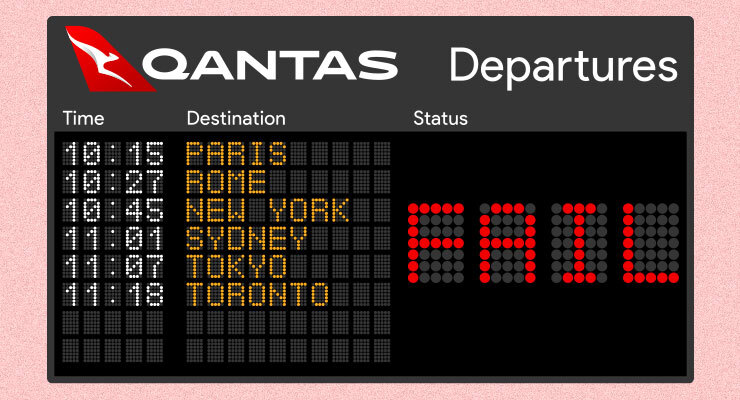

With Qantas, an increasingly failed airline incapable of aviation basics like running on time or keeping people’s baggage, the nation’s travellers are facing the reality that long-distance travel is no longer reliable.

Those flying interstate for a business meeting now must factor in that their flight will be at best delayed, or possibly cancelled altogether — and if they’re foolish enough to check in their luggage, the chance it may also be delayed or lost altogether. Lost time, lost productivity, lost possessions — and on a national scale. All the price of Qantas being run into the ground by its management and the man with a million excuses, Alan Joyce.

It’s suggestive of a developing-country airline, or Aeroflot in the Soviet Union. At least we can use online meetings, though — best stick to Zoom from now on, folks.

As the country’s major airline, any significant failings by Qantas flow directly into the economy and disrupt the lives and plans of millions of Australians. Qantas is systemically important, one of the sinews of the economy for both the conduct of business and tourism; its failures thus hurt Australia, not just the increasingly discredited airline.

Qantas has followed the same pattern of privatisation of large instrumentalities: since its sale, service levels have significantly deteriorated, the brand has become tarnished and its workforce has been repeatedly slashed. The same processes took place at two other entities sold during the 1990s: the Commonwealth Bank and Telstra. Around the world, corporatisation and privatisation have been the tools of choice for governments to deal with overstaffing of government organisations, often with highly unionised workers. But in the case of Qantas, management continues to attack its own workforce decades after the point where any “featherbedding” has been consigned to the history books.

That inevitably flows through to the experience of customers. Qantas’ inability to get bags on the right flights, or even simply avoid losing luggage, is a direct result of Alan Joyce’s illegal sacking of baggage handlers during the pandemic, and the outsourcing of baggage handling to tax haven-based Swissport, which has long relied on casualisation and precarious work practices like shift splitting to keep costs down, and which now complains it can’t attract workers.

While Qantas has followed a very traditional trajectory of privatisation that has led to tens of thousands of sackings and declining services, Telstra and Qantas also delivered systemic failure as a result of privatisation. In selling Telstra, the Howard government sold its capacity to build major communications infrastructure. When Telstra refused to deliver even the most basic communications infrastructure required by Australians for internet services, Labor had to rebuild its capacity to design and deliver major infrastructure from the ground up via NBN Co, leading to extensive delays in the rollout of the NBN even without the Coalition wrecking it. Two decades of inadequate, developing-country standards of internet speed were the result.

The Commonwealth Bank’s failure was less sins of omission than commission. It turned on its own customers, seeing them not as clients with needs to be served or fellow Australians, but as easy marks to be gouged, exploited, ripped off and immiserated in the name of parting them from their money. Even now CBA, like other banks, is still paying out compensations to tens of thousands of people whose lives it damaged or in many cases wrecked across its now-abandoned wealth management and insurance arms. Even after the Hayne royal commission, CBA and other banks continue to exercise a massive influence of policymaking courtesy of big political donations.

For advocates of privatisation — such as myself — the outcomes are salutary, if not deeply alarming. Privatisation, done well, is supposed to deliver ongoing economic benefits, not just a sugar hit to government coffers when entities are sold, by replacing bureaucratic management with commercial-minded management that leads to quality services being delivered at a lower overall cost. Inevitably, however, privatisation was not done in a way intended to provide ongoing benefits but to maximise sale value, which meant selling entities with minimal competition or regulatory requirements for service delivery.

In the case of electricity privatisation, some of those benefits have been realised — price rises in states with privatised power generation have consistently been lower over the past decade than in states with government-owned generators. But the electricity market is very tightly regulated, and even that hasn’t stopped gouging by privatised and government-owned participants. The failure to regulate Telstra, the banks and Qantas as the core utilities they are, like electricity, has led to massive economic damage.

The billions earned from the sale of these enterprises have long since vanished into fiscal history, buried in the budget papers of decades past, but the damage from their privatisation persists to this very day.

Give me one example of privatisation succeeding.

The ideology of privatisation is emblematic of the the pompous nonsense sprouted by economists with smug certainty, only actual experience almost always proves them wrong. If a lawyer makes as many mistakes as conventional market economists (especially those deluded by the disproven theories of neoliberalism) he or she would be swiftly struck off. The same goes for doctors, accountants and other authentic professionals. But the economists, the shaman of neoliberal Capitalism, are diabolically wrong most of the time and magically suffer no consequences or damage to the credibility generally ascribed to them by the media. Is not just a dismal science, it is fraudulent science; ie not science at all. And I am not talking here of the economists of the ilk of John Quiggan, Thomas Piketty etc.

