Prime Minister Scott Morrison is considering defying the lessons of history by reducing the excise motorists pay on increasingly expensive petrol. Sounds logical, but anyone with memories ancient enough to recall the trauma of petrol prices threatening to push past $1 a litre might also remember it is a doomed attempt at relief.

And it certainly is not the time for the Liberals to again pose their cherished question: “What would John Howard do?”

Twenty-one years ago, Howard was in electoral trouble. Not as much as Morrison is now, but still significant. Like now, the household cost of living jumps were a central issue. Those rises are more acute today, with some grocery items feared to rise 10%.

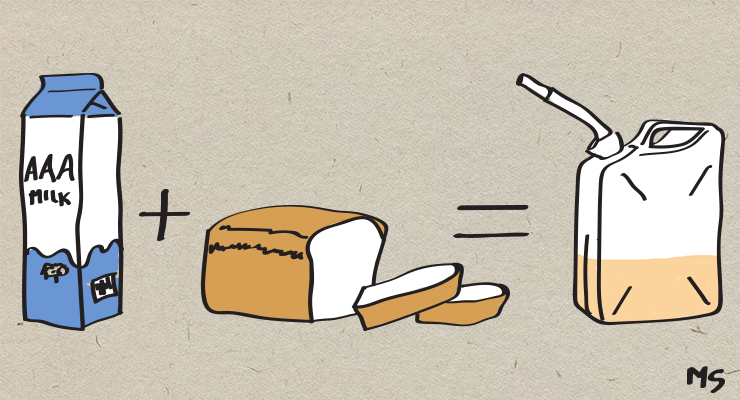

To be simplistic, if the price on your breakfast cereal rises by 10 cents a packet, you are angry maybe once a month. If petrol prices go up 10 cents a litre, you get angry possibly once a week or more. But for the trucking and delivery industry operators it’s a daily fury.

The extra costs of running their vehicles are passed on to consumers.

Howard reduced excise in 2001 when that quaint $1 barrier was at risk. And later regretted it.

It sounds good politics to argue an excise reduction would compensate for rising bowser prices caused by global ructions. Trouble is, even a small cut in the current 44.2 cents a litre would deny the government a lot of taxpayer money. The levy is projected to cost motorists close to $50 billion in the years 2021-22 and 2023-24.

The freezing of the twice-a-year indexation of prices by the inflation rate would also shrink government revenue significantly. And rising inflation costs the government hundreds of millions in indexed pensions and superannuation payments.

The Morrison government just doesn’t have the budget leeway to forgo a chunk of petrol excise.

Inflation usually becomes a bother when the economy is booming, but at the moment it is limping from the supply chain restrictions caused by the pandemic, and the shudder the Russian invasion of Ukraine is sending through the global economy.

So if fiddling with petrol excise is out, what options are left? If Labor wins government in May the petrol price crisis won’t just disappear.

Labor has yet to release a detailed economic blueprint but is expected to argue that a reduction in other household expenses would give families greater liquidity to afford fuel for their vehicles. These cuts might be in such cost as childcare and education, for example.

The policy hope is that these concessions would help keep family cars running — and, if coupled with aid to business, keep jobs secure.

It might be a good time to ask Howard what not to do.

Howard introduced the petrol excise in 1978 when treasurer to Liberal prime minister Malcolm Fraser. As prime minister in 2001, he cut excise and dumped automatic indexation which had been introduced by the Hawke Labor government.

This would “impose a welcome discipline on future governments”, he said at the time.

Perhaps more pertinent were the words of Kevin Rudd who as prime minister reintroduced indexation. In 2008 — as the international recession gained speed — he confessed on behalf of all prime ministers: “I can’t control the global price of oil.”

Why would you ask that fore lock tugging Howard anything?

Ninja turtle has no idea and I call him Ninja turtle because of his appearance at gun rally way back when.

Who was it that sold off Australia’s gold reserve?

In 1997 the RBA, under Ian Macfarlane, who had just taken over from Bernie Fraser, sold 167 tonnes of gold – 2/3rds of the hoard – approved by then treasurer Peter Costello.

This netted some AUD $2.4 billion, just under AUD $450 per ounce, which was very close to the average AUD gold price across the first six months of 1997.

What was the price of gold in 1997?

Gold Prices – 100 Year Historical 1997 $331.00

Gordon Brown did pretty much, sold bigly at the bottom of the market.

Howard forelock tugging? To whom? Certainly not the electorate.

Bush.

The Queen, he is avid monarchist.

Wage rises are supposedly linked to productivity – if that was in anyway true wages would be increasing massively

The right wing media and Liberals, Nationals bang on about productivity needing to increase – FACTS show productivity has continued to increase

The relationship between wages and productivity growth decoupled in the 1990s. Technology has driven productivity growth since then. Technology is making humans increasingly less valuable. Wages growth will continue to lag productivity growth. The lag will increase. I imagine in 50 years’ time, most jobs will be done by machines. We are all getting poorer. The only way this will change is through tax reform and phasing in of a universal basic income.

What about pay rises or is that taboo. High fuel prices and rising interest rates equals storm clouds on the horizon. Now is not the time to sign up for a new house.

Productivity in Australia increased to 103 points in the fourth quarter of 2021 from 102.60 points in the third quarter of 2021

Productivity in Australia increased to 103 points in the fourth quarter of 2021 from 102.60 points in the third quarter of 2021and is now over 4 points higher than the mean average. And higher than the 965 points in 2013

How is productivity measured?

Gee Willakers, they all went down a rabbit hole with that one.

Dare I say if I were to sell the Sydney Harbour Bridge and delare my profit it would enhance the nations productivity by a wee bit or maybe a lot. Thats the very simplist explanation. Waiting for the response to see if it is correct. LOL

So when we have finished selling everything to China and the US our productivity hits the wall or fan.

The LNP has not budgeted for climate change. Our national debt is going one way. They would happily spend 100s of billions on weapons but nothing on climate change adaptation/mitigation. The cost of inaction will potentially bankrupt Australia. The LNP cannot think beyond the next news cycle. That is why they keep announcing things. Delivery is another story. The sheer incompetence of the LNP beggars belief.

But then you support the LNP foreign policy without a question.