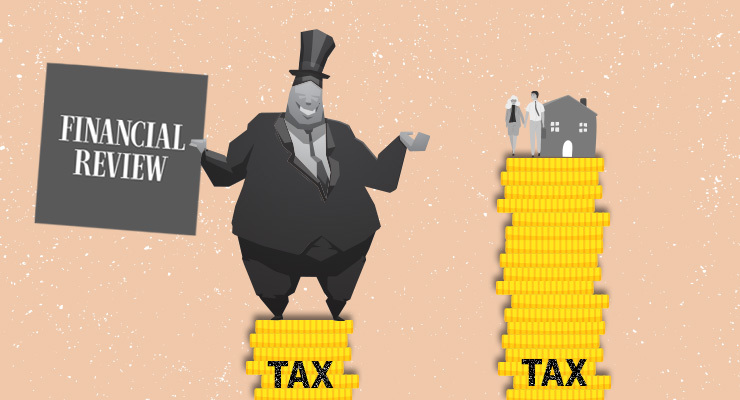

What a pack of hypocritical grubs they are at The Australian Financial Review.

Yet again the AFR has mustered up some business figures to demand “tax reform”, editorialising that it is “challenging both Labor and the Coalition to go to the May federal election with a commitment to commission an independent review of Australia’s broken taxation system in their first year in office” and to commit to “incentive-sharpening structural tax reform”.

Except the AFR has lobbied hard to protect much of that broken system in recent years.

In 2019 Labor went to the election foolishly promising to address two major flaws in the tax system: taxpayer-funded incentives for investors to bid up the cost of existing housing stock, and imputed dividend income for retirees. The AFR, of course, backed the Coalition at the election after providing a platform for it to run attacks against Labor’s tax plans.

And the AFR was happy to back the fossil fuel industry in its campaign to neuter any reform of our increasingly outdated petroleum rent resource tax regime, under which the likes of Woodside, Santos, Origin, Shell and Chevron pay little (in the case of Woodside) or no (the rest) tax for their billions in revenue from Australia’s resources.

If the AFR doesn’t like those basic fixes to major flaws in the system, what does it like?

It loves the regressive idea of increases to the GST — pushing up the cost of goods and services for ordinary workers, many of whom, especially those working in the gig economy beloved of big business, have seen their real wages fall for years under industrial relations policies championed by the AFR and business. The wealthy, who spend far less of their income on basics, would pay much less as a proportion of their incomes.

The current system supposedly “deters investment” — despite governments spending billions in tax write-offs for investment. As always, the AFR solution is company tax cuts — even though the clear evidence from the US is that they merely boost income for shareholders, senior managers and boards, and don’t lead to higher investment or wages.

And the AFR bizarrely claims the tax system “penalises homeowners” — ignoring that most Australian homeowners live in properties that are capital gains tax-free. In fact the system penalises low-income earners and young people trying to enter the housing market — but they don’t read the AFR, so who cares?

To help its campaign, the AFR has resurrected Ken Henry from his post-royal commission obscurity, along with “business doyen” Tony Shepherd. Both have written major reports on reform to governments, which have been ignored — though Henry at least briefly got the mining super profits tax up. (And guess what the AFR thought of that? It campaigned ferociously against that, too.)

The problem with the clamour for “reform” by outfits like the AFR is not that politicians have lost the will to do the hard stuff — though that’s partly true — but that voters have seen through the “reform” con.

The AFR and the business community have no interest in actual reform of the kind that would make the tax system more effective and efficient, as well as fit-for-purpose for funding what the community wants from government — and certainly no interest in supporting Labor if it proposed such reforms.

The “reform” they want is simply to make life even easier for business and investors, regardless of the impact on the community, on growth, on investment levels. And voters have worked out, through bitter experience, that so much “reform” of the past three decades ended up being a mug’s game where they paid the price and business got all the benefits.

The same forces keep robbing the public blind through mealy-mouthed, self-interested urgings for tax ‘reform’. Then when a popular backlash threatens, the Coalition uses culture wars to redirect the resentment to those least able to fight back. And the circle continues. On and on. You wonder what it will take for people to wake up to the trick.

Billionaires, Liberals and their supporting media have spent years telling poor people that taxing the wealthy will stop investment, while lower taxes do not see any increases in investment to build the nation. Only increased investment to increase the wealth of the billionaires through capital gains, franking credits and rental property investments

Cutting company tax would increase productivity in the same way that cutting penalty rates increased employment, i.e. not at all.

With acknowledgement to whichever German actually said it: “Whenever I hear the words tax reform, I reach for my Luger.”

Yes.