.

Central banks usually use high interest rates to rein in inflation. But with the enormous stock of debt afflicting the world, raising rates could be very damaging to households and businesses. Central banks are more likely to let inflation run a bit than to clamp down on it early. Both the Reserve Bank and US Federal Reserve have made formal promises not to stamp out inflation when it occurs but to let it develop before they act.

Indeed high inflation is one way to make debt loads more affordable — high inflation might be part of how economies recover from the pandemic. But for individual investors it can be tough to find assets that perform well in times of inflation. Gold is one. Bitcoin is possibly another.

If US inflation results start coming in high there could be a real case for investing in Bitcoin. The most recent US inflation result was a desultory 1.4% annual rate, so it hasn’t happened yet.

Would I buy it again?

You bet. Bitcoin has had several massive spikes in its life, as the chart above shows. My assumption is the pattern will repeat, and I would certainly consider buying if the price falls again. But of course the pattern could shift. I’m glad I invested, but also glad I invested only as much as I could afford to lose.

Isn’t asset price inflation a bit parasitic?

Only because it is the basis of capitalism.

People need çapital to survive, but do they need parasitic enterprise? Are you someone who approbates all mechanisms on Wall street, planning on dipping your toes in? Already there? You can take your Frigate. I will stick to my aluminum frame dingy. I will get blown out of the water first sure, but my footprint will be smaller than yours. There is so much depth to these issues than just spiking about. Agni, you and I probably think alike on some things. You have many fans here. I am not here to s*** on that. You can have an ego. I know I do.

I used to be so feral with passion, cutting my critical thinking short on these sorts of commentary sections. I am not suggesting you are feral, but the ‘feral’ left create just as much political upheaval as the right. They carry guns. They are at war. their in no diplomacy to be had their, as there is little diplomacy on the hard right. I imagine you are a centrist? You make good points here and there. I only just got here really, but just because people ‘like’ your comments: I imagine that is a hard thing to temper your zeal/ passion for issues. Go gently, but don’t be a pedestrian. But watch your ‘tenor’. Hitlers tenor and reign started and ended with admonishment. I am not putting you in the same basket as Hitler: But do mind throwing yourself about just to win the adoration on your Crickey fan club. Pander to the truth. And to nothing else…. 🙂 “Shut up you pompous prat!” Well that’s just rude! You could have put it more nicely than that.

their in no diplomacy to be had their

Where is that lady with the coffee cart? Time for bed… sweet dreams

there is no diplomacy to be had there.*

Jason, you really should read some behavioural economics, and then some Buddhism or other meditative educational book.

Watching the price of something to see if you’ve ‘won or lost’ by selling is such a sucker game. If it goes up, you imagine a loss, because you used to own it.

One, it isn’t a real loss, two, overcome this simpleton valuing of a loss as greater than a gain of similar size. Thinking Fast and Slow – Kahnemann and Tversky, should cover the first. I’ll leave it to re the second, but the Mahabharata is best when you get to be of sufficient vintage, covers every other philosophy with more besides. 🙂

What the f*ck IS Bitcoin. Numerous articles over numerous years, I still don’t know, and I’m sure I’m in the overwhelming majority.

WHY is Bitcoin?

That is the more important question.

Why teach when you can patronize? If you know stuff about this Agni: Inform Norm xo

Why is indeed the more important question. It just wasn’t what Norm was asking.

The internet will tell you that it’s a distributed ledger, that could record lots of things (no, actually not very much), but what it actually records is a list of all of the transactions that have ever been made, to exchange … bitcoins.

In order for this distributed ledger to be believed by everyone, despite the fact that none of the participants (theoretically) know eachother, there’s a protocol by which all of the participants come to an agreement about who made the last update, and what it was. That protocol is the sort of clever that relies on the sort of problems that make cracking cryptography expensive. People say that the protocol ensures a whole bunch of properties, without requiring trust between any of the parties, which is kind of cool in the sort of abstract libertarian everyone for themselves — cant get on with anyone sense, if it were true. Unfortunately this truth only holds when no one “player” of the game can solve more of the crypto puzzles than everyone else put together. At least four-fifths of the “player” resources are thought to reside in the PRC, so does the rule hold, or not?

The players who spend computer resources to solve these puzzles, are the ones who get to add records to the shared ledger, and for their efforts they are paid in … bitcoins.

The rate of payment (in bitcoins) is determined by the protocol, and diminishes over time: most of the bitcoins were “mined” in the early days, when they weren’t worth much. That’s why you occasionally hear stories of computer nerds having lost “millions” by throwing away an old hard-drive. They’re harder to come by now, requiring mind-bogglingly epic amounts of compute power (and real power), but people still do it, because the coins themselves are now worth so much more. And because they get to charge an actual fee for their services. Bitcoins are ultimately limited in number, so as a “resource” they’re limited, and therefore increasing in value. In fact: not only limited, but actually diminishing in number, because as I mentioned: quite a few are missing or destroyed on old computers, or locked away in “safe” storage with forgotten passwords (which is logically equivalent). A tradeable resource that you can burn. Yay?

And so you end up with an extremely inefficient, trans-national means of exchange, suitable only for paying ransoms to crypto-jackers and other cyber criminals, buying heroin or hits or missiiles on the dark-web. Because absolutely any other transaction can be made more efficiently and more inexpensively using one of the existing trust-based intermediaries, like, say, banks or credit card companies.

Oh: and for suckkering the next tier of patsies into the ponzi scheme with stories like this one. Not caring that the bitcoin that they’re buying is providing hard-currency liquidity for someone’s dealing in … well, anything.

Salute Andrew

Oh, Bitcoin? Everyone is making money off hedge fund death on GameSpot stock but that’s cool too.

It’s actually very cool, Draco. Hilarious in fact.

Oh, Jason/Crikey, spruiking pyramid schemes now?

Planet-destroying pyramid schemes? Pyramid schemes where you know in advance that the money you spend buying in goes directly to finance international crime and terrorism?

Based on a so-called technology that is capable of a massive 10 (Ten, Roman: X) transactions per second?

One which, thanks to technological churn in the warehouses of the professional operators, results in 100g of e-waste per transaction? Or that burns more energy than Denmark?

https://twitter.com/smdiehl/status/1350869944888664064

You know it’s dodgy when the municipality of Miami FL posts the original whitepaper to their web site, to encourage entrepreneurship:

https://finance.yahoo.com/news/miami-uploads-bitcoin-white-paper-184301949.html