There are types of news that strike like lightning. Then there are those that rumble like the grind of tectonic plates. Inflation is in the latter group. Rarely is there an event that causes inflation to make the news. A single item rising in price in a single store seems frivolous. And yet the shifting of tectonic plates raises enormous mountain ranges, and inflation can topple governments.

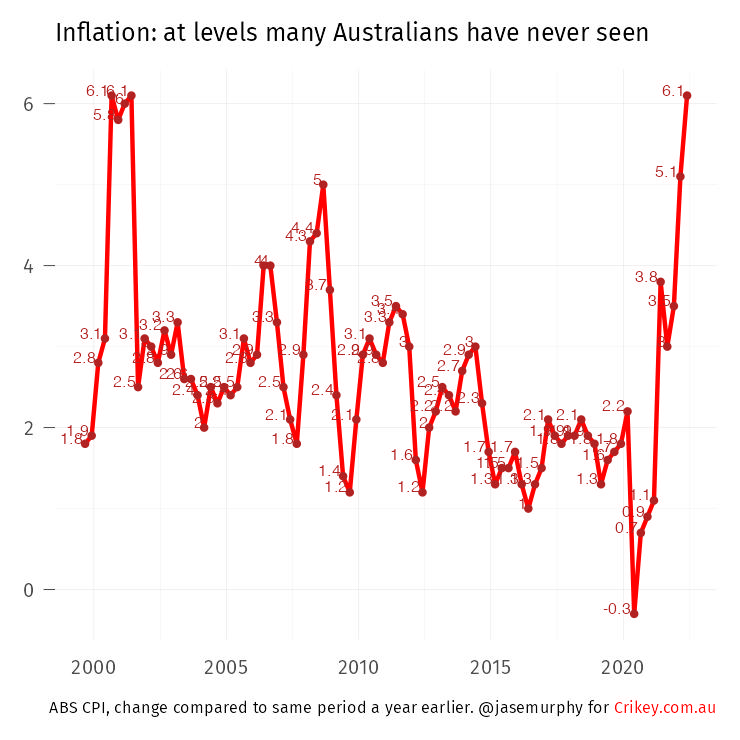

When the Australian Bureau of Statistics (ABS) collected prices to create the consumer price index (CPI) for the June quarter, it was documenting an event of significant rarity and magnitude. Inflation of more than 6% has been seen only once in the past three decades — and that was when Australia brought in the GST. Before that you need to go back to the very early 1990s to find inflation at such heights.

The Reserve Bank of Australia (RBA) is supposed to keep inflation between 2%-3%. People were concerned when it missed to the downside by a fraction of a percentage point. This is a far bigger miss: it is the one-in-30-years flood of price changes.

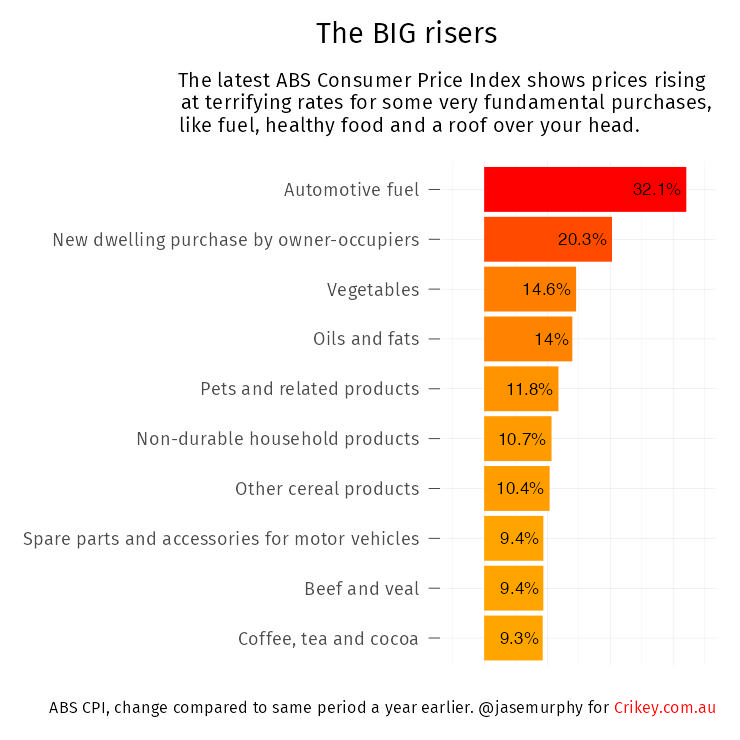

So where is the water lapping highest? Anyone who has unscrewed a petrol cap in the past six months will tell you what shows up first on the next chart: fuel.

Running a hot second is the price of new homes — this is not driven by land prices so much as by high prices for lumber and labourers.

A roof over your head

“Shortages of building supplies and labour, high freight costs and ongoing high levels of construction activity continued to contribute to price rises for newly built dwellings,” said ABS head of prices statistics Michelle Marquardt. The end of some federal and state subsidy programs also caused new home prices to jump.

Remember: the ABS doesn’t count purchases of existing homes in the consumer price index. If it did, CPI records probably would have been set much more recently, given the way Australian house prices have roared up. The reason the ABS excludes those prices is because “both sides of the transaction occur within the household sector, [so] there is zero net expenditure by the [household] sector as a whole”. Does that make sense to anyone?

