Public trust in big business is woeful. And there seems to be no sign of improvement.

The last few weeks has seen a torrent of headlines about corporate misbehaviour which reinforces the view that big business has no interest beside itself — despite all those warm and fuzzy TV ads and supposed commitment to ESG (Environmental, Social and Governance).

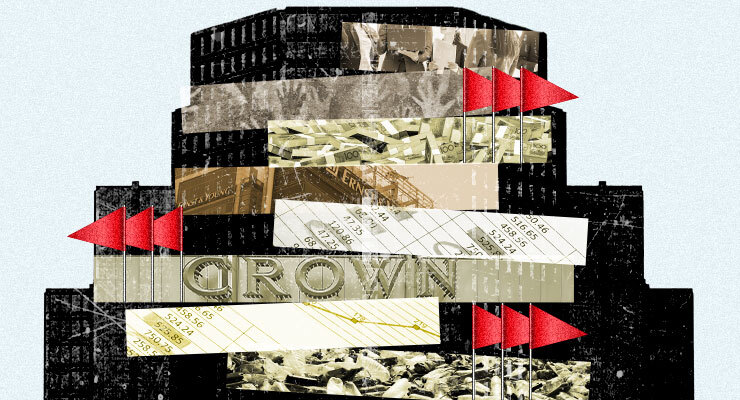

Top of the heap was Ernst & Young, hit with a US$100 million fine after company auditors cheated on an ethics exam. The US Securities and Exchange Commission (SEC) said it was the largest penalty ever for an accounting firm, and that Ernst & Young deliberately hindered the agency’s investigation of this misconduct by withholding information.

Moreover, the SEC noted that this continued after the discovery of a previous cheating scheme at EY.

In addition, it’s worth nothing that this cheating also continued after fellow big four accounting giant KPMG was fined US$50 million in 2019 for similar exam-cheating and other misconduct.

How many red flags does an organisation need before it takes action?

Closer to home, Crown in Melbourne was fined a record $80 million at the end of May for allowing foreign punters to illegally transfer funds from China.

And June saw a subsidiary of the Commonwealth Bank fined $1.71 million for charging fees to almost 500 dead superannuation members, while Origin Energy was ordered to pay more than $17 million in penalties for breaching its obligations to customers experiencing hardship and payment difficulties.

Sadly, such headlines seem to be increasingly commonplace, and almost expected in the wake of the shocking revelations from the Hayne royal commission into the financial industry and a prolonged series of damning inquiries into the Crown and Star casinos.

It’s little wonder that trust in business remains so low. The latest Edelman Trust Barometer (over 36,000 respondents in 28 countries) found that trust in business runs at only 61% (58% in Australia), although that’s ahead of NGOs, government and media.

Broken down by business sector, technology companies were the most trusted (71%), while the financial services sector was the second worst at 56%, kept out of bottom place by social media companies at just 44%. Similarly, trust in publicly traded companies at 56% was behind family-owned and privately held companies (67% and 58% respectively) and saved from bottom place only by state-owned enterprises at 52%.

The broad impact is equally concerning. On average, 52% of global respondents (an absolute majority in 27 of the 28 countries surveyed) said capitalism as it exists today does more harm than good.

When it comes to individuals, the same survey showed that 63% of the public suspect business leaders purposely say things they know are false or misleading, and only 49% think CEOs are very credible. In fact, on average only 66% of employee respondents said they trust their own CEO.

In this same vein, an earlier study for the Public Affairs Council found only 6% of Americans thought CEOs in major companies possess high honesty and ethical standards, compared with 36% who think small business CEOs are highly ethical.

These disheartening numbers represent much more than raw statistics. While shocking corporate headlines are often followed by a conga-line of executives departing — sometimes with hefty packages — the damage to reputation, and consequently to share value, has a very real impact for the rest of us, especially those with superannuation or a share portfolio.

Corporate scandal and adverse media can cause massive damage to reputation and market value. Corporate reputation as a percentage of total capitalisation varies depending on business sector, but 40% to 60% is a commonly accepted range, and that’s what may be at risk.

As Mark Sullivan wrote in Fast Company following the notorious Samsung Note 7 debacle: “Profits come and go. But loss of credibility is a pain that lingers.”

Most importantly, the recent spate of headlines about corporate misbehaviour is likely little more than a sample of what is happening. Or only those who have been caught. For the sake of all of us, these reported transgressions should be treated as what Jon Stewart has called “the banana peel in the coal mine”.

Big business needs to take note and do a lot better.

“Public trust in big business is woeful,” claims the article. It’s quite low, certainly. It is trending lower, that’s true. But I’d only say it is woeful if it is a long way off where it should be given the facts. Comparing these level of public trust to what is justified, it still seems the public has an excessively rosy view of big business.

What is really woeful is the atrocious and unregulated conduct of big business. The difference between organised crime and big business is merely one of degree, and anyway they work together much of the time, see for example the way various banks and financial institutions are deeply involved with laundering both corporate and criminal money, which is facilitated by governments who encourage it. The class war against the public being conducted by big business, and the governments it has corrupted, is only getting more intense.

Could not agree more with you SSR. You make some excellent points.

Indeed, the only shock is the level of naivety out there. Then again, people voted LNP for a decade, presumably in the belief it had their interests at heart, rather than just it’s own.

Damn straight – the truly woeful aspect is how many of us livestock still think democracy is a thing, after forty-odd years of neoliberal ascendancy. Morons whistling in the dark.

Damn straight – the truly woeful aspect is how many of us livestock still think democracy is a thing, after forty-odd years of neoliberal ascendancy.

None of what Tony Jaques says in this article about egregious corporate malfeasance is to be unexpected. In fact, quite the opposite; it IS exactly what is to be expected.

What Tony describes here is simply capitalism being capitalism. As I have said on previous occasions, being critical of what goes on in the capitalist corporate world, is like the brothel owner who complains bitterly upon learning that the staff are having sex with the customers. In both cases, it is actually what is meant to happen.

The other factor is why would Big Business even care what the public thought? Any drop in customers can be stopped by a clever ad campaign, and any fines from government can be countered by raising prices or fees.

The only thing that Big Business cares about Frank is making the biggest profit possible. Nothing else is of any consequence. This is the way capitalism has always worked and always will work.

Or like the outrage directed at privatised energy companies: “They’re putting profit before people!”

Uneducated public, many who still believe privatisation is cheaper (!!!) than a state run enterprise.

I’m actually quite shocked that it’s at 58% – that’s way higher then it really should be.

A quote at the beginning of William Dalrymple’s excellent book the Anarchy, the Relentless Rise of the East India Company

“Corporations have neither bodies to be punished, nor souls to be condemned, they therefore do as they like” Edward, First Baron Thurlow (1731 – 1806)

Nothing has changed.

You would have to have rocks in your head to trust big business, How many inquiries do we have to have into casinos to determine whether money launderers are fit people to be money launderers, and the best outcome we can get is a switch of ownership to another money launderer? How many millions of times can a big bank break the law before anyone goes to gaol? Bertolt Brecht once said: ‘What is a bank robbery compared with the founding of a bank?’