Will the Reserve Bank of Australia (RBA) raise rates today? The market is not quite as sure as a week ago. A two-thirds chance of a small hike is priced in. That small hike would take rates from 0.1% up to 0.25%. The market was pricing in a 100% chance of a small hike last week after the earth-shattering inflation figure. But confidence in the RBA’s response has cooled. Why?

The RBA is supposed to be an inflation-fighting central bank. Inflation is certainly fighting back. It clocked in at 5.1% annual in the most recent official data, the highest result in decades.

Still, a rate rise this afternoon is not certain. There are signs the central bank might choose not to act:

- The most recent official pronouncement from the RBA governor suggested he would wait to look at data on inflation and wages “over coming months” before lifting rates. There has been no update to that statement, and not all the “data” referred to — i.e. the wage price index — has yet come out. The bank could have, if it chose to, updated us. It could schedule a speech, host a webinar, or get its message out through the media. But no deputy governors have been spotted at a podium. Nor does scanning the press for signs of a background briefing of a top economics scribe reveal anything. Nobody seems to have the good oil on a rate rise. Which suggests the most recent pronouncements are meant to stand.

- An election campaign is going on. At the end of that, the RBA is up for review. The RBA is independent in its actions but ultimately this is a democracy and we the people control it through our representatives. The RBA should be worried about upsetting us — but might it also be worried about upsetting our representatives?

The RBA wants to preserve its credibility in two ways: to be taken seriously as an enemy of high inflation, but also by its statements acting as a reliable guide to its actions. At the moment it faces a challenging choice between those two kinds of credibility.

Cue the critics

If the RBA leaves interest rates on hold there will be furore. People will say it moves too slowly. They have a point. Inflation data is backward-looking, so the 5.1% inflation figure recently released applies to January, February and March this year. A May rate rise would flow through to mortgages over weeks and work its way through the economy over the next six months. You could argue any rate rise is nine months too long in gestation.

The argument that the bank has already waited too long makes sense. However, the argument that waiting another month to act won’t change much is also somewhat credible. Monetary policy is not a direct lever with which the RBA controls consumer price inflation. Rate hikes works in five main ways:

- By crimping our spending power (via diverting more of our earnings to paying off loans)

- By encouraging people to save, not spend

- By reducing the amount people and companies can borrow to spend

- By lifting our exchange rate, making imports cheaper and domestic goods more expensive

- By reducing asset prices and making their owners feel poorer

In summary, it works by making us spend less on local goods, thereby reducing their prices. This is certainly not a costless approach. The RBA is right to be cautious. Many are the central banks that have made their people poorer by raising interest rates too hard and precipitating a recession.

But also much of our inflation is imported. What good is it depressing the local economy to try to dig out inflation when its roots are in Ukraine, in the Organization of the Petroleum Exporting Countries (OPEC), in the commodities trading desks of Chicago? We live in an increasingly global world with a global coffee price, oil price, beef price, etc.

In the past few decades, the pattern of Australian inflation has been domestic goods getting more expensive while imports grow in price very slowly. For example, T-shirts made in Bangladesh cost $14 now, while haircuts in Melbourne cost, well, hundreds if you’re a woman going to a fancy place. This means Australians earn higher wages but can buy lots of goods cheaply.

