A weird thing is suddenly happening in the Australian economy. We are going back in time, reversing a major trend of the last century.

One way to see it is to look at the results of a company called National Storage.

National Storage owns cabinets which it leases to people who have more stuff than places to put it. It’s a listed company and it posted its results to the ASX on Tuesday. They were good. No JobKeeper was sought and none given, as profits soared and storage boxes filled up.

We knew the pandemic was causing an abundance of shopping — the items Aussies bought have overflowed our homes causing happy days at National Storage. Occupancy of its containers rose 7.7% to over 85%, and revenue was up, driving profit up too. This time last year just 3% of its centres were 90% full. Now 32% of its centres are above 90% capacity.

This is a symptom of the same hunger for things that has elevated the businesses of JB Hi-Fi, Officeworks, Harvey Norman and Kmart. We are in a frenzy of stuff consumption — which is not the way things were going previously.

The swift pivot from services consumption to goods consumption in the pandemic economy is astonishing. It runs against a trend that is extremely well established and has very deep roots.

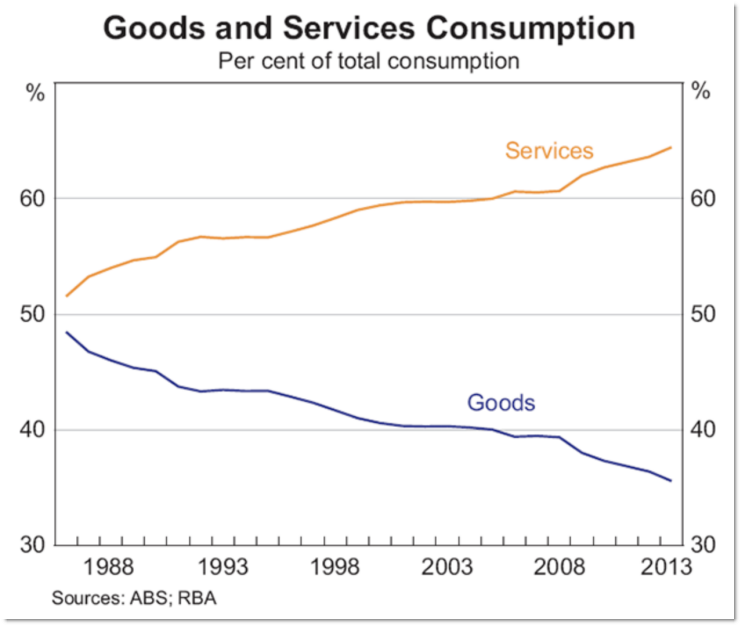

This chart comes from the Reserve Bank (RBA) and shows that our love for services has been blossoming for years. We wanted experiences, not things.

This is not just an Australian trend. It’s a global phenomenon that stretches back centuries: when countries hit a certain point, they cease to be manufacturing-centric and become services economies.

