Readers may wonder just how our politicians juggle so many conflicts of interest. But corporate Australia isn’t bad at it either, as shown by Monday’s $8.3 billion BHP bid for OZ Minerals.

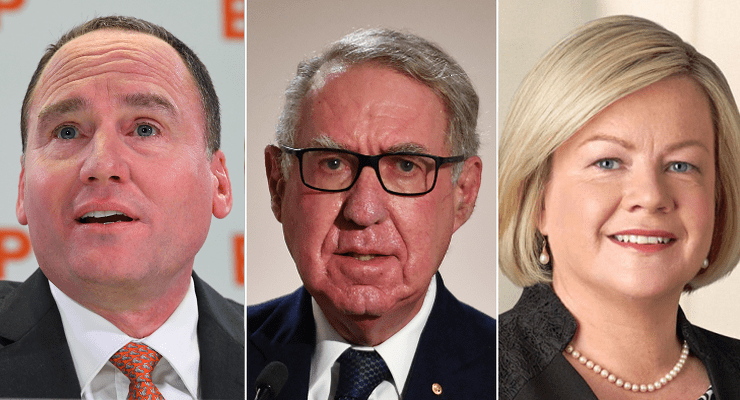

The strategic aim is clear — BHP boss Mike Henry wants to get his hands on more copper assets — but it’s the advisory table where eyebrows are raised.

BHP chair Ken MacKenzie is also a strategic adviser to the Magellan-owned corporate advisory house Barrenjoey. Guess who BHP chose to advise the company on the OZ Minerals deal? Barrenjoey.

Not to be outdone, OZ chair Rebecca McGrath also sits on the Macquarie board — and yes, Macquarie is her defence adviser in the bid.

It’s a small world, corporate Australia, as Sydney Airport’s new owners IFM, GIP, AustralianSuper and UniSuper have shown us after last week’s appointment of David Gonski as “independent chair”. That is the same Gonski who, along with the rest of the old board, stood aside in March after accepting the winning bid from IFM, AustralianSuper, GIP et al.

Crikey is assured headhunter Heidrick & Struggles conducted a thorough analysis and the new board could not think of a better person than Gonski, who knows the airport better than most.

Puzzled shareholders should remember the rule of thumb that can be summarised as “no conflict, no interest”.

“…the rule of thumb … no conflict, no interest.” Indeed.