The Reserve Bank (RBA) has recently called out “hoarding behaviour” by Australians who continue to panic about the pandemic. They’re not hoarding toilet paper. Or hand sanitiser. Or even pasta, rice, or lamb chops. This is about cash.

Australian banks are very, very safe. Very. Not only are they forced by law to carry lots of capital that means they won’t go broke, the deposits in them are also guaranteed by law. If they do somehow fail, depositors get their money back (up to $250,000 per account).

And yet, when difficult times strike Aussies get scared and try to take solace in cold hard cash. It happened in the dot-com bubble. It happened in the GFC. And during the pandemic it happened more than ever before.

“While strong cash demand is typical of periods of economic stress, the strength of demand during COVID-19 has been unprecedented,” the RBA notes.

“Not only has the growth in banknotes in circulation exceeded that encountered in the past, it has been the most sustained period of strong growth.”

In 2020, Aussies loved nothing more than a “pineapple”. As the next graph shows, the RBA found itself issuing an extra net $10 billion worth of the bright-yellow $50 note as they disappeared out of circulation and into shoeboxes.

By contrast, nobody wanted the $5 and $10 notes. The green line (representing 2020) is actually lower than the orange line (representing previous years) revealing that fewer new banknotes were issued in those low denominations.

The $50 note made up 70% of all the banknotes printed by the RBA since the start of the pandemic in March 2020. Hundred-dollar notes were the second most popular category, making up 20% of all new notes printed. Scarcely any $5, $10 or $20 notes came off the presses. In fact, they shut down the $5-note and $10-note lines for six months because no new notes were needed.

Are we spending all this cash? Lol, no.

Spending cash was already becoming weird and eccentric before the pandemic. “The share of total retail payments made in cash has fallen from 69% in 2007 to 27% in 2019,” the RBA says.

That includes online payments — but even if you only count in-person transactions, cash was used just 32% of the time. During the disaster, cash use during in-person transactions has fallen to less than a quarter (just 23%).

So what’s happening to all this cash that’s getting printed? People aren’t using banknotes when their toilet paper stash runs out, are they? Those were desperate times last March/April, but hopefully not that desperate. The mind boggles.

It’s important to remember that people really were freaking out. Back in April 2020 we didn’t know much about the virus at all and how it was transmitted. People were frightened of everything. Even now, 28% of respondents to an RBA survey said they thought cash was “unhygienic”.

Businesses also turned against cash with a vengeance. As the RBA notes, “45% of respondents had encountered a business that did not accept cash in the month of September 2020, a substantial increase from 23% in 2019″.

The most likely reason for banknote demand is neither spending nor, ahem, personal hygiene. It is what the RBA calls “hoarding behaviour”. People get worried. They fill the car with petrol and their wallets with money.

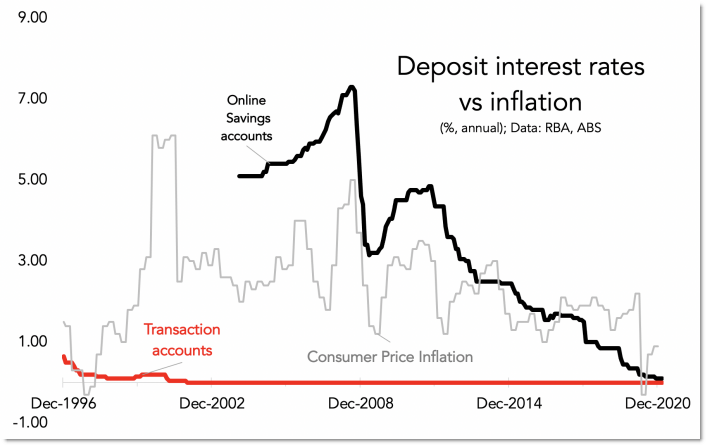

That’s usually totally irrational but these days, maybe not so much. After all, the actual bank isn’t paying interest anymore. As the next graph shows, interest rates are almost zero. Even though inflation is very low, interest rates are lower than inflation.

Banks are committed to keeping your money safe. That’s not nothing. But in the good old days we could also get paid for leaving our money in the bank. Once upon a time you could actually get a rate of interest higher than inflation. Not anymore.

When you leave money in the bank it loses purchasing power. So, Australians seem to be thinking, why not keep it at home in fat stacks? Maybe pile it up like Walter White in the TV show Breaking Bad, or swim in it like Scrooge McDuck?

