The great tulip bubble of 1637 is probably going to be bumped out of a lot of finance textbooks pretty soon because a far more astonishing and incomprehensible rise in prices has happened in 2021 and, just possibly, it’s starting to unwind.

They call them “meme stocks”. Unlike the memes your uncle emails to you (FW: FW: FW: Funny!), these are real companies trading on the market for real money. Trading for a lot more money than they used to.

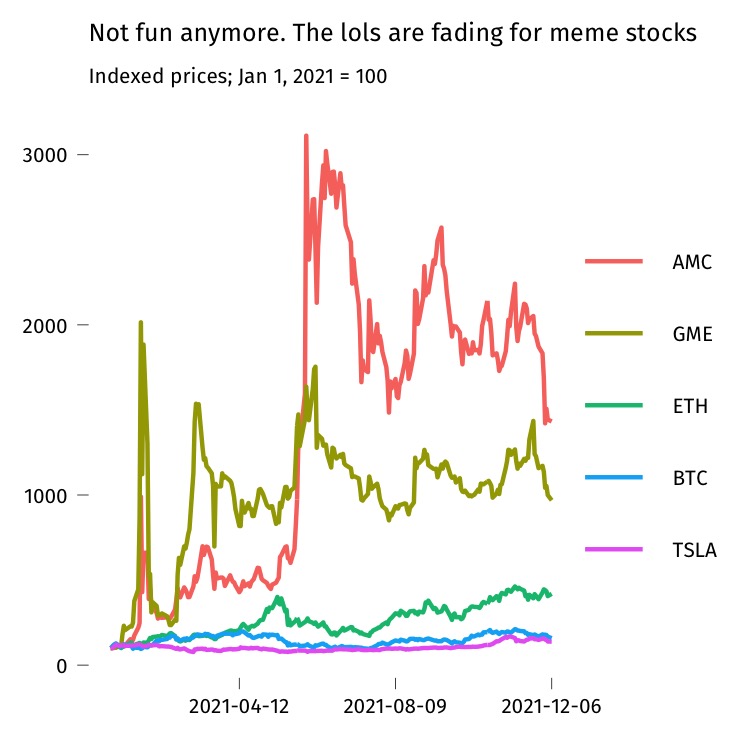

The graph below shows the prices of some of the hottest assets of 2020-21. They include pure meme stocks Game Stop (GME), a computer game retailer, and AMC Entertainment (AMC), a movie theatre chain headquartered in Kansas. Also included are cryptocurrencies Bitcoin (BTC) and Ethereum (ETH), plus the original hot stock, Tesla (TSLA).

They’ve each had a fast rise and a recent pullback, of various sizes.

We can see the price movements more clearly if we set all the stocks equal at the beginning of the year and watch what happens.

This next chart shows the changes after setting price = 100 on January 1.

AMC stock rose more than 30-fold, an astonishing rise based only on the fact that traders who gather on reddit stock-trading message boards decided to target it and push its price up. The same phenomenon explains the rise in Game Stop. (The relevant message board is called r/WallStreetBets, in case you are interested, and the top posts there right now are all full of snark and fatalism as the market turns down.)

The meme stocks are pure, crystalline proof for the argument that in recent years some assets have risen for no good reason. That was debatable for assets like Tesla, where the product is real but the valuation is extremely frothy. But for meme stocks, the value argument is torn off completely and stomped on. The reason to invest in it is that it is fun to do so. And profitable!

Meme stocks work — for now. There is so much money and liquidity loose in global markets that it has to go somewhere. So it piles in to something — anything — and as the price of that thing rises, more investors follow. Success begets success, the speculators laugh, the champagne fizzes.

First they laugh at you, then they fight you, then you win, then… ?

Cryptocurrencies are a good example of the rise of assets nobody previously believed in. Bitcoin rose throughout the past decade in fits and starts and against the odds. Its eventual triumph was due largely to low interest rates making a few speculative investment choices seem like a reasonable bet.

Then came the monetary and fiscal explosion of the pandemic. Governments borrowed incessantly to spend enormously, record low interest rates were cut even further, and central banks bought bonds in never-before-seen volumes.

All these interventions created an environment where asset markets were flush with money. That money flowed to normal assets — the S&P 500 has been at record highs for most of the time since 2013 — but it didn’t stop there. Big tech firms got huge valuations in public markets. Venture capital flowed like water in private markets. Bitcoin rose from under US$10,000 in January 2020 to US$50,000 today. And finally, when the liquidity was most extreme, we got meme stocks.