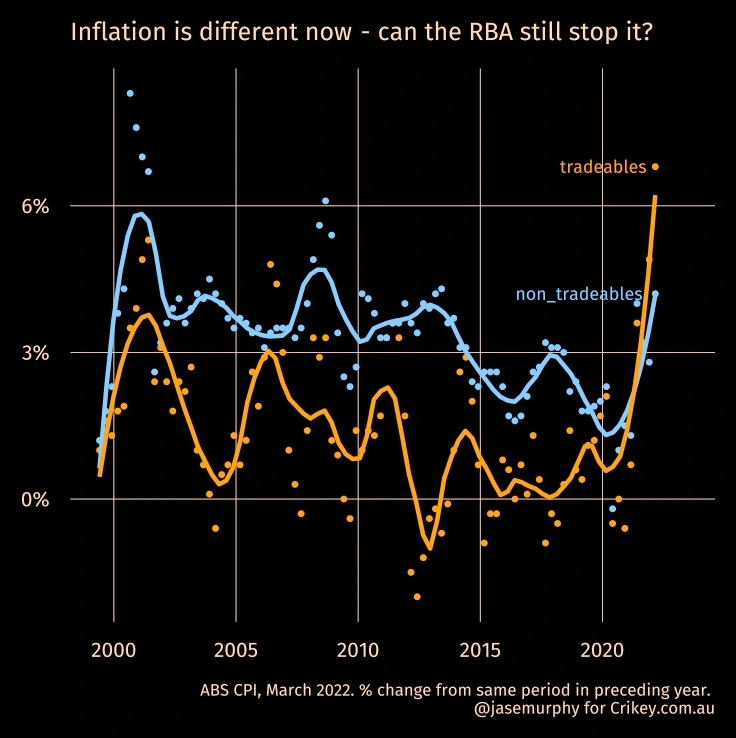

But more recently, something has changed. Inflation in tradeable items is suddenly very high, as the next chart shows.

Can we affect their price with tight monetary policy? The labour on those goods is all done offshore and the price of importing them is set on global markets. You might crush the price of a haircut with tight monetary policy, but good luck affecting the price of imported commodities. All you can affect is the margin importers can charge.

If the RBA chooses not to act today, the new composition of inflation is likely to be one reason why.

This is only the start. Rates will keep raising until they reach somewhere near parity with overseas.

It is going to be a very very messy result which no doubt the liberals will blame the incoming Labor government for. Unfortunately the public will do likewise.

I’ll believe that RBA interest rate tinkering is the Solomonic public-spiritedness of an ‘inflation-fighting central bank’ when the CPI basket includes all property transfers, not just new dwellings and renovations. Until then forgive my preferred ‘asset-enhancing central bank’. Property prices surged by 23.7% this last year, with 834, 008 individual settlements (up 32%, on year) totaling $688billion. That’s a third of our GDP. Of those settlements maybe 140,000-odd were new stock, and thus included in the CPI basket. Renos, even less impactful. Thus, even though a very high percentage of those 834,008 settlements will have represented Orny Orstralians mortgaging themselves to the hilt, maxing out their household operating margins even ahead of today’s call….oh, Stevo & Co are saying ‘inflation’ is only becoming a worry…now?

It’s the oldest, oiliest con in the regressive playbook: quarantine asset values (‘wealth’) from the cost of living & the value of labour. Then pump every bit of lazy capital you can into the first. Print more if you can, repeat…of course Australian’s housing Ponzi insanity has been quarantined from any real inflationary watch-dogging. The whole point of a Ponzi is to wildly outstrip CPI. And here-in lies the folly of allowing a house to become regarded as an asset – ‘wealth’ – and not the (essential) good & service of a home.

Today’s rate rise – or not – is barely relevant, really. Like ‘full employment’, it’s not the number that counts, it’s the way the number is calculated that conceals the short con and facilitates the long one.

Gah, Phil & Co not stevens…getting old.

The other effect of RBA rate rises is an increase to margins for banks. It seems to me a rise to 0.25% is largely symbolic and will do nothing to quell largely imported inflation other than theoretically suppress the demand. But it is wage stagnation that makes an inflation rate of 5.1% so shocking, not the RBA official interest rate.

I also agree with JR above that measurement methodologies are commonly perverse and never questioned.

Thirdly, the mechanical, almost robotic, speculation by the media that inflation of x% means the RBA must raise the official interest rate exposes the shallowness of understanding by ‘economic’ journalists and, indeed, many economic ‘experts’ with questionable intellectual capacity for complexity and nuance.

Having said all that, another kick in the nuts for the Liar From The Shire will always be enjoyable, even if the rise is largely irrelevant.

Spot on about wages stagnation being the killer. It’s terrifying, given that wages ‘should’ have been long rising by now…ie especially in building sector, given the employment vitality and profit growth there. But so long now has incredible property (and share) asset growth been brutally cleaved from (building) labour wage growth that I fear that link is just broken forever. Labour hire firms and some subcontractors and supply chain stakeholders might be getting rich from the housing Ponzi alongside the spivs, but few worker ants are.

I think Speculative Capitalism has grown to enjoy flat-lining wages as a ‘natural, undistorted’ market parameter entitlement…as the demand side tax breaks have long become.

PS: up it goes to .25…buckle up.

‘by’ .25…d’oh

Will he won’t he,❓

He’s too timid to do it today,.

Doesn’t matter if the patient bleeds out while waiting another month, for the surgeon to arrive…

There is a word that best explains some of the unexplainable decisions of the coalition government,it’s corruption The relationship between members of the coalition and the fossil fuel industry has held back this country’s chancesof becoming a world leader in the renewable market.