The boss of the Reserve Bank of Australia has popped up on TV for the first time in 12 years, in yet another sign that extremely unusual times have arrived for Australia.

Following the RBA decision to raise the official interest rate by 0.5 percentage points last week, Philip Lowe granted a rare interview on 730 to exiting host Leigh Sales. This is his first time doing a prime-time interview and the first time a Reserve Bank governor has been on TV since 2010 when Glenn Stevens went on Sunrise to chat to David “Kochie” Koch.

When the RBA slashed rates in the wake of the global financial crisis there was no TV appearance. When it hiked them afterwards, again, no interview. In the pandemic, when the RBA cut rates close to zero and began an unprecedented campaign of quantitative easing? No TV interview.

Lowe often fronts the press, but that’s about reaching financial markets. Questions largely come from Reuters, Bloomberg and the Financial Review, and the people hanging on his every word trade billions in government paper and collateralised mortgages. This was much more about punters — real Australians who owe money to the bank. It is a classy way to talk to the punters, doing it via Leigh Sales, but a way to reach them nonetheless.

Menu of worry

So, what is going on? Three things:

First, very high inflation. The RBA is way behind the curve here, with inflation soaring to 5.2% and still rising. The central bank used to try to head off inflation before it happened. This time it chose not to and will now play catch-up.

Second, the governor wanted Australians to think the RBA wouldn’t hike rates for years. He used his chat with Sales to try to reassure everyone with an “if-then” statement: we won’t raise rates so long as wages and the economy remain subdued — and we don’t expect them to improve until 2023-24. But that subtlety is usually lost by the press, and even sometimes by the RBA itself, which in 2021 described its outlook by saying “the cash rate was very unlikely to be increased for three years”.

The final reason that Lowe is on TV is he’s pulling a lever, and its fulcrum is households. When he pulls down, the pressure hits people with mortgages. They are the ones who feel the pressure — or the borrowers do, at least. A small share of people with significant sums in interest-earning cash are likely to be whooping.

So the governor wasn’t just making sure financial markets understood the nuances of his thinking — what they call “jawboning” — he was heading off potential popular dissent.

“The emergency is over and it’s time to remove the emergency settings and move to more normal settings for monetary policy,” he said.

The RBA doesn’t want people to feel they are getting screwed. Lowe was at pains to point out that the rate hike comes at a time of wealth.

“The economy’s done remarkably well. The unemployment rate is at a 50-year low, a higher share of the population has a job than ever before, households have built up very large financial buffers. Over the past couple of years, people have put away an extra $250 billion — it’s a lot of money — and the saving rate is still high, and the number of people who’ve fallen behind in their mortgages is actually declining, not rising,” he said.

“There’s a lot of resilience in the household sector.”

All of which is true. But reminding people they have money to spend is likely to dampen the effects of rate hikes, not amplify them. Why would he do it?

We’ll address the cynical reason first. The independent RBA is up for review this year, by the elected representatives of the people. A cynic might say the RBA will be very keen to put its best foot forward ahead of that review, for fear there is popular impetus for significant change. Lowe will not want errant claims about the probability of rate hikes in 2022 to be the main topic of discussion in that review, and he is attempting to bury that issue.

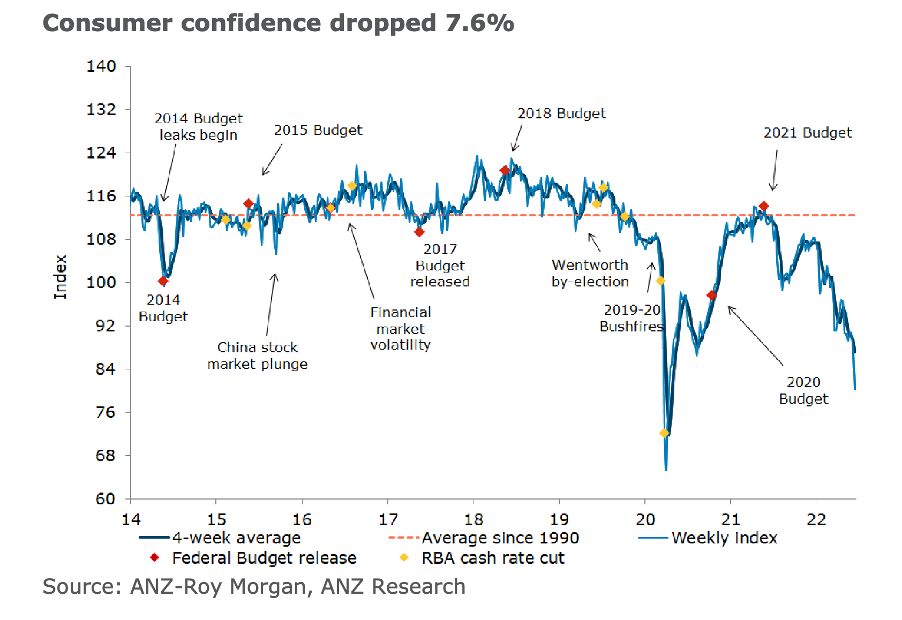

I’d favour a less cynical reason, which is that the two teeny-weeny rate hikes so far have coincided with a pandemic-scale collapse in consumer confidence.