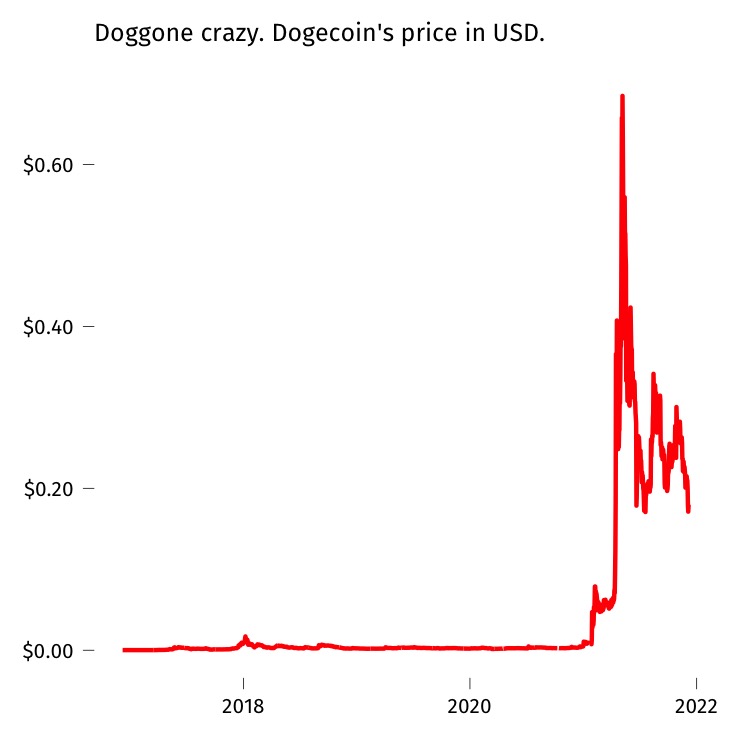

Meme stocks make a mockery of the idea that an asset must be useful or profitable — or at least show a prospect of being so — to justify investing in it. That idea was already dying when Dogecoin (a cryptocurrency that is explicitly a joke) briefly achieved a market capitalisation of US$75 billion.

The capitulation of meme stocks (and Dogecoin) in recent weeks is related to the prospect of a great normalisation. Interest rates are rising, central government bond purchases are going to slow, and fiscal policy is going back to normal.

Australia’s central bank is expected to start raising rates in 2022 or 2023 as inflation gets back to normal. The US Federal Reserve is expected to move sooner. New Zealand raised rates last month. As interest rates rise above zero, the return on safe investments gets better and the need to invest in crazy, risky assets falls.

Interest rates in Australia are expected to be much higher by the end of 2023. The big question is: what happens to the party when the booze runs out?

The meme stocks are the first to get a headache, of course. So are they the canary in the coalmine that warns investors to get out? Does their fall mean stocks can fall too? And houses? It is worth observing that the Australian sharemarket is off its August peaks, and the big banks are predicting house price falls in 2023.

Asset prices have gone mad everywhere you look. The madness can’t last forever. The tulip bubble lasted from 1634 to 1637 when it ended in a crash. Let’s hope we see a more orderly descent.

Weird analysis. What does it prove? That stocks can be bid up by social media sentiment?

AMC, for instance isn’t a “stocks make a mockery of the idea that an asset must be useful or profitable”: it’s America’s largest cinema chain (or there-abouts). Clearly the COVID pandemic has made them less useful and less profitable than they were pre-pandemic, on account of having to close, but the first plot seems to show their (clearly speculative) stock price having fallen back to around what it was pre-pandemic, which seems pretty reasonable.

It’s pretty easy, too to argue that Tesla’s valuation is wildly optimistic, but it’s also a going concern, a huge business shipping actual product around the world and doing on-going R&D. Can you be sure the investors are wrong, just because they’ve bid it up when it has a product the world needs, at the time that it needs it?

Some of these things are not like the others.

I wouldn’t go as far as DF in calling the article irrelevant, but it is painfully shallow.

Weird comment. What does it prove? That you can make some of the same points as the acticle and call it shallow, while offering no extra value of your own?

Agree, not sure what the point was in selecting outrider stocks, as it did not really enlighten one about anything except yes, fads and/or new technology can be risky investments (ignoring how can one decrease risks when investing?); like 9F Domain mostly spruiking property over stocks when the latter give higher real long term returns.

I recall only five years ago many experts were writing off ‘shopping’ stock Amazon for not being profitable, possibly because they ignored roll outs, innovations and other income streams e.g. corporate web systems, storage etc. in background.

However, one can take some investment risk (while being conservative for most) and e.g. bitcoin etc. represents innovative blockchain technology in the background which us used by e.g. the Estonian government for some online systems (NATO etc. too); Estonia is becoming ‘the’ place for digital government (inc. digital citizenship).

Not according to Crikey.

Dunno if I, a 68yo white male who has been subscribing to Crikey for 20 years, am typical of Crikey’s subscription list or not, but I found this article irrelevant and of no interest. I suspect I am not alone.

You don’t have to post every thought that passes through your mind 68yo white male

Perhaps you’re just too far gone. I’m a 63 year old white male and I found it interesting and thought provoking. Maybe it’s the 5 year age difference, but I doubt it.

You do realise if you whinge about everything you don’t like it doesn’t make the world a better place, don’t you? It just makes you and everyone around you miserable

I guess I’m just missing Hillary Bray and the Rundle reporting of the 2008 US elections, and pissed off with crappy Pavlovian media responses to every Morrison stunt.

“You do realise if you whinge about everything you don’t like it doesn’t make the world a better place, don’t you? It just makes you and everyone around you miserable”

Anyone see the irony??

Classic boomer white males

There is no irony. Unless, of course, it’s one of those words you young people have repurposed, and I no longer know what it means.

Now get off my lawn! Mutter, mumble…