The Reserve Bank (RBA) has changed. It’s official now, with RBA Governor Philip Lowe announcing he intends to chase unemployment down from its current rate of 5.8%, below 5% and perhaps even below 4%, to the goal of “full employment”.

“It’s not inconceivable we could sustain an unemployment rate starting with a three,” he remarked at a conference last week, raising the prospect of Australia returning to a level of unemployment last seen in the early 1970s.

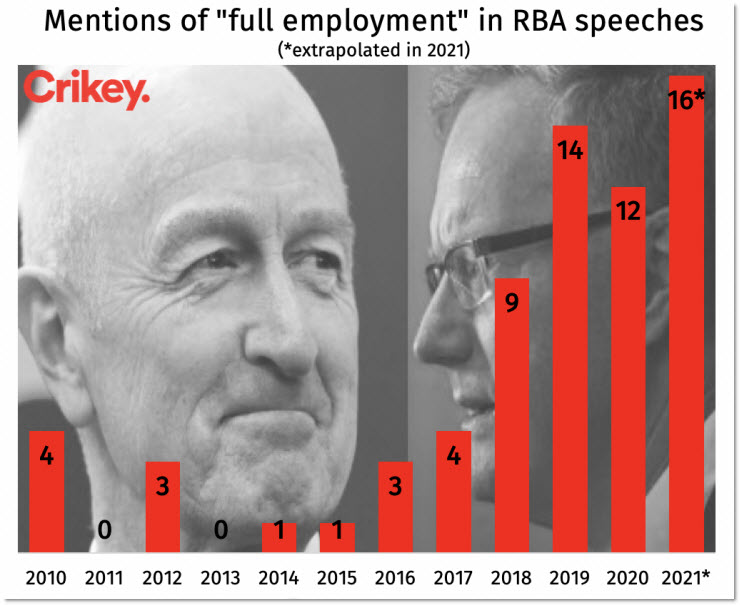

The RBA’s focus on full employment is in full view now as we emerge from the pandemic. But the bank, once famously inflation-focused, has been talking about full employment for a while. Since, in fact, the departure of former governor Glenn Stevens.

As this chart shows, mentioning full employment was all but verboten under Stevens. Under Lowe, however, it trips from the lips of RBA officials regularly.

The bank has always had a “triple mandate”, demanding it seek price stability, full employment and the welfare of the Australian people. But for years the price stability aspect took centre stage. No longer.

Never let it be said changing the governor of the RBA is ineffective.

Of course, ‘full employment’ in the early 70s was largely assisted by the exclusion of so many (especially married) women from the workforce. When I was researching full employment policy in the ’80s, the term barely crossed the lips of the RBA despite its explicit mandate in that regard. That was a period of improving entry of women into the workforce and accusations of them depriving men and young people of jobs. (Something like Morrison’s recent ‘support’ for women in the economy so long as ‘others’ don’t lose out.)

Stevens did mention employment, I admit often in a footnote grumbling that banks were not investing in job creating projects with a “solid return”. He was also angry about banks gross misconduct leading to the GFC. Sure Lowe has been much stronger, like Yellen as Fed chair. Bernie Fraser harped in public about how finance markets WANT poor economic activity, and let’s not start with Coombs, who wrote the white paper on FE and fell out with Menzies later, for relenting to banks.

Brilliant expertise by the Reserve Bank on employment….

The elephant in the room never mentioned is demographic change, we are slowly heading into, amongst the permanent population, a proportionate decline in working age versus an increase in retirees/pensioners (requiring more state support via taxes).

Aside from the immediate or short term impacts on (un)employment e.g. filling in gaps or skills, avoids the impact on budgets and how to maintain support for budgets via the tax base?

Permanent skilled migration is low by historical standards (0.5% population?), but we have a far higher churn over of temporary residents with employment right/restrictions and are ‘net financial contributors’ i.e. PAYE, GST, private insurance (students) and no access to permanency nor benefits (ex. an eligible small minority).

But the latter are denigrated as ‘immigrants’ adding to ‘high population growth’, responsible for environmental degradation and unemployment….. old (unsupported) Malthusian principles…..

The other side of that view is that many 50+, 60+ are unemployed for various reasons but would love to continue working, either f/time or p/time, but most employers aren’t interested in older workers.

Agree, my own brother has that issue often, in a regional centre; possibly generational, economic issues and govt. policy too.

However, I know of many old ‘white collar’ friends in the PS who can/should retire but are able to return to work, through boredom (now accumulating more super and/or in addition to defined benefits), while new starters of younger generations are placed on a casual register…..

This demographic change is a slow process and much of the world will be competing for human resources, skilled and unskilled, to make up for gaps.

The “going down the rabbit hole” metaphor is as misleading as the ABS unemployment statistical treatment of workforce data. The ABS data is not usefully representative as anything more that a periodic comparison based on flawed criteria that have very little to do with “full employment” or “actual unemployment” levels. The current criteria are nothing more than a political construct to keep the masses happy in their ignorance. The RBA is obliged to use the only yardstick their political counterparts are willing to accept.

I am yet to encounter any political party that wants to answer to a more robust, accurate system based on the reality faced by most Australians seeking employment.

It is judged by some researchers that the actual level of unemployment is as high as 15% with up to an additional 25% underemployed.

Our politicians cringe at any prospect of having to respond to unemployment levels anywhere those levels. The show ponies are more than content to do laps of honour, the basis for which would make a carpetbagger blush.

Lets not pretend that our politicians are going to anything more than tend to the razor thin edges of a very large and understated problem.