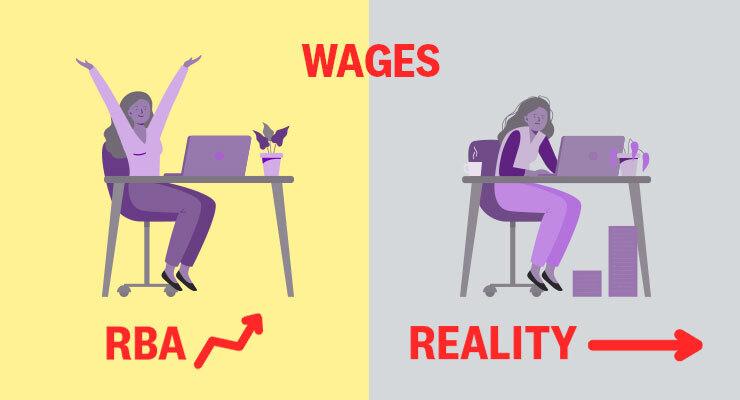

“Recent information from liaison and survey measures provided further evidence that wages growth had started to pick up from the low rates of recent years,” the Reserve Bank noted in the minutes of its August board meeting, released on Tuesday.

It’s a familiar refrain. “Other information received in June had affirmed the outlook for faster wages growth in the period ahead,” read the July minutes. “Labour market conditions were the tightest they had been in many years and wage pressures were emerging,” it said in June. In May, “members observed that price pressures were intensifying and there was upward pressure on wages”. In April: “reports from the Bank’s liaison program suggested that private sector wages growth had continued to pick up in the March quarter”.

You have to go back to the March meeting — the second last one where the RBA left interest rates on hold — to find the RBA expressing scepticism about wages. Back then, it noted that wages growth had only returned to pre-pandemic levels.

But in the ensuing six months, wages growth hasn’t increased at all. In the December 2021 quarter, wages growth rose from a measly 0.6% to 0.7%. It’s been 0.7% ever since. The only reason the annual rate for the year to June rose to 2.6% is because the terrible June 2021 result was replaced with the quarter just finished.

And this while the jobs market hit an unemployment rate of 3.5%.

But don’t let those facts get in the way of the narrative. There were signs of an “uptick” to come, said a KPMG economist. “The quarterly change pushed the annual rate of wage growth higher for the sixth consecutive quarter,” said one outlet. There’s “growing momentum that will force the Reserve Bank to push the official interest rates to about 3%” reckoned The Australian Financial Review. Even Treasurer Jim Chalmers joined in suggesting higher wages growth was coming.

Some economists have sought to shift the goalposts and suggest the wage price index (WPI), which doesn’t include bonuses, is misleading. But bonuses are excluded for good reason — they’re a one-off, and even a substantial bonus will only ever be a small fraction of an annual wage, especially multiplied over several years.

If the economy turns in another 0.7% WPI result for the current quarter, then in three months’ time we’ll hear it all again — things are improving, the annual rate has just increased, better times are coming.

Fact is, no one has ever had the decency to apologise for getting wages growth forecasts so wrong, for so long — certainly not the Reserve Bank, which has now abandoned its focus on wages growth entirely and reverted to its Pollyanna-ish ways of most of the past decade in insisting that growth will pick up any quarter now.

Growth with a two in front of it is wage stagnation at the best of times. At the moment, it means massive real wage cuts. More than 1% in one quarter for Australian workers; 3.5% over the year. Even if the RBA’s fantasies are fulfilled and we hit 3% growth — still far below the levels of the Gillard-Swan years — workers will still be going backwards at a rate of knots.

But the perpetual sunny optimism of the RBA and much of the commentariat means no one ever has to come to grips with the fact that our industrial relations system is tilted too heavily in favour of employers, and that corporations wield too much market power over workers and consumers. It’s a form of denialism that’s seriously impeding addressing a core problem with the economy.

The result is workers will be patted on the back and told to celebrate if growth crawls to a feeble 3%, when every day they go backwards. Policymaking at its worst. It should be a big red flag to Chalmers and the intransigent neoliberals at Treasury.

To me, this is more evidence that the argument isn’t about what causes wage growth, but acts as a moral permissibility for the way things are now. We see that the tax system is structured to help the rich get richer, to exacerbate inequality, and holds a portion of the population in poverty (and another portion teetering on the edge of it). Yet none of that needs to be addressed when the system as it stands will deliver for those people any day now. This system allows people to thrive but doesn’t leave anyone behind with only a hint of wishful thinking on the latter.

I disagree entirely. It is about the causes of wage growth or in the current case, wage stagnation and real wage falls. Anything else you say is utterly dishonest. Moral permissibility is utter BS. Face facts. It is wage theft and worker repression pure and simple. The tax system has nothing to do with wage growth. It is a non-event.

Wage theft is a business model and the FWC under the auspices of the FWA is the enforcer of said economic suppression. The FWA is ‘WorkChoices’ lite. I know this for a fact for workers not under State Awards like cops, nurses, teachers, firies – all of whom can strike to their hearts content. If you are in the unfortunate situation of having to renegotiate an EA or a CA and you have a devious employer, in my case the Federal Government and its various agencies AND the Public Service Commission, they can all stall and bargain in bad faith putting up insulting offers of 4% rise over 3 years with loss of most allowances while the employees had to give 10 day’s notice of industrial action and there were no rolling stoppages unless negotiations had stalled for months. Negotiation had to be ‘frustrated’ over a long period for effective action to take place, all the while scabs are available, usually senior Officers not doing their normal duties, brought in. The stuff-ups I have heard are legendary and can’t be repeated on this forum but be assured they do exist and await more proper disclosure at a later date.

Workers can’t strike. That is a fact. Employers don’t want to pay wage rises. Also fact. Does Jim Chalmers want to change this? No way Jose.

The great con of wage rises is the percentage always measures the gross rate, not the net rate after taxation. If inflation is at 3%, and you get a 3% pay rise, you don’t get to keep all of it. Income tax will be levied and thus reduce it by your top marginal rate.

3 decades ago I was on a pension with part time work. Wage went up $6 per week. Pension cut by $3, went into next tax bracket – actually received a $1 – always remember this true example.

The Government should hire private security, approach all the Reserve Bank Board, tell them to remain at their desks, cease all work, call each one into a Commissioner’s Office who is heading up a Royal Commission into them, ask each Board member to explain their tasks and provide details of their performance appraisals, quickly benchmark them against the small wage rises over the last decade and sack each one of them and appoint a new Board so as these parasites can’t take any sick or personal leave as this is not paid out as they are being sacked. Only their Long service leave and annual leave. And of course make accurate forecasts and analysis part of the new Boards new performance appraisals.

Just the modern, secular, capitalist version of ‘the opium of the people’ – keeping the masses quiet with false promises.