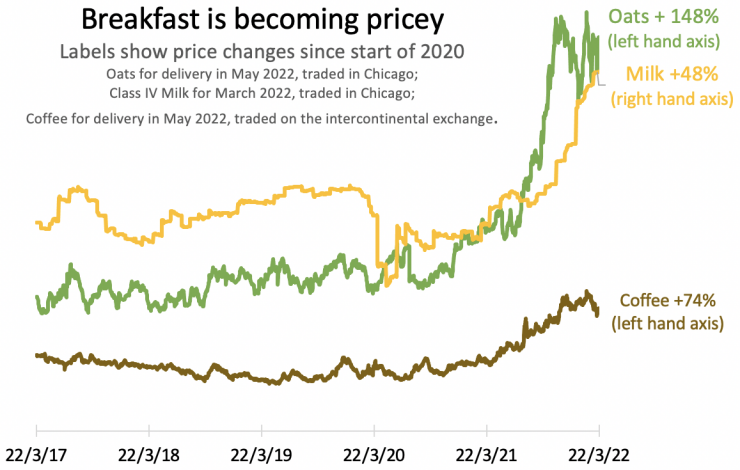

Breakfast is supposedly the most important meal of the day. But skipping it could soon be the best financial decision you make. Breakfast foods have been caught up in the great inflationary impulse, with coffee, milk and oats for your muesli all rising sharply in price over the past year.

Inflation in global markets hasn’t yet flowed through to local prices entirely but in time it will. However, a doubling of global oat prices needn’t mean a doubling in the price of your box of toasted Carmen’s muesli. That price is also determined by local logistics, packaging costs, the retailer’s profit margin and competitive concerns. The flow-through of price rises — in markets other than petrol — can be slow. Still, starting the day with lunch might soon be the financially prudent choice.

As coffee goes up, tea might be a better choice. I can inform you that tea prices in global markets are down since 2020, and prices for cocoa are stable. A few squares of chocolate might be just what we need to soothe us as inflation takes hold.

The terror of inflation

The word inflation refers to a rise in prices. Rising prices are persistent over time. It’s why we remember a can of drink costing 50 cents and a house costing $50,000. It’s also why future generations will pay $10 for a can of drink and $10 million for a house.

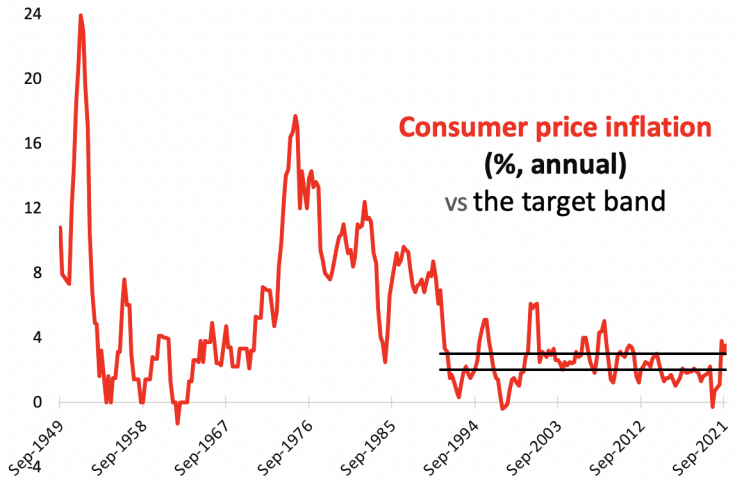

Experts believe a little bit of inflation is helpful, mostly because it provides a buffer against deflation (falling prices). Falling prices are believed to make people hoard cash and avoid spending, because their money will buy more later. That hoarding of cash stops the economy from continuing on its merry dance, and puts people out of work (in theory). This is why the Reserve Bank of Australia (RBA) aims to keep inflation between 2-3% on average.

Overall, the RBA used to be very bad at this task and has in recent times got a lot better, as the next chart shows.

Still, they miss. Between 2014 and 2021, inflation was mostly below its target and recently it has shot above the target. This has caused much shouting. Many people believe the RBA should raise interest rates now to clamp down on inflation. (Higher interest rates are meant to reduce inflation; lower interest rates are believed to spark inflation — interest rates are the RBA’s main tool for achieving its target of 2-3% inflation.)

Who wins and who loses?

Inflation creates winners and losers. If you hold cash, its buying power falls with inflation and you lose. If you have debt, its size relative to everything else falls with inflation, and you win. Inflation is one reason why the terrifyingly large mortgage you got at age 28 seems manageable at age 40.

Right now inflation is above the 2-3% band. Why hasn’t the RBA hiked rates? To understand why the RBA is cautious, we need to go back to the graph that we started with. The inflation we are seeing now is not caused by domestic optimism. It is caused by fluctuations in global markets.

