While the Australian media were focused on Queen Elizabeth II’s passing, some potentially significant comments by Treasurer Jim Chalmers went underreported.

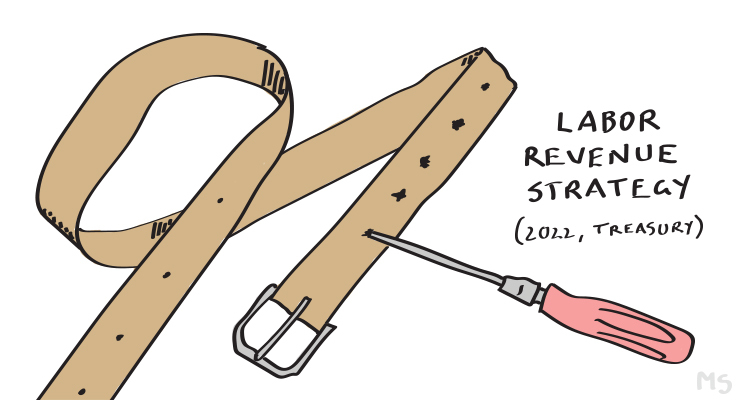

Chalmers told ABC Radio last week he intends to focus his first budget in October on delivering election promises before then tackling the economy’s “structural challenges” in his second budget next year. And because he views most fast-growing budget items — such as healthcare, aged care and the NDIS — as “untouchable”, some “politically sensitive tax and revenue measures might need to be confronted”.

It’s the biggest indication yet that federal Labor might cautiously pivot from its “small target” election agenda and seriously consider raising taxes.

And while many Australians might not want to hear the harsh truth, it’s about time.

Australian taxes are simply too low

Australia remains one of the lowest-taxing countries in the OECD. Our federal and state revenues are 5.8% lower as a share of GDP than the developed country average.

Despite this, Australians have enjoyed increased social spending in recent years, putting the balance on the national credit card. The resulting debt is manageable for now, but it will shackle our ambitions long-term.

Even centre-right stalwart Paul Kelly and a slew of high-profile economists argued this weekend that “Australia is heading down the path of bigger government sanctioned by public demand”, which necessitates “an overall increase in the taxation burden”.

Pressure to rectify this imbalance will only increase, with a national revenue summit planned by the Australia Institute for early October.

Put a cap on it

So, which taxes should Labor raise or broaden? It’s a shame that in opposition Anthony Albanese killed some of Labor’s best tax proposals — and assented to the Coalition’s worst one — for fear of spooking the electorate.

This is where Chalmers must get creative. I’ve previously argued he could partially offset the highly unequal stage three tax cuts by hiking the top tax bracket. Similarly, on egregious tax deductions like negative gearing and the capital gains tax discount, there are less-than-perfect but politically palatable workarounds.

For instance, instead of removing these deductions altogether, Labor could impose caps on their use.

Back in 2015, Albanese himself passed a successful motion at Labor’s National Conference, calling for a “Buffet tax” — a 35% minimum rate on the total incomes of those earning more than $300,000 per year, then costed to raise approximately $2.5 billion per year. He foolishly ruled out reviving it in a January interview, but its scant attention could render it a “non-core promise”, Howard-style.

Conversely, Labor could impose individual caps on how much one can deduct for each tax item, or cap the number of assets to which one can apply write-offs. For instance, one could set a maximum number of houses one can negatively gear. To err on the generous side, let’s say four properties — to keep beneficiaries outside the top bracket of federal MPs in Crikey’s Landlords List.

This would allow politicians to keep pandering to people with investment properties while also hitting those with obscene portfolios. It’s not optimal, but at least property hoarders, like this recent talkback radio caller who owns 238 houses, would pay their fair share.

Super-charging inequality

Another item ripe for capping is superannuation accounts. Super remains, despite recent reforms, generously undertaxed, allowing the wealthy few to supercharge their earnings — most of which they’ll leave to their inheritors. As Crikey’s Cam Wilson recently reported, the top 32 self-managed super funds in 2020 were worth more than $100 million each.

Putting a cap on the total amount one can hold in super would force excess funds into higher-taxed accounts or assets. The proposal is so uncontroversial that even the super lobby supports a cap of $5 million.

This capping approach isn’t ideal. The revenue gained will be much smaller than that garnered by simply ditching tax loopholes altogether. And housing concessions will continue inflating prices even in a market of smaller property portfolios.

But since its shock election loss in 2019, Labor has shown a profound fear of alienating the relatively but not obscenely well off. Some of this was an overreaction, but Australia’s bloated asset markets do pose tricky electoral dynamics.

Capping concessions would allow Chalmers to recoup some much-needed revenue from overdue targets, reduce wealth inequality and assure voters that only the very richest will pay. Targeting the richest is the lowest-hanging fruit. It would also allow Albanese to save face by not backflipping on major promises.

Labor will need to consider such reforms sooner or later, lest the only cap be on the quality of Australian hospitals and aged care homes.

…and speaking of low-hanging fruit, how about taxing the multi-national (and Australian) oil/gas companies furiously avoiding paying ANY tax on the billions they rake in from Australian ( or perchance Timor Leste) assets? If Labor has the guts to do this, it would help us achieve emissions reductions (maybe) and only offend the filthy rich fossil fuel people who don’t vote Labor anyway. Win-win! And bringing billions of dollars tax revenue to help plug the Coalition hole. On that topic, the third tranche of tax cuts are gold-plated lunacy. And why, when tax scales are discussed, does no-one ever say that the thresholds should simply be indexed to inflation? Maybe because governments bribe voters with promises of tax cuts? Or am I just a cynical old bastard, out of touch with reality politic?

If they are not paying tax, they are not viable. And this should lose their license to extract and explore.

