Just how big a rate rise the Reserve Bank will inflict on Australians at its next board meeting in August will be determined at 11.30am on July 27, when the inflation data for the June quarter will be released. The RBA will be undeterred by any warnings about causing a recession after yesterday’s record jobs data.

The Australian labour market is tight and getting tighter, judging by unemployment falling to a new 48-year low of 3.5% after 88,000 people found work. That’s the lowest unemployment since 1974 (when quarterly surveys were the norm) and came despite a rise in the participation rate to record highs as more people joined the workforce looking for employment.

In fact female participation is at a new record high in seasonally adjusted terms: 62.5%. Three years ago, it was below 61%. If it wasn’t for women entering or reentering the workforce in their hundreds of thousands, who in previous decades would not have done so, our labour shortage problem right now would be catastrophic.

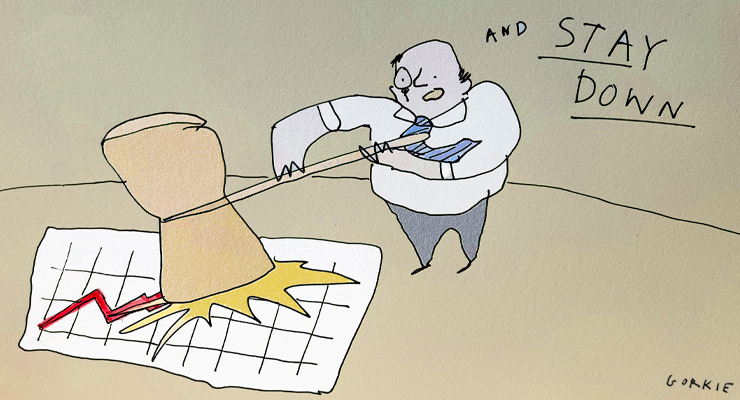

The fall in unemployment is much faster than the Reserve Bank had been predicting — it doesn’t see unemployment falling to around 3.5% until June next year. It is thus unconstrained by its commitment to full employment in how it responds to inflation. Another substantial rise in inflation on July 27 guarantees the RBA will lift the cash rate by at least 0.5% but perhaps even 0.75%, which the US Federal Reserve has been lifting rates by. That’s now been outdone by the Bank of Canada lifting rates there by 1%.

AMP chief economist Shane Oliver suggested in a note after the labour force data was released that he doubts the RBA will go beyond a rise of 0.5%, suggesting that “0.75%-plus hikes will be avoided in Australia given that the RBA meets monthly whereas the Fed and the BoC only meet six-weekly and so the RBA does not need to hike as much as they do at each meeting to achieve the same over a three-month period, and inflation and wages pressures are a bit less in Australia than they are in the US and Canada”.

As the ABS has been reporting in previous updates and in job vacancies data, the fall in unemployment through the pandemic has coincided with large increases in job vacancies (480,000 in May 2022). As a result, there was almost the same number of unemployed people in June 2022 (494,000 people, down 54,300 from May) as vacant jobs. “This equates to around one unemployed person per vacant job (1.0), compared with three times as many people before the start of the pandemic (3.1)”, ABS head of labour statistics Bjorn Jarvis said yesterday.

“The large fall in the unemployment rate this month reflects more people than usual entering employment and also lower than usual numbers of employed people becoming unemployed,” the ABS said. “Together these flows reflect an increasingly tight labour market, with high demand for engaging and retaining workers, as well as ongoing labour shortages.”

That’s an important point in assessing how aggressively the RBA will go on inflation. Not merely are there labour shortages now, but also employers are trying to hang on to the staff they have, which will mute the employment impacts of any fall in demand brought about by interest rate hikes.

Whether that translates into wage rises, which every economist and the RBA has been predicting will happen any moment now for months (in the RBA’s case, for years) is yet to be seen. Australian employers have proven adept at avoiding paying higher wages for a long time now. A few strikes (as NSW teachers, Sydney train drivers and Shell’s Northwest Shelf LNG workers are doing) might help change that. If we’re going back to the 1970s, perhaps we’ll see some 1970s-style industrial disputation as well.

I’m tired of hearing that the only ‘weapon’ against inflation is interest rates.

Workers under the median wage spend all they earn on necessities.

The rich are the discretionary spenders. I bet this inflation is mainly pent up demand for renovations, new cars and third and 4 houses.

The obvious move is increase income taxation – for the rich – i.e bring back progressive tax rates and stop the planned cuts.

The other obvious ones are to stop the tax breaks for the rich – negative gearing on established homes and capital tax breaks.

This will bring house prices and rents down for homeowners and renters.

But it seems there are too many selfish wealthy people and the Govt is too gutless. I do see hope though in wealthy suburbs turning to teal independents with progressive policies.

Did you forget what happened to Bill Shorten at the 2019 election? Us idiots (not me personally) got spooked by the big agenda from Labor, resplendent with the phasing out of negative gearing and abolishing franking credits. It is the 51.9% of Australians that voted the Morrison government back in in 2019 that you should be annoyed with.

If we are going to have some real industrial action, I’d like to see the return of union types such as Fred Kite (Peter Sellers) in “I’m Alright jack”.

A super profits tax would be far more effective since it’s high corporate profits that is driving inflation.