Why does privatisation not deliver the fantasies of economists? Because privatisation makes profit the obsession of management and the shareholders the only beneficiaries of that obsession. The objective of the public enterprise pre-privatisation is service delivery, which Bernard criticises as bureaucratic. I do not agree that the characteristics of the humans populating the management of public enterprises differs in any way to the humans managing private enterprises. What differs are the incentives. Which brings one to the fundamental problem with corporate law; the glib acceptance that the private corporation exists solely for the benefit of shareholders, constrained only by law and regulation. That fundamental assumption needs to change so that the legislated purpose of all corporations is to benefit all stakeholders: shareholders, customers, employees and society. Germanic jurisdictions do this across Northern Europe by mandating the the board contain representatives of labour and the community in which it operates (Rhineish Capitalism). Only when the legislated purpose of a corporation is broadened to encompass shareholders, customers, employees and society may privatisation actually match the economic fantasies currently attached to it.

And while I am at it, the public service has been gutted by the corporatisation commenced in the 1980s under Labour. The error is the corporate style management is suited only to profit, not exclusively service delivery which us the mission of the public service, or at least should be.

The role of conventional market economists is to provide the veneer of academic legitimacy to an ideological position.

I think that veneer is called a “fig leaf”.

I think the big accounting firms have a lot to answer for in the advice to Government, and their tax advice they provide their customers. They appear to walk both sides of the street.

You said it so well, thankyou!

All problems started in the 80’s. Not necessarily with privatization, but with company restructures to get a KPI bonus.

Then move on before the restructure starts to hurt both employers, and ultimately shareholders.

No long term vision. Which is what politics has become, federal and state.

Most importantly, accountability has been removed as it was considered red tape. But that red tape held companies accountable.

Well said. Another example of the privatisation myth is what are now called ‘Public Private Partnerships’. This is the new lingo for what used to be called Build Own Operate & Transfer schemes (essentially hire-purchase arrangements).

Every post-hoc review of the BOOT schemes has shown that they cost more in the long run than if the government had borrowed the money itself and owned the infrastructure from the beginning (because governments can always borrow money more cheaply than commercial organisations, and because the commercial organisations fleece the governments with inflated rental and servicing costs during their period of ownership).

The analogy would be between using your mortgage line of credit to buy your fancy TV set outright, vs using a hire-purchase company.

Yep right on, the past is the past, current gov enterprises and councils operate on a profit making basis justl like the “private sector”

When has privatisation been “done well”? I say that it is the people who have been dover over.

I have the same question. Am currently scratching my head trying to dredge up a single example.

I understand that shareholders should be rewarded for investing but why must that be the standout priority far in excess of all else? If Qantas had an exceptional reputation for service its advertising budget could be significantly cut – no more choirs at Uluru pressing the public’s patriotism buttons. If existing customers maintained their loyalty the profits would naturally flow…& would lead to decent dividends for shareholders.

Cut all performance incentives to Joyce (&/or his successor), he’s already handsomely overpaid.

Zut

Its excellent National Party Policy, Just like stock we get serviced regularly.

Have alook who started all this , Keating and Hawke, both side of politics do it. Open ones eyes

The privatisations were started by Hawke and Keating

“In the case of electricity privatisation, some of those benefits have been realised — price rises in states with privatised power generation have consistently been lower over the past decade than in states with government-owned generators.”

Really?

I’ll be getting $135 rebate from my Queensland power bill, courtesy of the state govt – on my winter bill, the most expensive seasonal bill of the year.

Privatised electricity? No thanks.

From the moment Jeff Kennett sold off Victoria’s Energy Providers, (Gas & Fuel Corporation and SECV), our costs have steadily risen.

All costs have risen, thats what targetted inflation is.

Yes here in WA we will also be getting a $400 credit towards our power bills, plus I don’t think we have had anywhere the spikes in costs eastern States consumers have had to endure. It gets confusing as most of our news is repackaged eastern states bulletins with little relevance e to WA .

So whats changed, ” Solar panels “

Here in the ACT our government-owned electricity is 100% net zero CO2 and has been for 2.5 years, and is providing stable prices as electricity in much of the rest of Australia goes through the roof.

ACT is a little tiny bit of australia divorced from reality.

Net zero i dont think so, thats politcal statement backed by nothing,

If you think its true disconnect from the grid and see what happens at night time

Yep correct here elect and watet sould be owned by the state. problem is the state companies operate the same as private companies which they essentioanally are. Try to deal with with and you will hot a brick wall

The only good thing about this article, the substance of which could have been – no, was! – written a quarter of a century ago, is that Keane has finally admitted to his deluded history of rabid support for privatisation.

Next up, how about apologising for years of vilifying people who objected to neo-liberalism, something he vociferously argued didn’t even exist.

His numerous claims of having seen the Light, been SAVED and cured of neoliberalism are a sure sign that the Monkey is still riding his back.

I’ve lost count of the relapses.

Also prison management, refugee detention, covid hotel security, etc. On the other hand the BOM, CSIRO and ABC all seem to work pretty well up to a point – the point at which their money runs out. Forget the Anthropocene, we’re in the Economocene. Let’s face it, economists are a plague on society.