As soon as I saw the reference to “national credit card”, I knew we were in for some pretty dismal analysis. Simondo asked who we owe all the debt to. The answer is “we” as citizens don’t owe it. It’s owed to us.

The federal government is a currency sovereign. They issue the money, and can no more run out of dollars than Coles can run out of Fly-Buys. Just like Fly-Buys, dollars represent an IOU from the government (or Coles) to the holder. They promise to redeem it for something. In Coles’ case that’s air miles or an air fryer, in the government’s case it’s your tax obligation. It’s the fact taxes and fines can only be paid with dollars and we must pay our taxes or fines or face gaol that gives dollars value. How many dollars we are willing to pay for a schooner of beer is derived from their availability and our ability to acquire them. We are trading government tax IOUs amongst ourselves.

Yes they can issue too much money, but that is not of itself the cause of inflation, that’s monetarist nonsense. Inflation occurs when the nation’s collective resources are insufficient to meet demand. This can be demand-pull or a supply-shock, such as we are seeing with fuel and shipping costs and the constraints on supply that feeds through to prices.

By all means tax the rich, because they have an outsize share of the claims on our resources. But don’t peddle this nonsense that it will pay for hospitals or aged care homes. The government can afford what it can resource. Can the nation provide the nurses, carers, buildings, beds, medical facilities? That’s the question you should be asking.

CURRENT INFLATION IS NOT CAUSED BY WAGES, ITS CAUSED BY CORPORATE GREED PUTTING PROFITS PRICES AND CEO

S INCOMES UP BECAUSE THE MORRISON GOVERNMENTS POLICY SETTINGS ENCOURAGED THEM TOO, ALL THE COALITIONS EFFORTS IN GOVERNMENT WERE DESIGNED TO PUT DOWNWARD PRESSURE ON WAGES BY DESTROYING UNIONS AND CHANGING THE INDUSTRIAL LAWS TO BENEFIT THE EMPLOYERS AT THE EXPENSE OF THE EMPLOYEES. AND THE DUMB WORKERS ENCOURAGED THEM BY REPEATEDLY VOTING THEM BACK INTO POWER UNDER THE INSTRUCTION OF THE MURDOCH MEDIA.Thanks for the explanation, but I still don’t get it. If the money I have is owed to me by the government, why do I have to pay tax? I’m busy exchanging the stuff for other stuff, handing the government’s debt to someone else presumably. If the government stopped printing it then they would not have all this debt? But then how would it pay the trillion dollars back to… who? I can vaguely see that there is something in what you say, and yet it is so bizarre and scam-like that it baffles me in its enormity. OK that’s me done – I’m going to go and hide under the bed for a few days.

I may have to wait for you to emerge from under the bed, but here’s the thing.

It’s not that the money you have is owed to you by the government, but what it can be redeemed for, which is expiation of your taxes. Enough people have to pay taxes, and the taxes can only be paid with the government issued money, so therefore it becomes collectible. People are scratching around trying to get hold of it to meet their tax obligations. This is how a currency gets going in the first place. Just look at the hut taxes imposed by imperial forces on colonies to force the locals to work for them. It’s this very process in miniature: impose a tax, then provide a means of paying it, thus acquiring resources for the common good.

One thing is crucial. We have to recognise that money isn’t a physical resource dug out of the ground. It’s just a way of allocating those (and other) real resources, and there’s no purely financial constraint to how many of them exist. In order to get our heads around that, we have to separate how we as currency users see our individual stacks of money, and how the issuer of that currency sees the money it alone can issue.

Look at Fly-Buys from Coles’ perspective. They can issue them in any quantity they like. They don’t borrow them, they just spring forth from a computer at someone’s command. But for them to have a value, they have to be able to be redeemed for something real, right? So if you have some FB points, you have an asset that you can redeem at Coles’ expense. Your asset is their liability. They must honour their IOU or it’s worthless.

And that’s the crux of it. If one party has a debt, then some other party has a credit. One party’s financial liability must be another party’s financial asset. As Stephanie Kelton puts it in her excellent book “The Deficit Myth”, “their red ink is our black ink”. I highly recommend this book, it’s very digestible, and she can explain this better than I can with just a couple of below the line comments.

Just a quick addendum to this. You can also go to YouTube and search for “Stephanie Kelton TED Talk” or “Stephanie Kelton Angry Birds” for more.

In addition to RET’s points, the main purposes of tax (other than giving money value) are to reduce inequality (by taking money away from people who have lots of it) and influencing behaviour (by either punishing things we don’t want people to do or rewarding things we do want them to do).

Specifically with this last point, Negative Gearing[0] could be used as an incentive to increase housing supply, by only allowed new build houses to be negatively geared.

[0] As in claiming investment expenses against salary income and running a persistent loss to reduce income tax liability. Though if left up to me I would also require the second and any additional investment properties be run as a business.

In the immediate term, the gov could do a Tony Abbot, and do a temporary tax on the rich.

Thanks Bernard, a practical approach. I’d like a lower cap on houses.

My son is 20,. He and his friends think being a landlord is a terrible thing, and a property portfolio is obscene. He says no more than three houses with tax deductions, including a principal residence. Perhaps that would be a practical cut off.

The most important progress is structural change. Suddenly removing tax deductibility isn’t fair – why should someone who has bought 3 units for retirement income suffer compared to someone who stayed in super?

Keep up the good work Bernard!

`Why should someone who has bought 3 units for retirement income suffer compared to someone who stayed in super?’ Shouldn’t. Both should be taxed on their income. The unearned incomes you mention should be taxed at a higher rate than earned income. Subject to reasonable, not opportunist disagreement of course.

Albanese’s is not shaping up to be anything other than an imitation of the previous rabble – international relations and defence for instance still remain ceded to the likes of the ASPI and the Americans