In today’s economic statement to Parliament, Treasurer Jim Chalmers presented gloomier economic forecasts compared to the pre-election economic and fiscal outlook, but says inflation will peak later this year at 7.75% and real wage growth will resume in 2023-24.

The forecasts are less bleak than the government had hinted in the lead-up to the statement, the first economic set-piece of the Albanese era. In particular, the new government has maintained the long tradition of rosy wage growth forecasts, suggesting workers will see wage growth of 3.75% from 2023 onwards — a level higher than at any time since Labor was last in power.

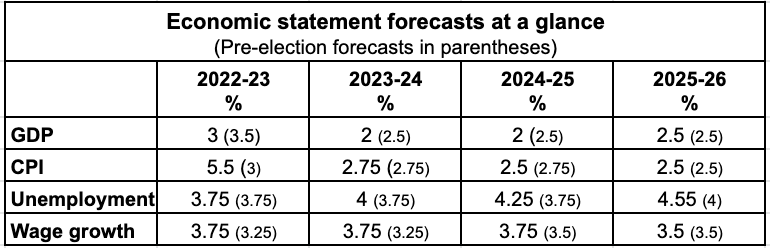

Inflation was the main focus of the changed forecasts, which was a dramatic increase compared to what Treasury and the Department of Finance provided at the start of the election campaign — figures that were rapidly rendered out of date by galloping price rises. Inflation will now peak at 7.75% in the December quarter and will average 5.5% across 2022-23 — but is expected to come back within the Reserve Bank’s target band of 2-3% when it returns to 2.75% in 2023-24.

Based on the optimistic wage growth forecasts, workers will see real wage growth that year — though Chalmers explicitly noted the poor history of wage forecasts over the past decade, which have seen workers wrongly promised higher wage growth time and time again.

It’s interest rate rises that will put downward pressure on inflation — or at least the comparatively small part of inflation driven by demand. This means lower economic growth, particularly via lower dwelling investment: 3% this year instead of 3.5%; 2% in 2023-24 instead of 2.5%. Lower exports resulting from flooding will also drag growth.

That means unemployment will drift up again more quickly than forecast — back to 4% next year, then above 4% for the two following years.

That creates a weird paradox: wages are expected to grow at a much more rapid rate than in recent years despite unemployment rising. We haven’t been able to get wages growing above 2.5% when unemployment has been below 4% — why they will grow at 3.75% when unemployment is above 4% is a mystery known only to the Panglosses of Treasury.

Chalmers’ other task was to prepare voters for budget cuts ahead. The outcome from the past financial year — 2021-22 — will be “dramatically better” than forecast earlier this year, but the current year and onwards represent more difficult fiscal times: payments are already expected to be $20 billion higher over the forward estimates than expected. And while the government would meet all of its election commitments, Chalmers foreshadowed significant cuts in Coalition-era programs. The fastest area of government spending was not the NDIS or health, he said, but government debt payments, fueled by rising interest rates.

Now we wait until October, when the Albanese government will produce a revised 2022-23 budget, and we’ll get to see the nature of the cuts that Chalmers is warning voters are on the way.

So it’s shake the magic 8-ball, roll some dice and take a peek at some chicken guts before making economic predictions, then?

They have inherited a shambles. An omni-shambles.

Watch it made worse by this Treasurer’s unthinking adherence to the same noxious nostrums from the “Chicago school”.

So what do you suggest, the Chinese school. We have a FIAT currency and Gov spending ( Keynsian ) has led to out 1.2T debt levels have alook at the numbers.

Get past the politics and read the numbers – low interest rates + high gov spending (debt) = inflation as its not backed by production- this has been coming since 2007, it doesnt happen over night, a bit like climate change and repair.

excuses excuses – they got voted in the fix it

Gov spending does not get cut. The only cut is to the growth in spending. As soon as spending is shifted/though the Publi Sector Unions cry out loud even if the spending is not benefiting anyone in the community but the Gov employee and managers in particular. Australia has been living off gov borrowing since 2008, have alook at the Federal Debt levels and forget the politics of it if you want reality and facts. Also 25 percent of Australians work for the public sector, in QLD there are more administrators in Education QLD than teachers. The education and training system doesn’t work and that’s why because there is a belief that things can be fixed by throwing money at the problems, that’s WRONG. Look at the case of the QLD deputy general of education suspended for 2 years on 300 K per year full pay then he resigned, is that the REAL world.

1 in 100 Australains are on the NDIS and there were alot of jobs made there thats why we are at full employment.

Look at the numbers as the politics is a different matter.

Gotta be careful with high not targetted spending as it can lead to stagflation when coupled with high interest rates. Opposing forces. Remember Gov spending is money printing as its above tax revenues so inflationary.