It’s May 2024. Jim Chalmers has just handed down the second Labor budget — the third if you count the September economic statement back in 2022, a virtual mini-budget that brought Anthony Albanese’s post-election popularity to a rapid close as the new government cut back on spending, declaring that surging interest rates demanded fiscal discipline.

It’s been a grim two years. Interest rates are now 2.25%, with the Reserve Bank signalling at its May meeting it may be nearing the end of its tightening cycle but will wait to consider further evidence — chief among which, according to the commentariat, is the size of the budget deficit.

Chalmers has unveiled a deficit of $29 billion, lower than expectations but evidence, opposition leader Peter Dutton says, of Labor’s reckless obsession with debt and deficits.

While inflation is nearly back to 3%, power prices, driven by the continued high price of coal, have hammered household budgets — evidence that our obsession with renewables has to stop, The Australian editorialises. Growth has slumped to pre-pandemic levels — just 2.5% in 2023-24, according to the budget, with 2024-25 expected to be the same. Unemployment is headed back to 4.5%, but wages growth is expected to pass 3.25%, finally, and deliver at least small real wages growth to workers, with low-paid workers benefiting from a higher-than-expected minimum wage rise after a strong government submission in support in 2023. Public sector wages, however, remain stuck at 2.5% growth due to continuing salary caps.

But aged care remains in crisis: the 19% pay rise for aged care workers approved by the Fair Work Commission in early 2023 commenced on July 1 that year but the sector is still struggling to attract workers, and a new temporary visa category specifically for the industry has been announced and funded in the budget with the goal of an additional 50,000 workers in the sector over the forward estimates.

But despite the restarting of large-scale immigration and the return of holidaymakers and foreign students — much fewer from China, with that country still in isolation — workforce shortages remain.

The health workforce cannot expand quickly enough, with most state governments engaged in rounds of beggar-thy-neighbour poaching of doctors and nurses. The benefits of Albanese’s signature childcare policy are starting to be felt, true, with female participation finally increasing beyond the high levels it reached under the Coalition, but critics say that’s more because desperate families need two incomes to meet rising mortgage repayments.

The government points to its massive expansion of vocational education funding, but demands from business for an expanded skilled migration program of 150,000 a year appear regularly in The Australian Financial Review, along with routine calls for greater workplace flexibility. On productivity, despite a national summit in late 2022, labour productivity growth still remains at the low levels of the Coalition years.

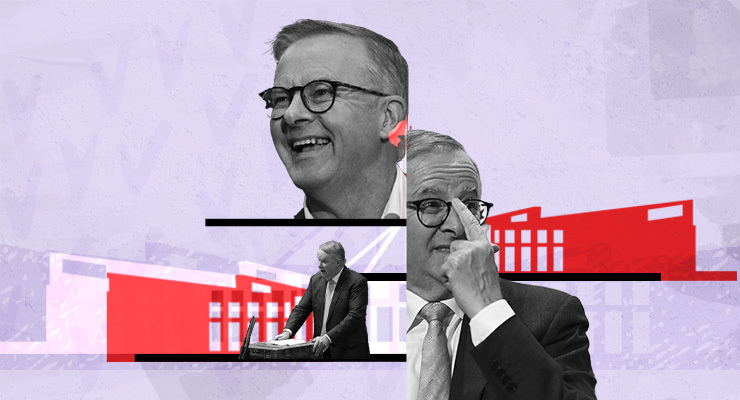

The government remains caught between criticism from the right that it is a high-spending, high-taxing Labor government, and the political impacts of spending cuts, especially in outer suburban seats — though beyond the occasional Troy Bramston article in The Australian there’s no speculation yet Albanese might be replaced by Chalmers before the election.

The one bright spot is energy investment, which surged following Labor’s win and the announcement of a national transition plan, in cooperation with all the states, centring on expanded transmission capacity and funding for regional renewables-and-storage hubs up and down the east coast. The federal Coalition is still mired in climate wars after Dutton committed to new coal-fired power stations in his 2023 budget reply and savaged the NSW government as “Liberal traitors” for working with federal Labor on major renewables projects.

