The government’s Your Future, Your Super bill, designed to clamp down on industry super funds and establish greater government control over them, will “do more harm than good”, “leave more people in poor-performing funds for longer”, “create new compliance burdens that would add new costs and risks, and would divert management and board attention”, and represent “arbitrary powers granted to the treasurer of the day… [that] would set a dangerous precedent and would add a new and unpredictable source of sovereign risk to the investment process”.

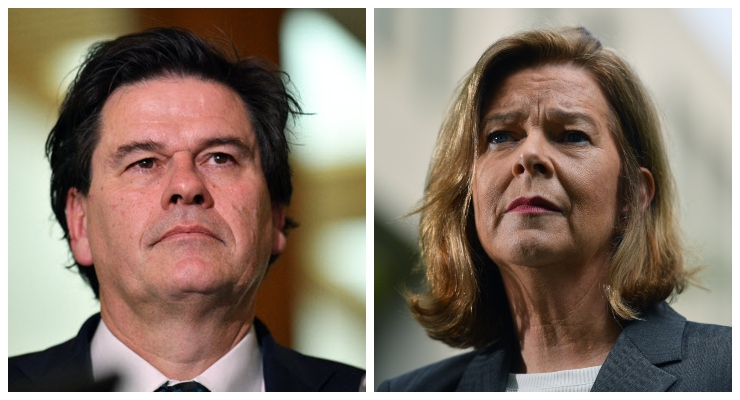

Who says? Labor? Industry super funds? Trade unions? Actually, it’s Innes Willox of the major employer organisation Australian Industry Group. The bill is “disproportionate, ineffective and intrusive”, Willox says, and wouldn’t have survived a proper regulatory impact statement process if the government had bothered doing one.

Ouch.

Willox has even written a letter with ACTU president Michele O’Neil, normally an arch-enemy of AI Group, to Senate crossbenchers urging them not to pass the bill.

The government is usually a big fan of Willox, especially on industrial relations. After all, AI Group members “employ hundreds of thousands of workers across Australia”, according to Treasurer Josh Frydenberg. But after yesterday’s statement, Willox was reduced to a “vested interest” by bungle-prone Superannuation Minister Jane “make domestic violence victims raid their super” Hume.

Hume doesn’t usually lump employer groups in with trade unions on superannuation. In fact, one of the key elements to the Liberal Party’s long-running vilification of industry super is to never mention that they are jointly run by trade unions and employer groups. The government’s stenographers at News Corp and the Financial Review traditionally follow suit.

Hume is famous for her religious zealotry over superannuation, having claimed “the Labor Party is in an unholy alliance with the union movement and the industry superannuation movement”. Not an unholy alliance with employer groups and unions and the industry super movement.

In fact, Hume has traditionally separated employer groups from her Axis of Evil comments. Compulsory super was “very hard for employers”, she has said, and had “put a lot of people out of work”.

One can sense that now, doubtless more in sorrow than in anger, Hume has been forced to shift employers — or at least members of AI Group — into the unholy alliance.

The grim reality for Hume and the Liberals is that industry super has always lived up to what’s on the label. It is a model in which unions and employers work together in the best interests of their workers. And it has delivered far better returns for workers, generated more jobs, made more investment in key sectors like infrastructure, and done more for economic growth, than bank-run retail super funds that have focused on playing the sharemarket. It has locked unions and employers together in a joint enterprise that builds the nation and safeguards the retirements of Australians.

You couldn’t have designed a better model to cement trade unions and the progressive movement into the capitalist system, if you think rationally about it. But Liberals can’t think rationally about super. Unions and employers working together is “unholy”.

Other institutions, however, need to be very, very wary of being caught up in the Liberals’ war on super.

Courtesy of a leak by the Liberals’ leading backbench warrior against industry super Andrew Bragg (that’s the Andrew Bragg who once explained in detail why compulsory super needed to be increased to 15%), the business press is today reporting that the Australian Prudential Regulation Authority’s deputy chair Helen Rowell has written to Bragg saying APRA’s review of its guidance to super funds around use of funds was well advanced and it would be considering whether any enforcement action would be required.