The slower pace of banknote use should also mean much less damage to banknotes. This means the recycling arm of the RBA has less work to do. A few years ago they were destroying $1 million worth of used cash every hour. Now it is almost certainly less. Money doesn’t get worn and torn if it is being hoarded.

So what will happen with all this cash? Is you withdrew during the pandemic, my advice is to spend it ASAP. The longer that money sits in shoeboxes, the higher the chance it gets forgotten about or lost. And then it’s gone forever.

Am of an older generation. Have experienced difficult times and know comfort of that all important coin or note set aside to settle a debt. This very day, once again, scammed. The electronic age has allowed many advantages despite ever more sophisticated criminality. Thought of a cashless society, dread, paralyses my sense of control. Electronic crime always, seeking to outsmart even national governments, banks, everyday functionality. At times of community dysfunction, disaster, when one realizes, value of self reliance. A note or two safe in a secure shoebox spells independence, self control. An iPhone immersed in flood waters or computer frazzled by lightning in middle of once in lifetime cyclone debris . . . and power unavailable for three, four weeks? A wet note will still fuel car and place food on table. Hoard in moderation peoples and stuff those secure in glass houses.

Imagine waking one morning and the entire net has disappeared and those with no bank statements trying to prove they have accounts. Can’t possible happen could it.

That’s it TonyP! Also, keep in mind, as I was reminded this morning. A cashless society not cheap. Regular updating of computer, software, phone etc etc are all part of a ‘defence’ requirement. Overall, technological growth, expansion possibly ‘the’ most rapid change, adaption and adopt sector known to man?

One big solar flare and we will see how good your electronic society is, phoners. Not to mention EMP weapons which are overhead right now. All financial planners recommend you hold a reasonable amount of cash as a fall-back. Cash is also a good antidepressant. If they want to take away my cash, they’ll have to wrest it from my cold, dead hand. Etc.

These financial planners seldom say their advocacy of a cash reserve refers specifically and only to bundles of banknotes. They generally seem to include readily accessible cash held in current and savings accounts.

As for the more apocalyptic scenarios you envisag, it’s true that would put the banking system out of commission. But trying to exchange bank notes in such circumstances would be unlikely to bring you much joy either – after all they are bank notes – no banks (and maybe no government either) and they become just fancy sheets of plastic.

Obviously Shopkeeps could/would accept cash -IF/WHEN electronic payments system fails.

After a nuclear bomb has gone off? Did you think about the sort of circumstances ‘drastic’ was postulating? Perhaps you live among unusually tough and phlegmatic shopkeepers.

Be none left after a Nuclear incident. Try again – you must have more outlandish examples?

No thought given to the possibility of off-the-record transactions in the service economy, eg discount for cash to the gardener or cleaning lady, or for services like those purchased by Michael Johnsen, late of NSW Parliament, or those provided in the APH Prayer Room?

“That’s usually totally irrational but these days, maybe not so much. After all, the actual bank isn’t paying interest anymore.”

Yeah, it’s entirely rational. The banks aren’t valuing my cash as much as I do, so I hoard a bit. Also, when the banks have my cash and pay me near as nothing for it, they make quite a bit of money from my deposits, and I have no say whether I agree with what they are doing with my cash. They might be lending it out to supercharge a ridiculous real estate market (they are) or helping the worst kinds of people launder money around the world.

Looking away is hardly a plea of innocence. I’m not quite sure why I have any money in banks, other than the essential business needs. They are a flaming pox on society, and unfortunately essential, but they don’t need my leg up.

There are a thousand reasons for cash, and one of them is so they don’t know what I’m spending all my money on. Got nothing to hide, just nothing I want them to know.

—– other than the essential business needs.

Spot on – Don’t keep too much Cash in a Bank.