Otherwise, there’s been little progress on climate, beyond the formal adoption of a 2030 43% emissions reduction target by Labor and the slower than expected rollout of EV charging infrastructure. Coal export revenue has remained above $100 billion a year for the past two years, and the expansion of major gas projects such as Santos’ deeply polluting Barossa field have proceeded apace, with continuing subsidies for carbon capture and storage projects despite mounting evidence of the failure of that technology. Meanwhile, petroleum resource rent tax revenue has “surged” to $2.4 billion a year off the back of high gas prices.

On housing, Labor’s Help to Buy scheme finally started in mid-2023, but has had low take-up, and in any event the 5% average fall in house prices — 10% in Sydney and 8% in Melbourne, despite the increase in immigration — has taken the heat out housing affordability as a political issue, even if the conditions are set for affordability to deteriorate dramatically once house prices start rising again.

“We’ve weathered the storm, and better times are ahead,” says Albanese in the post-budget round of media — but with speculation of an election in the second half of the year, it’s unclear whether that applies to Labor.

I hate these speculative future articles. If the past three years has taught us anything, events can derail the best laid plans.

If events, dear boy, events prove to make a mockery of his attempt at foretelling the future he can always republish this article in 2025 as a counterfactual “what might have been” if only that meteorite hadn’t struck Moscow, starting WW3.

Mass immigration reboot needed like a hole in the head.

Not saying it won’t happen mind.

But advocating wage rises and an influx of 250 000 newcomers annually is kinda like seeing who can whisper the loudest.

And the ACTU?

Sound of crickets.

Pushing unemployment up is a traditional way of forcing inflation down. And a VERY traditional way of forcing wages down. 😉

It’s time to stop relying on poorly conceived immigration plans, most of which are at the behest of business groups to keep wages down and property prices high.

What it IS time for is a bold, strategic nation building program to create a skilled workforce capable of rapidly building affordable housing, using innovative pattern-building and prefabricated technologies. This program will also need to skill the new workforce to develop the environment and infrastructure to support it by facilitating the transition to renewables and a sustainable economy. This is the only way to weather the looming storm with any chance of emerging as a functional, healthy society as opposed to a Banana Republic with Gina Rinehart lording it over the remaining natives from her fortress plantation house.

The obvious problem with this is that despite the clear evidence that we need to get on and do it (the ‘market’ won’t magically solve it for us) we are woefully served by our governments who are beholden to the beneficiaries of late-stage capitalism. To the vested interests served by Australia’s political class, ‘renewables and sustainability’, in the present vernacular of right wing political discourse translates to ‘irresponsible woke elite Greenies’ and ‘nation building’ to ‘communism’. This is nothing less than active, planned class resistance to urgently needed reforms in order to preserve their wealth and status.

As change becomes ever more urgent and the solutions ever more radical as time is wasted, then the resource extraction, property development and rentier system that basically ‘owns and operates’ Australia must become equally more desperate and irrational is defending its wealth and interests. The endgame is to accumulate as much as possible for themselves before the manure really hits the wind farm.

The gap between what reality requires and what our government and its sponsors are prepared to do just keeps growing. We’ve seen how woefully ineffective all the bureaucracy and platitudes about ‘Closing the Gap’ for our indigenous communities has been and the planning for the coming structural shocks is about as ineffective as that.

‘Incrementalism’, the self-serving approach of a political class that refuses to acknowledge reality and take responsibility, is failing Australia. Time to start building a real nation, not feathering the nests of the squatters and diggers.

In my version there are no continuing subsidies for carbon capture & storage. Why would they?

Because fossil fuel subsidies-hidden or otherwise-won’t stop with an ALP government.

The only shot of meaningful change lies with an independent/green balance of power providing the ALP with enough cover to, you know, actually do something.

Not hopeful.

Is this a “I have to write an article but I’ve got nothing to write about” piece?

Lotta that here – not as if there were anything else in the news, like war & alarum in the world or region, that might need reporting.

Or a federal election here.

Prescient. Labor is unfortunate to inherit the damage of Liberal economic policy and then blamed for the mess. I think Jason Clare may be more of a leadership threat than Chalmers.