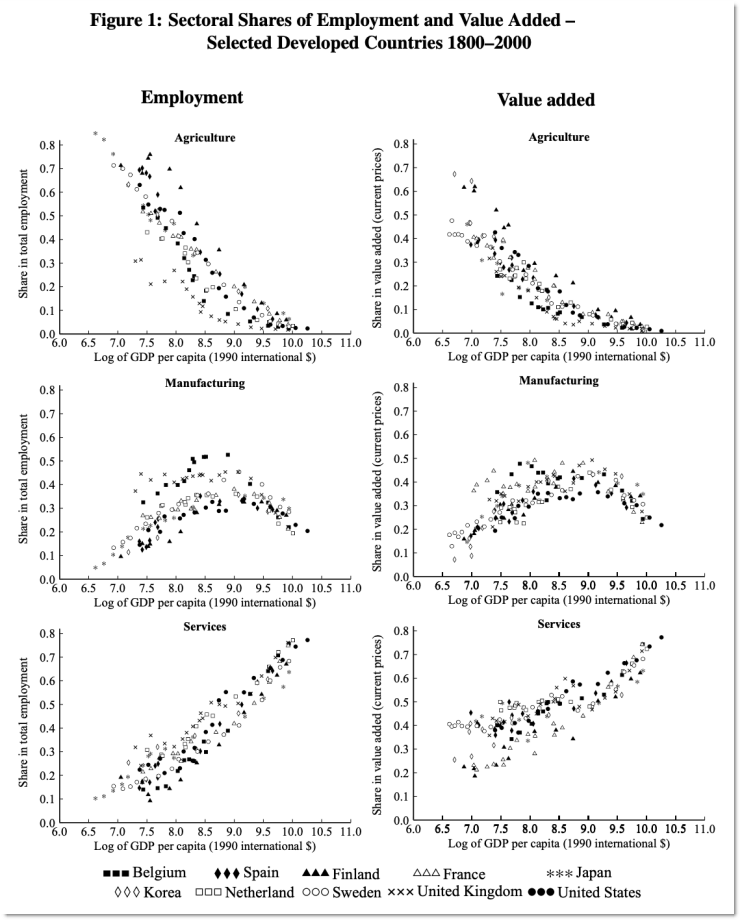

The following graph comes from a very influential economics paper by US and UK researchers Herrendorf, Rogerson and Valentinyi (2013). It shows that as economies grow, the importance of agriculture shrinks first. At first manufacturing replaces those farm jobs. This is where countries like China are now: young people are moving to the city to work in factories.

When manufacturing employment begins to slow, services employment keeps growing. Most of the richest countries have most of their workers in services. This can include IT, accountancy, consulting and law. It can also include household services like medicine, education, architecture, finance, etc. Not to mention government.

So the trend to services is big, well-established and seemingly unstoppable.

And yet the pandemic has halted it in its tracks.

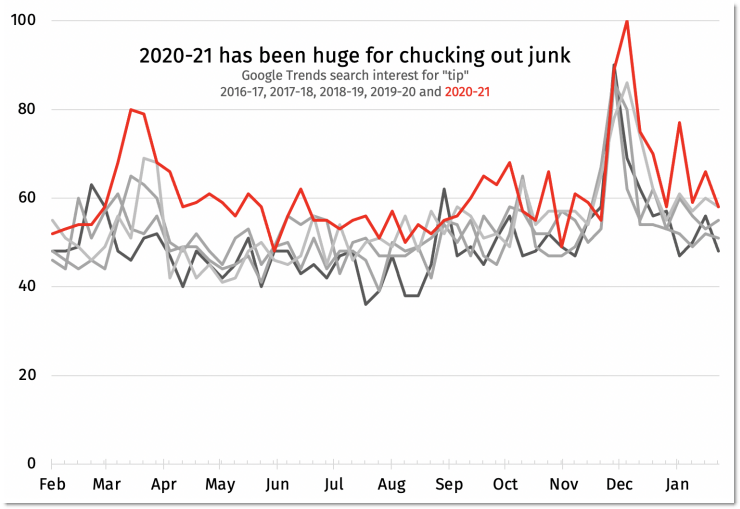

You can see traces of our over-buying everywhere. I like to use Google trends, which tells you what people have been searching for. It shows Australia has been heading to the tip in large numbers, ever since the first lockdown kicked off in March.

No, this search interest is not just about people tipping their Uber Eats drivers. It correlates very closely with searches for landfill. And in the parts of Australia where the term “hard rubbish” is used for throwing away bulky objects, search interest in hard rubbish is also at record levels.

I was not immune from going goods crazy in 2020. Our house has bought a new microwave in the past year (it’s brilliant — going from 750 watts to 1100 watts is completely worth burning your mouth for), an office chair, and untold heaps of clothes and books. It feels like new boxes arrive at our front door each day.

The global thirst for stuff is so strong it is beginning to affect the global economy.

As RBA deputy governor Luci Ellis noted before a parliamentary committee last month, when we buy things China wins:

A number of countries, including China and many others in East Asia, have had a pretty good level of control over the virus and have very industrial economies so have benefited from the switch from services to goods.