“Outside of the pandemic, consumer confidence hasn’t been this low since January 1991, the midst of the early 1990s recession,” said ANZ head of Australian economics David Plank.

Recession is not a word you want to see right now, and yet it is one being bandied about in relation to the US. The RBA must walk a narrow path. That is not to say the two little rate hikes implemented so far are the cause of the collapse in confidence. It’s the expectation that interest rates will keep rising that is pulling confidence lower, as well as collapsing asset markets here and abroad. But lifting rates in an environment of such consumer angst will be a novel experiment, and it may be why the governor is so keen to talk to households directly — to remind them this is a normalisation, not an attempt to crush them.

Will it work?

I mentioned earlier that the previous RBA governor, Glenn Stevens, went on TV in 2010. It is worth having a quick look at what he said when he appeared.

“We cut interest rates to what we call emergency settings when we had an emergency, when we thought we really were going to face a big downturn and we wanted to try to get ahead of that. Once the emergency has passed and things gradually look more normal, then it’s not wise to leave interest rates right down at rock bottom any longer than we need,” Stevens said at the time. (Transcript preserved by the inestimable Peter Martin.)

The circumstances were alike: the acute crisis had passed, inflation was rising and so were interest rates. What happened next is instructive. Stevens managed only three more rate hikes — all in 2010 — before the economy ran out of impetus. Unemployment bottomed out in late 2010 and hovered around 5% in 2011. By November 2011 the governor was cutting rates again, but it was not enough to stop unemployment from creeping up.

In my view, one big problem in 2011 was fiscal policy. The ghost of Peter Costello haunted the treasurer’s office. Wayne Swan was determined to be a good manager of budget debt, to get back in black.

“We have imposed the strictest spending limits, delivering $22 billion in savings to make room for our key priorities, ensuring our country lives within its means,” Swan said in 2011.

He tried to run tight budgets, trying to reduce the deficit each year. Unemployment rose steadily until Labor was voted out (and rose further under the management of Joe Hockey, who also saw Costello’s surpluses as an ideal). Swan’s chief of staff, Jim Chalmers, is now our treasurer. His budget comes out later in the year, but in the 7.30 interview Lowe gives a big hint about the fiscal settings Chalmers may apply.

“I’m not particularly concerned about a lack of alignment between monetary and fiscal policy. I’ve already had a couple of meetings with the new treasurer. I know he is as committed as I am to bringing inflation back to the 2-3% range. So I think over the next little while there’ll be close alignment between fiscal and monetary policy. I have no concerns there.”

The budget will be tight. The risk here is that Chalmers moves hard to reduce stimulus while Lowe is doing the same and, combined, they go too far. Could TV appearances by the governor of the RBA be a leading indicator of overreach? Time will tell.

What a con man. Telling us as late as February that interest rates will remain at historic lows until 2024. He said this more or less for the last 2 years and many thousands of people have entered the property market on the basis of his authoritative say-so. Now he is wrong, he is pulling the panic button and trying to get respectability for himself. Well, it won’t work. It was a massive stuff-up. The bond traders have called the bluff on the money and share markets and both have caved in. Shares are in free fall. It is only through government intervention on a massive and prolonged scale that the property market is not also in free fall like it was in the 1990s. Reserve Bank people and economists can’t be trusted. It is obvious to anyone with courage and foresight to face unpalatable truths – It’s all up to you!! You can’t trust politicians, business people and bureaucrats. When they get it wrong thy don’t get sacked. They just justify their mistakes with long winded, mealy mouthed, 2-faced explanations about how things got out of hand and they didn’t see it coming. These excuses and explanations are not able to be used by the ordinary working stiff. I used to respect this guy. Another illusion shattered.

The bit we often miss is the confident predictions. Economists have hardly ever predicted the major crashes, fuel hikes etc. yet the predictions capture governments and media. The (as you note) we get the reveal and the analysis of what actual went wrong.

A good summation of the current situation.

As far as respecting the current RBA Governor ,I have always found him to be a gazer through rose coloured glasses who has gotten more predictions/estimates wrong than right during his tenure.

To be honest it would be hard to look objectively at the world when you are living a life of privilege on a multi million dollar salary with every perk under the sun and seen as untouchable as he is.

His salary and super etc guaranteed regardless of performance unlike the great unwashed out there in the real world.

The other thing that never seems to be acknowledged by any of the monetary lever pullers is that all of the free money pumped into the worlds financial systems recently has caused inflation ,it is convenient that Putin started a war ,it has given all of these idiots an excuse for their ineptitude and ignorance.