One way we get inflation is when Australians are rich and bold and happy and buy so much that local retailers start putting up prices. In that case, rising interest rates cool everybody’s ardour and inflation is moderated (people spend more on their mortgage, less at the shops).

But the cause of our current inflation is not powerful local spending (or not solely, anyway). It’s due to disrupted supply chains and the megalomania of one KGB veteran with a nuclear button. If the RBA hikes interest rates now, it won’t change imported prices, and instead will make everyone’s household budget much harder to manage. Nobody wants higher mortgage repayments when they’re already skipping breakfast.

So the RBA waits. It wants to see higher wages growth before it hikes interest rates. And that means inflation will be high for a while yet.

The people who are worse off as we wait will be those on fixed incomes. If your pension paid out $1000 a month and the buying power of $1000 is tumbling, you are getting poorer in real (inflation-adjusted) terms. The government raises payments every six months to try to compensate for inflation — this week, payments to pensioners and recipients of JobSeeker are rising by 2%. People receiving JobSeeker payments will get an extra $13.20 a fortnight.

It’s not nothing, but it’s hardly enough to keep up with the price of food. And remember, JobSeeker recipients were probably already skipping breakfast before the latest surge in prices.

“But the cause of our current inflation is not powerful local spending (or not solely, anyway). It’s due to disrupted supply chains and the megalomania of one KGB veteran with a nuclear button”.

I would have thought the cause of the inflation is the 8.95 trillion dollars the US Government pumped into the global economy to save capitalism from its internal contradictions as manifested in the Global Financial Crisis.

This money did not result in wages growth or increased living standards in the real economy but fed straight into a mad growth in asset prices. Whenever Trump got up and said how well the US economy was doing, this is what he was referring to. Not wages growth or the economy of people doing real jobs but the economy of people who owned stuff. They got even richer.

The inflation demon is now awakening, and we will have to face the consequences of profligate and irresponsible financial policies of the last two decades.

Putin be damned, the demons of capitalism are back. Lay the blame where it needs to be laid, and strap yourselves in for the ride!

Wages stubbonly refuse to go up because the party of free markets, currently our government, has consistantly frigged with the labour market so that it is not free.

I’m on a fixed age pension. Going backwards with finances.

One interesting point continually made by Scomo is that the price of electricity has gone down! For whom?

In rental as well, and owner has looked at solar but it is truly not economic to do for the 4 units.

Anyway, back to my story – last pension increase of $14.00 plus some cents (per fortnight) – rent up $10 per week. Gas price hike recently and in the last 3 years have had electricity prices up as well.

It’s not consumers getting cheaper electricity!

Another pension increase this week.

Prices up on so many foods it’s quite staggering. And I rarely buy prepared packaged foods. Can’t even do basic cooking – do supermarket shopping only (regional town) so no boiler chickens for soup, bones are expensive! And my diet of mainly vegetables pulses and nuts have become more costly.

Seriously pity families with young children – how will they afford healthier foods?

On Wednesday’s LNL, Diddums had the UK stringer telling on poor not buying spus because they cannot afford the gas to boil them as they must choose between frosted breath or junk food.

Two generations ago, it would not have been even noticed, the really poor would have boiled the pratties on the, wildly inadequate, coal grate whlst heating their hovel.

But greenies have forbidden them to burn coal, condemned to starving or freezing in the dark™ ®.

Inflation is going to cause a lot of problems ,it will be lot worse than Russia invasion of Ukraine. The USA ,reserve bank claims inflation is running at 7% lots of banks are saying true inflation is running in USA at 8-10 %. It seems the printing of monies since the crisis of 2008 ,has finally caught up , lots of economic commentators are saying the USA reserve bank has lost control of the inflation cat. If you want to believe the USA reserve that inflation is 7% but they are still printing dollars ,raising the interest to a quarter % then a years time 2/ quarter % if inflation is still between 7-10% surly the bubble housing Stockmarket has too pop,in the USA and Australia. Labor might wish in 2023 it lost the election

How do you think the baby boomers got rich. Buy a house in the 60s/70s (still worked for me in the 80s) for what you can barely afford and wait as wages rose with the cost of living, ten years later the repayments were very low compared to income and repeat. But those were the also the days of 40hr/week employment and strong union support and action. Where is that union action these days? I think the younger generations are enormously let down and taken for a ride by both politicians and unions. How long before they wake up and throw both major parties on the scrap heap.

Agree about disposal but what then?

Replace them with the usual 2nd/3rd rate Jobsworths who malinger in the rear, waiting to go out foraging after the/any battle and despoil the fallen?

To be frank, I don’t know what then. I have close ties with the Netherlands and my family there and they somehow manage with multiple parties and loads of independents. Sounds chaotic and everybody complains (LOL) but one way or another it works.

I believe it’s called parliamentary democracy.

I’d opt for that – multiparty governments – in a heartbeat.