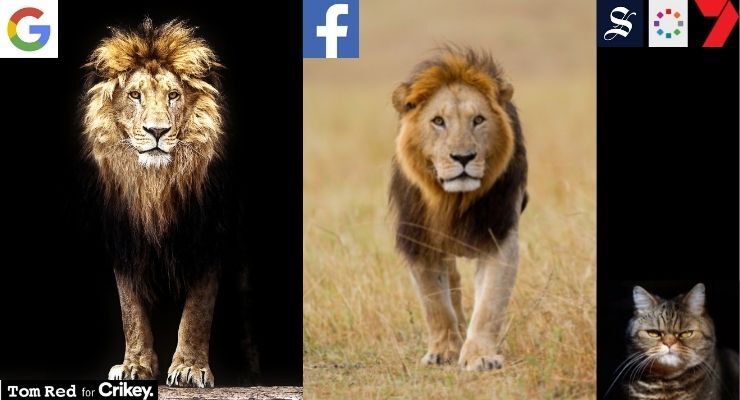

Game over. Google has pretty much wrapped up the global monopoly of digital advertising, first through its domination of search and now through controlling the technology that delivers display ads across the open web.

Facebook lags Google but dominates the so-called closed web through its social platforms, including Instagram, and is starting to elbow into classified advertising, which in Australia is dominated by News Corp’s REA Group and Nine’s Domain.

No sign of it stopping, either. According to the latest report on big tech released this week by the Australian Competition and Consumer Commission, Google is using its monopoly power to both crush potential competitors and increase its clip of the growing digital ad spend.

We’ve ended up with a functional web that’s largely “free”. That’s good. But we’re paying the price of that ad-supported web with data surveillance matched with clickbait and fake news. Take anything you hate about the web, and blame it on the corporate decision made by the Silicon Valley giants to provide both search and social as free services paid by advertising.

It’s not just the Silicon Valley cultural sphere. It’s happening in China’s splinternet, too. As Ling Huawei, managing editor of China’s leading business masthead Caixin Global, put it in economic speak this month, the country’s high-profile antitrust crackdown on social platforms is “aimed at correcting their negative externalities while safeguarding their positive externalities”.

The Chinese authorities have greater power to bring their tech platforms to heel, and greater willingness to exercise that power as the country’s tech titan Jack Ma found to his cost when he attacked the country’s financial regulators for stifling innovation.

What to do? Digital has taken over advertising so suddenly — and the big tech players have moved so quickly — that it looks like the regulatory frog at the bottom of the internet pot was well and truly boiled before it could jump free.

More players — greater competition — with the same flawed advertising model underpinning it is unlikely to help. The choices are to regulate as tightly as possible, like a public utility, or to break up the tech giants to diminish their power.

The latest ACCC report recognises that from an Australian perspective the damage has been done: it recommends greater enforcement with increased transparency about just how the advertising technology works and more public detail on the various charges levied as ads work through the companies’ secretive platforms.

In the US, meanwhile, Google is facing four antitrust actions by state and federal authorities, with growing support to force Google to separate its search and ad tech arms and for Facebook to separate its platforms, particularly the core News Feed and Instagram.

Jiu-jitsu style, Google is turning the regulatory pushback against the demand for greater privacy into its proprietary “Privacy Sandbox” which, ahem, respects your privacy by grouping you into lookalike clusters for target advertising purposes.

Of the $10 billion spent on digital advertising in Australia, the ACCC says that Google already takes almost all of the 45% that goes to search. On top of that, it found that almost all the $2.8 billion that is spent on display ads on the open web — increasingly video, increasingly mobile — is funnelled through Google’s ad tech and a disconcertingly high proportion of it ends up with Google’s own YouTube.

The ACCC estimates that Google clips about 27% of this spend as the ad travels tech-step by tech-step from advertiser to publisher. Doesn’t leave much of those ad dollars to support actual content that people want to see.

Facebook, meanwhile, takes most of the $3.8 billion that goes through proprietary social platforms (aka “the closed web”). Those Facebook dollars are under threat as Apple has restricted the company from scraping data of activity on the iPhone outside the FB app, making their advertising much less compelling than the offering of the more detailed Google data.

The platform is attempting to compensate by muscling into the $1.6b billion classified advertising through its Marketplace. So far, this is focused on personal sale ads (which can be free or upgraded to paid). In the US, it’s damaged stand-alone classified ads sites, with Craigslist, for example, seeing its income falling by about half.

Looks like the platforms have more bad news for Australia’s old media.

We hardly see an ad in this household. There is an adblocker and anti tracker on the router. All the computers run a version of Linux so no Microsoft ads. YouTube is watched using a developers account so no ads. Live TV is recorded and an ad remover program is run before viewing. Streaming channels use Kodi addons so no ads.

In fact the children plead to watch an ad during some shows because they are more exciting then the actual show.

Yet the Murdoch Press manages to keep its overbearing share of the old tech ‘paper’ in Australia. No one in authority wants to touch Rupert.

I don’t have any issues with Google, but like Facebook, would question the effectiveness of their paid ads and SEM (search engine marketing); difficult to learn or have businesses divulge impact (especially if not embedded in an overall marketing strategy, including research of customers; often many businesses do not know….).

Facebook maybe ok for branding etc. but pales in comparison with the effectiveness of Google for small businesses, tools/resources, analytics and feedback, while the organic search results are far more important and more likely to attract targeted traffic vs. paid ads (most normal people do not click on paid ads as you will be ‘stalked’ by the same after); small businesses can be rewarded by applying SEO (search engine optimisation) techniques.

However, the debate in Oz seems more about supporting legacy media income streams in the short term when they willingly chose to hive off their ‘rivers of gold’ into stand alone websites some years ago, in which they have invested and receive income from.

There is a real debate about the effectiveness of internet advertising Drew. They seem to have created a world where a business can’t ignore it, but the effectiveness of it is dubious at best. Nice work if you can get it.

Use an ad blocker!

I use Bing brings up immediately what type in, never never touch goggle too many who ever pays the piper nothing to do with what the search term is, ad blockers Bliss!