Nor does the ABS count the price of purchase of land, because it is not consumed (that does make sense to me; land is an asset, not a consumption good. Unlike a dozen eggs, it can be resold in 20 years). What the ABS does count when it comes to housing is the purchase of the housing component of newly built homes, and that is what has risen so quickly in the past year.

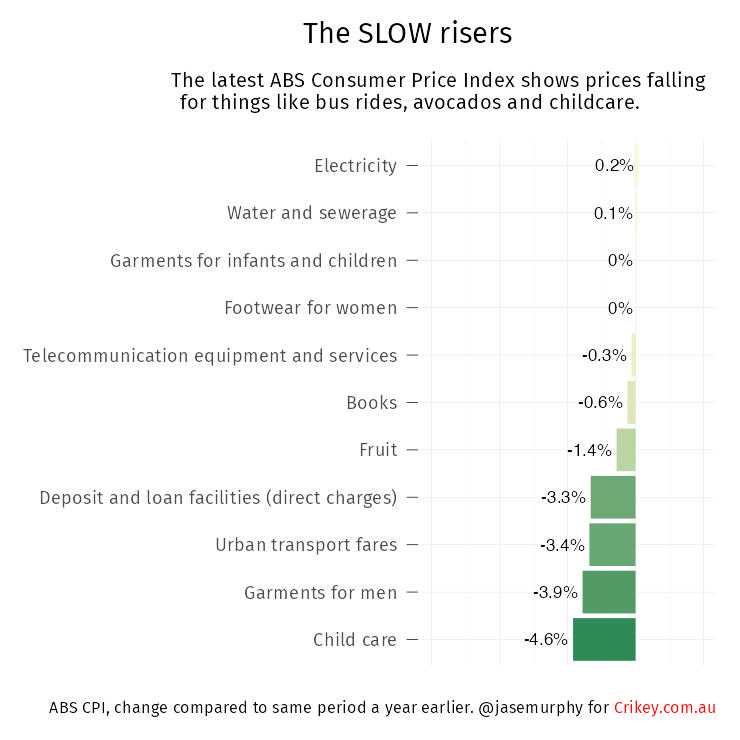

The other end of the scale

If you like to take your kids to childcare on the bus, you probably don’t know what all the fuss is about. As the next chart shows, some things have been rising in price very slowly, or even falling in price over the past year. The biggest change is in childcare, a price fall that has affected my own household budget noticeably. The previous government increased the subsidy for second children in childcare by 30%.

Other categories that defied the inflationary trend are books, public transport and garments for men (garments for women rose in price; why inflation has it in for women but not men is a mystery for another day).

The appearance of fruit on this list is a surprise given that vegetables were so prominent on the list of rapid risers. The reason fruit is weighed down is all those avocados. Planted amid the “smashed avo” zeitgeist of five years ago, young avocado trees are now bearing great volumes of fruit, and the supply glut is suppressing the price rise of the entire fruit category, even though things like berries have actually risen in price considerably.

Inflation is expected to peak this year. Price rises will continue but at a lower rate. We can also hope for price falls in some categories — lower prices for fuel and food could be a result of hostilities in Ukraine ceasing. But some prices will never go back down, and we can expect higher interest rates to last for a considerable period. The impact of this era of high inflation will be felt for a long time.

I suspect inflation is increasing for womens clothing for the same reason prices are high for other womens items, eg hairdressing. Women are seen as easy marks and tolerate higher prices for specifically womens products. They should kick back.

One of the analgesic manufacturers was convicted a couple of years ago for selling, with a significant mark-up, their stuff with claims of special formulation for period pain though it was plain on the packet that it was identical to their other product. Similarly those pink lady razors and no need to even mention miracle wrinkle creams & potions.

You’d think with the rise of the women’s empowerment movement and the new anxiety around masculinity, sellers are missing an opportunity make an extra buck by targeting “fragile masculinity”. Like those ads for utes do, but got everyday items.

I read an article that stated “40 percent of the costs of a new hose are government charges.” It was in the Australian.

If we have 25 percent of the jobs in this country in the public sector making “nothing” we need a lot of gov charges to pay for this/. And then add on materials and IT, Big gov loves microsoft, apple, at least phones use linux (android), which is free.

In the good old USA about 3 trillion of the stimulis went into the bank accounts of the rich so CPI inflation doesn’t matter.

It the asset price inflation/ deflation that matters to them, shares, debt, houses, investment income as it can be used to avoid and evade income tax. If you want to be super rich dont pay tax.

We dont get much talk here about tax haven legislation required to even things up. Even the dear old ABC steer clear of this except for the odd story. It mainly focuses on social issues as they are soft stories.

3 percent compounded over 10 – 20 years is a hell of a lot of money, thats why we cant lower poverty in this country.

Its the red queen effect, you have to run just to keep up. A lot are not that fast as inflated money reaches them last.

The avocado mountain should be left to rot and turned into useful avgas.

At first glance I misread that as ‘turned into useful Amgas’ and was about to say Taylor’s never been of use to anything but himself.