The Liberals are particularly keen to destroy Industry Super Australia (ISA), the lobby, campaign and research group funded by more than a dozen major industry super funds. ISA has been central, over more than a decade, to consulting on financial services legislation and campaigning, mostly successfully, against attacks on the industry super sector launched over and over again by the Liberals.

APRA giving legitimacy to a bald campaign of intimidation by the Liberal Party does little for the credibility of a regulatory body that was monstered by Kenneth Hayne in the banking royal commission, which exposed the rorts and rip-offs of retail super funds. Asleep at the wheel when retail funds were ripping off their members, but going after industry funds for funding ISA and advertising that they’re better than retail super funds? Yep, that’s a good look.

The government’s string pullers are terrified that independent organisations representing and governed by employers and average Australians have, or soon will have, the power that comes with owning massive lumps of capital and making the decisions about how and where that is allocated. Not to mention enforcing accountability with potentially hostile voting power over large blocks of stock at the AGMs of companies that are LNP owners/ donors. Historically those powers have resided in the likes of the Melbourne Club, the board rooms of the banks, large corporates and big financial/insurance firms – but maybe not anymore. Hence the panic from the “Three Marketeers” – Hume. Wilson and Bragg.

Good article from Bernard…and very good reply, Sidney.

I have long thought that the ‘super’ power a few trillion dollars gives to Industry Super was the main concern of the LN/P.

This government couldn’t give a stuff about ordinary workers and the potential for them to have a comfortable retirement…too focused on their own power games!

And desperate to present super as representing ‘lefty union thugs’ versus e.g. a sign of the future, the influential ‘Canadian Teachers’ Pension Fund’ (about $300 million in funds), the likes of which puts the frighteners on ideologues of the right when looking into the future…..

Workers and bosses are like oil and water.

Murdoch getting in a tangle ?

If only the average punter from the Rooty Hill pub saw the double standards self serving cynicism.

What I don’t understand, and maybe someone here can explain it to me, why would anyone, not rich, in their right mind put their money into a private fund when the benefits of industry funds are so superior and well documented.

The main reason for that is the demonization of Industry Super Funds by the Coalition Government, mainly because they are hell bent on destroying what is left of the Union movement, as it is seen by the Coalition as evil and the complete opposite of their Ideology.

They have tried all sorts of ways to nobble Industry Super, including the Banking Royal Commission, where they failed dismally as the opposite to their claims were found to be the norm. The bigger problem has been with Retail Funds.

So, are you saying that anyone in private super funds, except for the wealthy, who use it for tax purposes, are just monumentally stupid?

Sorry PM, I realise you didn’t say that, but your answer didn’t really address my question.

This insane and sustained Liberal Party campaign against industry super should convince any reasonable person that their core tenet is to destroy the connectivity of society to facilitate profit. Clear evidence that the Liberal party has no affection for an equitable society. And half of society votes for these sociopaths.

Bernard, stop being silly. The Liberals love Super. It’s a fabulous way for the wealthy to minimise their tax and create a hugely effective wealth generation and estate management tool. But only for the wealthy. Seriously, if the hoi polloi got in the act and got rich who would be there to do the actual work? No far better that the great unwashed work till they’re nearly dead and then subsist on the pension for a year or two, while we enjoy retirement in style, and then pass a tidy nest egg on to our children. The true purpose of Super.

I was under the impression that the Wealthy paid no. tax “only the little people pay tax” quote.

Well Labor set up super so it must be destroyed especially since those industry funds are doing too well and are worth trillions. It’s a bit like keeping the hoi polio out of university- can’t have them aiming too high. As if a Liberal Treasurer if Party would have the intellect or skills to direct investments. Everything they touch is a miserable failure.