Ever heard of the cashflow boost for business? No? You’re not alone. Nobody has. We should have — it was a convoy of gigantic dump trucks full of money stretching as far as the eye can see.

The money was bound for small business owners (and a small number of non-profit entities). Business owners were eligible for up to $100,000, depending on their scale. What did they have to do with it? Whatever they wanted! They could buy supplies, pay rent, pay the lot as a dividend to themselves.

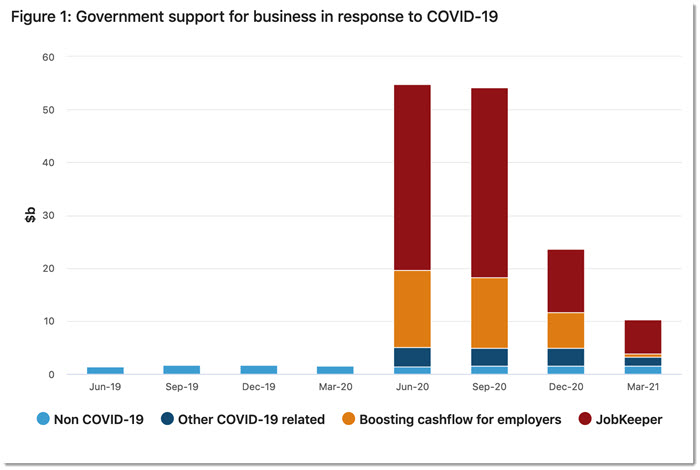

This was a $35.5 billion program, the third biggest expenditure in the history of the Australian government. (Behind the $90 billion we spent on JobKeeper and the new submarines, price tbd). It cost about twice as much as the much doubling of JobSeeker, and got about 0.0000002% as much attention. You can see it lurking menacingly in this next graph. It’s the orange part and it’s enormous.

More context? Well it cost almost twice as much as our fleet of Joint Strike Fighters. Unlike them, it proved capable of flying entirely under the radar. Think about how many articles you read about the doubling of JobSeeker or those blighted warplanes, and contrast it with the number you’ve read about the cashflow boost (equal to the two put together) and you can see something is amiss.

Now we are not being reductive and miserable here — the policy was both good and bad. It was part of the big fiscal push that got Australia up and out of the depths of the biggest recession since the Great Depression. Government spending gave the economy a huge electric shock and got it back to life.

The cashflow boost was designed to provide “cashflow support to small and medium businesses and not-for-profit entities to keep operating, pay their bills and retain staff”, Treasurer Josh Frydenberg said.

The boost for business is a major underpinning of our current surprise prosperity. If you want to know why unemployment is suddenly at pre-pandemic levels and unemployment below those levels — instead of the much higher rates forecast by the RBA in 2020 — the enormous fiscal push of the past 18 months is why.

That’s the good part.

I’m a big fan of using fiscal policy to prevent unemployment and all its attendant social malaises. Keynes once famously said that you could bury money in old disused coalmines and the work done in digging it up would be better than unemployment. In that sense, fussing over the detail of the cashflow boost is by the by.

Compare the pair

But the bad part is this policy it is far more questionable than JobKeeper — and we failed to question it. Scratch that. We failed to freaking notice it. Labor has whipped up a frenzy over JobKeeper, but this policy sank without a trace. We gave business $35 billion with no strings attached and no scrutiny and … does nobody care?

The cashflow boost was more business-friendly than JobKeeper. JobKeeper cost the budget more but businesses had to qualify by losing revenue in 2020, and they had to pass JobKeeper payments on to their employees. (Of course, if that freed up an equivalent amount of money to pay out as profits, they could pay that money out as profits.)

The cashflow boost didn’t even have that sort of guidance. Businesses became eligible simply by having turnover under $50 million and employing people. After that it meant they got between $10,000 and $100,000 for whatever whimsy and japes they could dream up.