The macroeconomic authorities are obviously excited about this, because RBA governor Philip Lowe was also keen to talk about the switch back to goods and the way that helps commodity prices, which helps Australia:

This is not just in Australia; it’s everywhere around the world. That’s causing a recovery in global trade and industrial production. Because all those goods require commodities, the commodity prices have lifted and China’s doing well. You’re seeing, through North Asia, strong demand for semiconductors. So that’s helping the recovery in the global economy.

The iron ore price is at very elevated levels, more than US$150 a tonne. The latest Treasury forecast had it falling to US$55 a tonne. That difference is going to have a big impact on Australia’s budget bottom line, not to mention the earnings of the big companies that dig up the ore.

Services trade often requires people, so it will take a long time for services to bounce back. Chief among them is tourism. And what we’ve learnt in the past 12 months is that Australia is actually a net economic loser from tourism. Our outgoing holidays cause more to be spent overseas than incoming tourists spend here. We’ve managed to give our economy a big shot in the arm by inhibiting all those jaunts to Kuta and Kyoto, Rotorua and Rome.

Turns out, if you can’t go and see the Colosseum, you stay at home and buy a big TV instead.

All quite alarming when you realise that the old stuff (microwave) has to be disposed of, lots of environmental damage from producing the components and energy use manufacturing the new stuff. It brings Armageddon a few years closer and significantly reduces any hope of dealing properly with global warming. A burnt tongue is the least of our worries.

Yup. Check out this interview with Vaclav Smil about his new book

https://www.noemamag.com/want-not-waste-not/

I shop therefore I am.

Hail the great cargo cult god in the sky.

Our resident neocon BK has been railing for years at those who dared suggest that a society with more people providing superfluous services than making stuff might have grasped the wrong end of the gilded turd that is modern consumerism.

A society/economy reliant on service for full employment -aka taking in each others laundry – has a very short life span.

Why? Even large manufacturers e.g. motor vehicles, are services based enterprises with the physical assembly line making up only a small part of the total headcount (and more robots); research, design, development, admin, assembly, marketing/sales, logistics and service.

Conversely, somebody formerly working on an assembly line should view any other occupation, even if better paid with more opportunities, as demeaning and superfluous e.g. if retraining as a cook/barista, bus driver, logistics, telecomms technican etc.?

A tad sardonic Agni. Useful services are produced nowadays that could not be imagined in the early 70s. Spreadsheets and word processors have been revolutionary for any firm.

OK : so manufacturing is being undertaken, globally, by the relatively impoverished but, equally, standards of living are increasing in non-war zones.

Corruption is an issue, particularly in the African States and less so in Central and South America.

Happy to debate but for some wrong reasons Bernie is more right than in error as to manufacturing. As an aside, the PRC is determined to be the manufacturing hub of the world. Trump got hammered in the trade war. Uncle Joe won’t repeat it.

Good article, and the present squabble between digitally innovative BigTech and legacy media NewsCorp et al., with the latter directing govt. and resisting, is allegorical.

Old industrialists have always used (often monopoly) ‘power’ to support their solid state industries whether Henry Ford or Rockefellers’ interest in fossil fuels (Standard Oil -> Exxon); backgrounded by their class system that resonates with Malthusian views on population (via lower order over breeding and/or ‘immigrants’) and social Darwinism via his relative Galton and the eugenics movement (Nazis did not invent it).

Much is invested by senior management in Porter’s Five Forces Analysis to focus upon and preclude service/digital competitive threats of substitution and/or innovation; we have viewed similar in the media stoush, plus fossil fuels sector have for decades, avoiding environmental constraints, by blaming humanity or ‘immigration led population growth’ to delay…..

Simply need to see the history in the US which informs Australian policies directly; radical right libertarianism for legacy industries (vs. competitive threats of services, described as not real work for the mythical ‘white unskilled working class males’), joined at the hip with eugenics or the class order, one should know their place and not have unions etc. to support.

Economies and workforces always change and evolve in occupations and/or skills required, but in Australia we seem to do the opposite in preserving mythical, and often declining, employment and sectors over change and more fruitful employment and investment.

“And what we’ve learnt in the past 12 months is that Australia is actually a net economic loser from tourism.”

A point I’ve considered likely since early in the pandemic without any actual evidence. I wonder where you got any figures for this, but it rings true.