JobKeeper is set to be the greatest head-fake in the history of Australian fiscal policy. A policy purporting to keep workers employed is likely to achieve two other things. First, it led to a massive transfer of wealth from future generations (the young, and the not-yet born) to wealthy baby boomers. Second, it created a swathe of businesses that should have been wiped out by a COVID recession but instead live on, in zombified form.

At the time it was launched, JobKeeper was lauded by almost everyone. The left loved the prospect of free money purportedly being handed to young workers. The right loved it because it was a targeted boondoggle created by a Liberal government, which would likely be able to be manipulated by sophisticated businesses.

One (but not the only) flaw of JobKeeper was that it allowed companies to qualify for the cash handout based on a “forecast” of their turnover. In March 2020, as the nation was temporarily shut down, if a company believed (with reasonable justification) that its revenue would fall by 30% (or by 50% for larger businesses), it would be entitled to JobKeeper. Strangely, if it turned out revenue and profitability increased, the recipient could still keep the taxpayer-funded largesse.

JobKeeper was no relatively minor boondoggle, like regional grants — it cost $70 billion. Remember the much-criticised pink batts debacle? That cost $2 billion. Robodebt (before it imploded and led to a successful class action) wrongfully raised $2 billion from mostly unemployed people, some of whom ended their lives due to the mental anguish and stress.

Less obvious beneficiaries

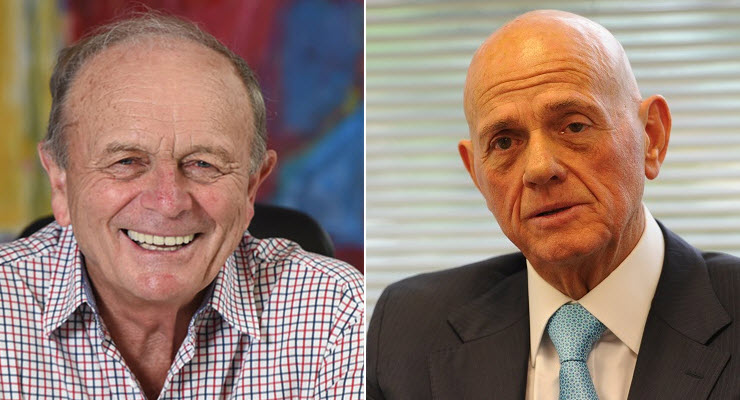

While the high-profile winners from JobKeeper were billionaires like Solly Lew and Gerry Harvey, who collected tens of millions of dollars in taxpayer-funded lucre (note: the tax hasn’t yet been paid), they were merely the public face of JobKeeper. The less obvious beneficiaries are the millions of already wealthy, older Australians who own real and financial assets. Similar to the US, rampant fiscal (and monetary) expansion has translated not to consumer price inflation, but to asset price inflation.

Property prices, spurred by a combination of stimulus and near-zero interest rates (as well as looser bank lending terms, because that will end well) have jumped to record highs. The sharemarket last week also hit its all-time high. This makes assets such as property even more out of reach for many aged under 35. Don’t forget, the $70 billion-plus cost of JobKeeper is almost certainly not being paid for by anyone aged over 60 given the fiscally prudent Liberal Party is running world-record budget deficits.

So, just to summarise: older folks, who already own most of the assets, see those assets increase in price due to government policy, which will be paid for by young people who don’t own many assets.

The second problem is that the stimulus (coupled with other boomer-friendly policies such as rental relief and eviction protections) created a large number of zombie companies that survived only due to government policy. Podcaster and brand expert Scott Galloway summed it up: “Creative destruction is good for young people and bad for the entrenched. The shedding of skin from existing players to new innovators — it’s a means of transferring wealth. Unless you let the winds of creative destruction blow, all you’re doing is cementing the wealth and status of the incumbents.”

These half-dead businesses being funded by future taxpayers are preventing new businesses from taking their place.

The federal government could have easily fixed the obvious problem of JobKeeper. Any business that made a profit, paid a dividend or enjoyed revenue increases should simply repay JobKeeper, up to that reported profit or dividend level (whichever is higher).

So those who praised the Morrison government’s COVID policies should probably look more closely at the fine print. JobKeeper was no Marxist handout to the poor. It was a reverse Robin Hood: a tax on future generations that benefits the rich.

Postscript: as I’m finalising this article, The Australian just reported that The Australia Club, arguably the most elite group of white males in the country (membership of which is understood to include George Pell, Tony Abbott and sexual harasser Dyson Heydon), received millions of dollars of JobKeeper money in 2020, before reporting a surplus of $1.8 million.

Should companies that made a profit during the pandemic be forced to pay back JobKeeper? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication in Crikey’s Your Say section.

Adam Schwab is a commentator, business director, and the co-founder of LuxuryEscapes.com. He is also the author of Pigs at the Trough: Lessons from Australia’s Decade of Corporate Greed.

Good work Adam! Another sickening piece of LNP largesse for their mates…

Didn’t think I’d ever say this but Adam is on the money here. There’s not much chance that those who profited from Job Keeper will give anything back. The perfect robbery: not illegal and carefully disguised as protection for ordinary people.

“Pink batts” was NOT “a debacle”. Thousands of households got useful insulation, and the number of workers who died was no more than could be expected. It is an unfortunate fact that someone dies in a workplace accident almost every working day – over 200 a year.

“Debacle” and “Fiasco” are those annoying tags that get started by pollies, picked up by the media and then repeated a thousand times until the issue and the tag fuse together for eternity. So annoying! But so damn effective.

The number of deaths under the insulation scheme was almost exactly the same number as before, despite the number of installation being tenfold bigger.

Possum Comitas and John Menadue have successfully argued this point for years. Abbott lied!

https://johnmenadue.com/pink-batts-facts-and-fiction-john-menadue/

All those Pink Batts and school halls, all still working fine. Maybe the school halls could of got a lick of paint instead of giving Gerry Harvey $20,000,000

I was renting at that time. The contractor for the estate agent brought the batts to the property, sub contracted the labour to 2 men who simply laid out the batts – no clean up of debris, gaps left for electrical areas. Rush job as they got paid for number of houses completed. No one came to see if work was adequate. However for tenant certainly helped on sweltering days. Good scheme but poorly administered. Rorting ruled. But surely that’s the case for any govt scheme that’s geared towards the less privileged in society?. Someone will find a way to benefit themselves first.

Hello, anyone seen Jim Chalmers anywhere, anywhere at all? Albo busy doing the high moral ground stuff at Uluru, fine, good, but not the way to government. You can only advance the Indigenous agenda from high office, otherwise you’re posturing for photo ops and feel-goods. Do the work of Opposition. Crikey, Michael West, John Menadue (the last 2 now Dutton targets), The New Daily, The Australia Institute, Juice Media, Friendly Jordies (undoubtedly about to be in Dutton’s sights) etc give you the ammunition. ALP the minor arm of Aus Govt Inc, with its own place at the trough and a joint role in The Carbon Club, but tame and no threat to the major partner. Meantime, gear up for fake war with China over Taiwan, whose richest man runs massive factories in China to exploit the labour conditions. All the way with the US of A except on CO2, hey? Sorry, bit fed up today.

The Crikey of old!

More of this and less fluff please!!!