Yes this is a rolling scandal; a fiasco that some were warning of early in 2021; including me and much more importantly, Alan Kohler. to his credit has continued to show up Lowe and the RBA’s failures. It not just Lowe, but the other senior economists and the Board, who must take responsibility!!

The Deputy Gov, Guy Debelle left earlier this year I wonder if he clashed with Lowe and the Board??????

And not forgetting late last year 2021, RBA boss Phillip LOWE, emphatically stated that the home loan interest rates would remain at a historical low for at least the next four years. How can such a supposedly smart educated man get his prediction so wrong?

How can you trust and have confidence in the RBA?

Yes, Yes- and Leigh Sales let him off the hook!

you can not trust any of the models they use, we will be in recession in 6 months

Was he to know that Russia would invade Ukraine?

Wayne there is a lot more to this than the war. This has been in the making since 2007, have alook at the debt levels, thats MMT – modern monetary theory – now proved wrong. Russia was a little thing to help tip it

I’m interested in who is putting away the record amounts of savings? My partner an I are in the top 10% of joint incomes (got kids ) we would struggle to save meaningfully.

You prefer to not take the cynical reason why RBA Governor Phillip Lowe appears on the 7.30 Report on ABC TV eh? I say it is not cynical to question variously and speculate as to the reasons for this. The election of a new RBA Board is a good one. I just think that Phillip Lowe is kidding us with his gratuitous conversation about the emergency being over.

For years he told us, the people, that the official cash rate wouldn’t go up unless there was a substantial and prolonged increase in wages as evidenced in the WPI. For years there was no substantial increase in the WPI and real wages went backwards – for years, for nearly a decade. So on his reasoning there was no reason for households to believe otherwise as they were experiencing this lack of growth of pay packets. However, perversely, there is a similar situation today to that experienced in the 1970s and some of the 80s in the form of inflation as a consequence of resource price shocks. We are seeing that with the Ukraine war and the price of natural gas skyrocketing. This gives our largely privatised unregulated energy providers/wholesalers an incentive to seek shareholder and company profits by raising the price of gas. This happened to oil in the period from 1973-74 and in 1979. This affected energy for vehicles and transport costs largely. This time it is households and businesses affected by gas prices for energy. We have the perfect storm situation as well of aging and broken down coal fired energy generators adding to pressures for their energy generation, transmission and storage. Tripled with the failure of the coalition government to invest in renewables for generation, transmission and storage.

Yet Lowe told us that as long as wages were low, the official cash rate wouldn’t go up and our mortgage rates wouldn’t go up. He was wrong and needs to resign in disgrace now! All he did was pathetic jawboning of our politicians and business leaders to give wage rises yet he never commented on the unjust nature of our industrial relations and our legal system that prevents wage rises from being argued for and fought for industrially and granted legislatively or legally. He avoided that part of the equation. Hopefully this 5.2% minimum wage rise will stem the continuing loss of real wages and be the start of some new push for wage growth. There is still the injustices of taking industrial action under the FWA which Labor has shown no interest in in reforming. So there will be possibly less than optimal wage growth for a while yet.

Not only is Lowe talking himself up, but he is also doing this while talking up the economy. It’s almost comical. These nothing econocrats are amusing if it weren’t for the fact that their decisions are affecting many people’s lives in a bad way. Who is to say when this energy crisis will end? There could be a situation where the war in Ukraine recedes momentarily and then expands to other areas with geo-political consequences. There could be a situation of high gas prices for months if not years. There could be a situation where transitioning to reliable fossil fuel generation like gas and renewable power can take months and years as well. All of these can push up energy prices and oil prices, both of which are happening at the moment but the crucial area is gas for energy. This can feed through the entire economy as the oil shocks of 1973 and 1979 demonstrated. In this situation of rising and continuing inflation, not brought about by wages, official interest rates could rise and stay at their heightened levels. They are predicted to rise to 3% by end of next year, meaning mortgage rates will have another 3% added to them. Workers are told if they argue for wage rises this will add to inflation. Yet If they don’t argue for wage rises they will go backwards in their living standards and pay higher prices for everything, including money which is what mortgage interest rates are – the cost of borrowing money.

As I said in earlier times about economic topics, I don’t think the Albanese and Bowen government have the courage to tackle industrial relations and provide for broader wage rises for the broader workforce. Already the primary producers are whingeing as only they know how to do best, in having to possibly accommodate this 5.2% increase to the minimum wage.

BTW, the inflation of the 1970s and into the 80s was not mainly caused by resource prices rises, oil shocks and galloping wage rises. It was caused by strict currency controls and lending controls and the lack of availability of money for borrowing by households and businesses. There was too little money in the economy, in banks and other financial institutions, able to be lent out to households and businesses to subsidise their mortgage or for their business expansion. There was therefore too much competition for the money supply and as a consequence, interest rates were high to reflect this demand and lack of supply. It wasn’t until the financial controls were lifted from 1983, the banks could decide how much they lent out and from where they could borrow their money to lend out to households and businesses.