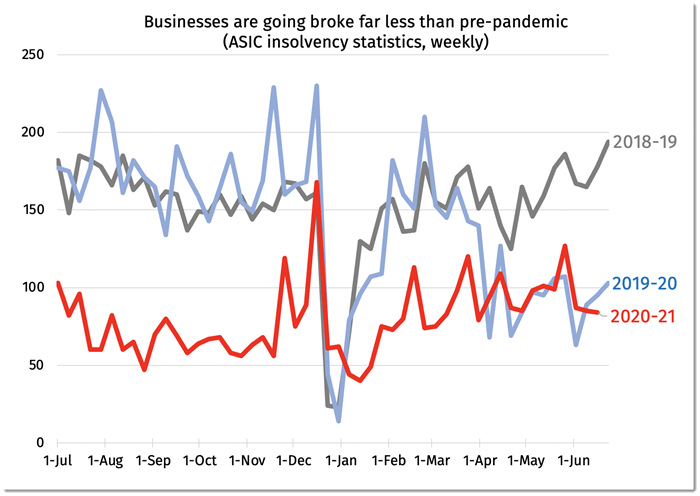

The clearest imprint of the cashflow boost is in the business insolvency statistics. More business survived this epic recession than would normally survive in a time of growth. And there has been no catch-up in insolvencies since the support programs ended.

Overseen or overlooked?

It’s peculiar and concerning that such a large spending program can go on with so little public attention. A barely noticed spending program of this scale really puts stingy decisions around universities and non-citizens in context.

Is it its name that makes it invisible? Would it have got more attention if it had copped a Teutonic double-barrelled moniker like CashBooster? Or does the media feel it would be of little interest to the general readership because it is a business program with no hip pocket relevance? Or is the issue the cashflow boost went to small businesses, so we don’t get the sort of reporting we get from large listed companies?

We ought to dwell on this question before the moment has passed because the fact the government can give $35 billion to business with so little scrutiny or attention is a concern for the future. If the government has found a way to lavish money on business without anyone noticing, we need to be alert.

Hilariously, despite expiring in 2020 this monstrous program is still pumping out money. The ATO lost a court case and now has to make retrospective payments to a lot of people who applied and were denied back in 2020. So the government is still granting tens of millions of dollars to small and medium businesses. The dump trucks of cash are still rolling — if you know where to look.

It may surprise many readers that quite a few (but not all) owners of small/medium accounting practices are equally astounded at the amount of money ‘released’ under this program. The astonishing ‘lack of focus’ was sickening especially because many of the small businesses that really did need support didn’t get a single $.

The LNP can see the writing on the wall and are leaving a booby trapped economy.?

The Coalition have never bee interested in managing the economy for all taxpayers and Australians, ever. Labor is the only party that has ever received a triple A credit rating from all 3 major agencies.

What better excuse – after all this money going out – to try to sell off public assets and raise the GST : – “to fix” this government’s profligacy …. sorry “economic stimulus necessary to save us from the Covid melt-down”?

“…. They could buy supplies, pay rent, pay the lot as a dividend to themselves – or cream some off the froth off to give back to the government handing out this sort of “corporate welfare” ….”? .

“…. They could buy supplies, pay rent, pay the lot as a dividend to themselves – or cream off some of the froth to give back to the government handing out this sort of “corporate welfare” ….”? .

You first sentence is the future – if this shower survives the next election.

If “Labor” fluke a win, the ‘debt & deficit disaster’ will be given a grease & oil change and rolled out again by the usual suspects, “it’s in their DNA“.

Ha ha ha. Blatant. Rort. Incompetent government that goes after robodebt non-debtors pees $35B up against the wall for absolutely no purpose. Makes those school halls look freaking bargain basement.

Unbe-effin-lievable.

…. Then there’s the way they played those “Rudd’s/Garrett’s insulation deaths” for politics.

A small business can still make an application for the Cash Flow Boost, notwithstanding that the Commissioner of Taxation has recently given guidance that a delayed application would be less likely to be approved with respect to a discretion to extend time for the business to provide evidence of activity between 1 July 2018 and 31 December 2019.

AAT and Fed Court can review the disallowance of the Commissioner’s discretion, as it did in favour of a small business concerning the time in which an ABN was effectively held.

A small businesses can consider making a Cash Flow Boost application if it paid some employees and/or contractors between 1 January 2020 and 30 June 2020 and the business:

David C. Barrow

Lawyer and Accountant