Treasurer Jim Chalmers could use some cash right about now.

He has inherited a sizeable budget deficit with rising interest rates — and that’s before he’s paid for Labor’s promises or cleaned up sectors Morrison neglected. Last week’s economic update showed increasing tax receipts. But with recessionary storm clouds on the global horizon, that might not last long.

How should he plug the fiscal hole? I never thought I would say this, but he should look to the fine example set by former prime minister Tony Abbott.

Tony Abbott: class warrior?

Don’t get me wrong — Tony was probably Australia’s least successful political leader ever, with a legacy more instructive to satirists than serious policymakers.

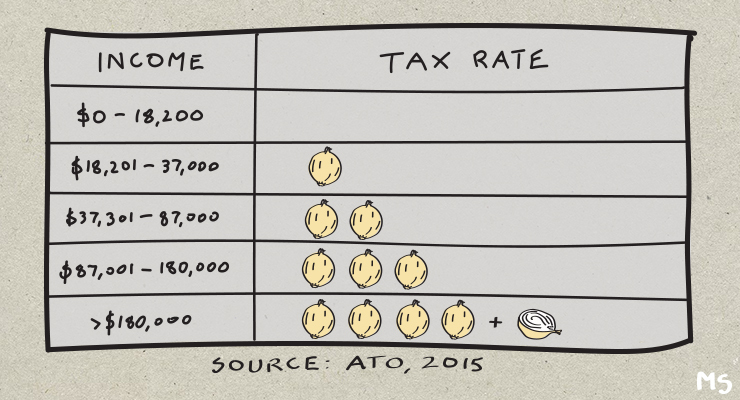

But he did have one good idea we should revisit: the temporary budget repair levy. It applied an extra 2% of income tax to earnings more than $180,000 — like a second Medicare levy for the wealthy.

It was intended to spread the burden of his government’s austerity, to ward off criticism that it was leaning too heavily on the lower and middle classes. It was a piecemeal offering amid savage budget cuts, but we nonetheless witnessed our most right-leaning prime minister since Menzies raise taxes on the rich — a surprising fact that the left is yet to fully exploit.

The Turnbull government allowed the three-year levy to lapse in 2017. With the budget now in much worse shape, it’s time to bring it back.

Bring back Tony’s tax

Former opposition leader Bill Shorten vowed to keep the levy in place for at least 10 years if he became PM. But since Albanese took over, Labor went quiet on the proposal in keeping with his “small target” strategy. Asked by the Nine papers on the campaign trail whether he’d reintroduce it, Albanese said no.

Labor also backflipped on the Coalition’s proposed tax cuts — whereas Bill Shorten had proposed to just match and extend lower-income cuts, Albanese agreed to those for higher earners too. This opens a significant hole in the government’s revenue from 2024, in the least equitable way, adding to its current fiscal woes and entrenching inequality.

However desirable, reversing course on the “stage three” cuts now would be admittedly controversial for Labor. Accusations of lying to the electorate would be fierce and damaging.

However, Albanese would lose much less skin from reversing course on the deficit levy. It hardly featured in the election campaign and is narrower in scope, affecting fewer people. He’d be in a stronger position to say, “The books are worse than we thought, so something has to give”. It would also be harder for the opposition to argue against.

Making the richest give back

Australia is a low-taxing country, and that would hardly change if we raised the top tax bracket. Only approximately the top 4% of earners would be impacted.

For those on high-but-not-astronomical incomes (let’s say they’re a federal MP, and thus earn $217,060 per year), it would merely claw back a small fraction of their upcoming savings from the 2024 tax cuts. They’d hardly notice the small hike on their top tax bracket amid the larger lowering of their middle brackets.

The levy’s real importance would be for the very rich. Taxing their earnings above $200,000 at 47% (instead of 45% currently) would compensate for the lower amount of tax they’ll pay on their first $200,000 from 2024. For the obscenely rich, it would overcompensate and see them paying more overall.

This would not fix Australia’s revenue problem alone — for that we’d need broader taxes on, for instance, capital assets. Nor is it preferable to stopping the “stage three” tax cuts altogether. But it presents a politically viable pathway to ameliorating the worst excesses of our future tax code, which without modification will be extremely inequitable and fiscally reckless.

Chalmers admires Keating for administering harsh but necessary economic medicine. In following suit, and in the unlikely footsteps of a less-esteemed former PM, it’s time for him to shirtfront the rich.

great idea. And can the tax cuts! There’s every excuse to do so. And collect from the multinationals!

Three words – “Budget black hole”. Done.

Agree. But when the levy gets questioned by the Fin, News Corpse, et al, make sure that you credit Abbott with the idea, and watch the cognitive dissonance set in.

“The levy’s real importance would be for the very rich. Taxing their earnings above $200,000 at 47% (instead of 45% currently) would compensate for the lower amount of tax they’ll pay on their first $200,000 from 2024. For the obscenely rich, it would overcompensate and see them paying more overall.”

This is true when only looking at income. However, it’s seriously misleading when looking at how much tax the wealthy pay. Those with really serious wealth can easily enjoy the benefits of their wealth without taking personal income. Some of the wealthiest Australians have barely enough personal income to even meet the tax threshold. They operate through companies so income does not accrue to them personally. The companies are tax-efficient. They structure their wealth so capital gain, in many jurisdictions at a rate well below the top income tax rate, is much more important. They use trusts and other financial arrangements. The proposed levy would not be ‘important’ to the obscenely rich unless they are very careless. For most of them it would be irrelevant.

This is of course true everywhere. Liliane Bettencourt, who inherited a huge stake in L’Oréal, was for a time the world’s richest woman and the fourteenth richest of all individuals and still paid no income tax in her country of residence.

Exactly. Clark’s article slides around, conflating income with wealth and back again. If you want to tap into that mass of wealth that at present lies beyond the reach of the ATO, you need to tax that wealth, not the income – of many who will be far less wealthy that those hiding their wealth in trusts, tax-deductible farming operations, property, the Cayman Islands and Vanuatu.

This is just petty marginal stuff. Windfall profits tax now! Dump the stage 3 tax cuts (and I am one of the beneficiaries). Introduce an annual wealth tax at modest percentages on total wealth in excess of, say, $1m. Labor must take advantage of the numbers in parliament and supportive progressives on the cross bench. These are unconventional times and demands new, innovative and courageous tax policy.

If Labor thinks avoiding past ‘traps’ is the way to get re-elected, then it is doing Australia a great disservice. It must harness the energy of 91 progressives in the house and come to the realisation that the coalition and News Corpse became irrelevant on 21 May 2022.

I’d settle for closing tax loopholes, getting rid of some of the absurd concessions to shareholders and landowners. Levy feels more a symbolic gesture than something that’s gonna make a real difference.

Cancel the stage 3 tax cuts for the rich. Tax the multi-nationals. Then you can set about fixing hospitals, Medicare, schools, NDIS and paying down debt. There was never any excuse for supporting stage 3 tax cuts. Stop being timid.

Yep. And bin the 50% tax discount and negative gearing, as well as including the home as an asset, all to be taxed on death. Stop subsidising fossil fuels. Raise the GST to 15%. Pay off the trillion. You know it makes sense.

Agree with most of the suggestions but not raising the GST and don’t even think about including food.

A tax on commercial food services such as delviery and a special health ‘levy’ (an Abbott nontax, sic!) on over processed semi edible junk would be a double win.

The vulnerable might eat less of it and the purveyors be less keen on pushing it.

In today’s world, unfortunately, it’s cheaper to eat junk food than good food.

Until health fails.