Australian workers are facing two or more difficult years after the Reserve Bank succumbed to pressure from markets and inflation hawks and abandoned its wages-first stance on interest rate rises.

It means that from now until at least 2024, workers with mortgages face falling real wages and significantly higher mortgage repayments due to inflation problems external to Australia.

While leaving interest rates on hold at its April meeting yesterday, RBA governor Philip Lowe said inflation is rising and the RBA only needs a little more evidence to see that it has risen “sustainably” in order to conclude interest rates should rise.

In the key final paragraph of the statement, the word “patient”, which had been in previous statements for several months and seen as a key explainer of the RBA’s stance, was dropped and a more complex phrasing introduced that suggests the central bank expects forthcoming data to show that rates will need to rise.

The final paragraph also has a weaker emphasis on wages than previous iterations.

The RBA has now abandoned its stance of waiting for wage rises to top 3%, focusing instead on the inflation rate per se. “Growth in labour costs has been below rates that are likely to be consistent with inflation being sustainably at target,” the statement says, reflecting the tone of earlier statements albeit with less prominence. However, “over coming months, important additional evidence will be available to the board on both inflation and the evolution of labour costs”.

That’s a clear warning that “rate rise looms”.

Where does that leave workers? The budget papers forecast that workers will suffer a 1.5% fall in real wages this year but there’ll be a 0.25% real wage rise next year — that’s assuming that the optimistic wage growth forecast of 3.25% is achieved. That will be followed, the government claims, by a 0.5% rise in real wages in 2023-24. But those rises are before tax, which will eat away at these tiny rises even if those wage forecasts come true, condemning workers in sectors with below-average wages growth, like construction and professional services, to persistent real wage falls.

And even those with some small wages growth won’t come close to catching up on the real wage losses they’ve endured over the past two years.

It paves the way for the RBA to start “normalising” interest rates by lifting them back above 1% and heading toward 2% over the course of the year, significantly increasing mortgage repayments, especially households lured into the property market for the first time by ultra-cheap loans. The timing is still in dispute — but not that it will happen.

The RBA’s change of stance will delight inflation hawks and financial markets, which can make far more money from betting on interest rate rises than it can from rates being stuck at one level for extended periods.

Those who have been demanding that households be punished for record low rates and that we return to an era when pummelling inflation was all that mattered will be over the moon. Demand will be smothered and households will have to direct more of their shrinking income to bank profits. None of that will be of much concern to the RBA board, now dominated by business representatives.

And if you made house purchasing and investment decisions comforted by the Reserve Bank’s repeated assurances for two years that interest rates would not increase until 2024, and would not go up until wages growth had lifted significantly, well tough luck and fool you for believing it.

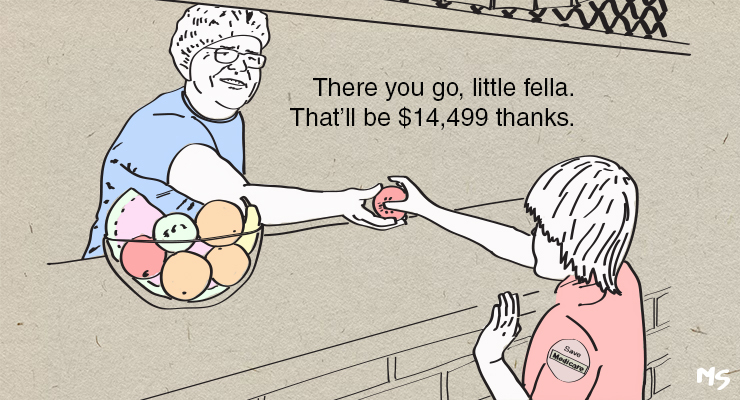

Not just interest rates are rising. I took my elderly Mum to the doctors this morning. The surgery was one of the very, very few left in Newcastle that bulk billed everyone, unless you were on a high income. Not anymore, not unless you have a concession card of some kind. A standard, 10 minute consultation including Telehealth will set you back $86 up front now. That’s a lot of money to find in a time of obscenely high rents and childcare costs, isn’t it? Not to mention the across the board cost of living rises and falling real wages. A lot of people will just stop going to the doctor because they simply can’t find the money, just like they stopped going to the dentist a generation ago. Preventative health care’s out the window.

Stay tuned for a primary health care crisis that will make the aged care crisis look like a walk in the park. Not that anyone will care. They don’t care about those obscene rents or the growing homelessness rates, so we’ve established pretty convincingly the care factor is zero. They’ll nuke the popcorn, stream “Housos” and have a giggle at the plight of a full third of the population (and growing). If only housos was real…

Inflation hawks, who have been wrong since Methuselah was a boy, get their own way again. We’ve had 40 years of sub optimal wage and economic growth because some neocons hate poor people

Property prices are too high partly because the interest rates have been too low.

And too many investors took advantage of all that free money to add more negatively geared properties to their investment portfolios so they could enjoy the capital gains windfall to add yet more negatively geared properties to their investment portfolios. These same investors are in a position to ride out the interest rate rises and clean up when actual homeowners lose their homes because their mortgage just became unaffordable.

What a racket. What a country.

One of the few biblical precepts which Scummo follows – Matthew 13:11–12.

PS for those unfamiliar with google – “For to him who has will more be given, and he will have abundance; but from him who has not, even what he has will be taken away.”

“Ride out the interest rate increases”. Only if they have sufficient cashflow to do so. Negative Gearing = Negative Cash flow. You may find that a lot of these overgeared property portfolios may come crashing down on them.

That’s not the fault of the RBA, that is poor fiscal and tax policy settings. Worker share of GDP lowest level ever, owners of capital share of GDP highest levels ever. The issue with paying the owners of capital more and more – they have the lowest propensity to spend. Sure they spend more but the lowest paid spend all of their money quickly, they are the job creators. The RBA only has 1 tool, it’s been forced to drop interest rates and cross their fingers.

Only ‘some’?

It’s a basic requirement, one might say their entire raison d’etre.

There are politicians at the top end of the liberal party who are making millions of dollars out of the poverty they are creating as they smirk their way to the poll.

When the PM has increased his net wealth by nearly $30 million dollars in a time when wages have fallen effectively by 10 to 20% its not hard to see why he does not give a damn for the average wage earner

My education was as a miner, & union offical of miners,but for the love me, I can’t see how those on low to middle wages are going to get wage increase. The deal of the income accord ACTU – Labour government,is one of the barriers to wage break out,namely enterprises bargaining, with the companies arguing that only increases is to come from more productivity,regardless of profit across plants. I would like somebody to explain what the USA reserve bank is doing, that inflation is 8% their word ,raise interest rates to one quarter percent,that seems like peeing on a bush fire to control inflation, it seems to me,that reserve banks around the world,are protecting property & share market ,rather than control inflation

Why will this “difficult time” end as soon as two years? … Climate change – with all it’s extras – will ease up too?

Not bloody likely klewso .The PM will go down in history as one of the architects of Climate Change and the exponential costs our children will pay because he chose to enrich miners the likes of the fat coal miner and the selfish grandmother.