Jason, I think you have missed a few more valid reasons underpinning this behaviour. 1. The Federal government kept attempting to criminalise paying $10,000 or above in cash for anything. That generated fear. 2. Banks are closing branches at huge rates. Some country towns and suburbs no longer have branches they used to. 3. If you are older, disabled, have transport problems or super busy, you now have much further to go to access cash in your bank. 4. Nin bank cash teller machines are disappearing st a rate of knots with possible exception of gambling venues. But even gambling venues have implemented blocks on cash withdrawals. 5. Have you ever tried to withdraw $10,000 or $20,000 in cash? I have. My bank cannot give me my money back when I want it. I have to make an appointment and go in to speak to some kid . Who then argues with me about why I should not be taking my money in cash. The level of questioning and intrusiveness is shocking. I told one kid “you never asked me any of these questions when I deposited hundreds of thousands with you but you put up road block after road block when I want to withdraw it.” 6. My bank ANZ requires a weeks notice ( a week!) for such withdrawals and I have to agree to be there to collect it in person the day it is delivered. Otherwise they’ll send it back. 7. The paperwork is horrifying – they use it abd these other methods as deterrent tactics. 7. The questions about how I plan the spend my own money are outrageous. I told the last nosy ANZ Manager that I had a toy boy in Nigeria who wanted to marry me so half woukd go to him and the other half I was trotting down the road to the local RSL to gamble it all away on the pokies. I really enjoyed that moment. 8. She then tells me as its over $10,000 she has to report me to the Cash Transaction Reporting Agency as a “suspicious ” cash withdrawal. I said I would be delighted to waste the time of Federal Agents but could she pass on my mobile number so I could bake some scones – I would put on Devonshire tea for them if they told me when they were coming to my house to interrogate me about my dreadful behaviour in withdrawing my own money from my own bank account. And tell them I was putting in a few swimming pools. 9. I then received a stern letter from ANZ , unfortunately with no reference to my tour boy or pokie story but referring to the swimming pools and saying they may have to escalate it to CTRA or – here is the threat, close my account. I spoke to them and said if they closed my account, I wanted it all back in cash. That was a year ago. They did not close my account and so far , no Agents have come over for afternoon tea. Im actually disappointed. I was looking forward to giving them my full philosophical discourse on the evils of criminalising cash and how it elevated Banks power over and above what wS healthy in a modern democracy. 10. I checked the anti cash nonsense being spouted around covid. Guess what? The science says cash is not the problem Banks were pretending it was. 11. Harvard University has be doing excellent research into dangers of a cashless society. They have shown it disproportionately harms the poor, homeless, victims of domestic violence and is also arguably racist. 12. The greater your card transactions, the greater is your loss of privacy. Marketers and others who get your electronic purchasing information, sell or pass it on, then yiur inbox is bombarded with ads. Paying cash for all but eg fixed government type expenses eliminates most of that I have found. 13. Professor Shoshana Zuboff’s 2019 book “The Age of Surveillance Capitalism” says this is the new frontier fight in capitalism. 14. I am a contrarian at heart. If the world is zinging hard to plastic ( as is the case in Australia) I will Zag , and double down on cash. 15. I get tired of cash positive citizens being misportrayed by the self interested government and Banks as fringe nutters, criminals or black market creeps

Defending cash against these egregious incursions is a matter of honour for me now. And it has been fascinating watching and dealing with the unrelenting pressure and obstacles put in my path. My bank will only “allow” me to withdraw $1,000 in cash per day. If I need $10,000 they charge me for 10 separate transactions over 10 days. If I want more I have to beg some kid to give me my own money back. All for a measly 1% interest rate. And negative interest rates in some countries now. Going hard to save cash is not a right wing survivalist fringe interest or purely for drug dealers, criminals and tax avoiders. There is a lot of sophisticated analysis surrounding sticking hard to cash and avoiding electronic transactions as much as possible. Even in Australia. Yes our first $250k is government protected, but no more than that. Even if you open 3 or 5 or 10 accounts all containing $250k – only one $250k is protected. So anyone who has more than $250k has already exhausted the limits of that protection. My only surprise – that more businesses that refuse cash are not being prosecuted. HCF for example sent me a memo saying they only accept cash payments at their Haymarket and Strathfield offices in NSW. Thats a 5 hour round trip for me. Rules, policies and procedures against cash are deeply undemocratic and feed surveillance capitalism, concentrating more power in fewer and fewer organisations.

Good Post — Hint -Change Banks ! I simply send an email to Branch saying I want X $ in 2-3 days. No problem. F the ANZ !

Ah, so good. Had thought was all alone.

And as usual, no nuance, Aussies hoarding cash! Except for the bottom 30 or so percent who are struggling to survive! But hey, if Aussies are hoarding cash, we can scrap Jobkeeper, shrink Jobseeker, and cut other benefits because Aussies are hoarding cash!!!