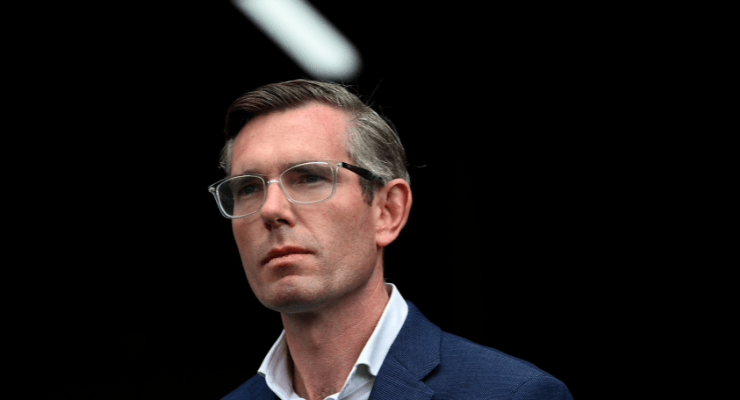

NSW Premier Dominic Perrottet is running out of time to make reality a major reform he’s been talking about for years. Perrottet was the state’s treasurer when he first announced his intention to replace stamp duty — a fee demanded of home buyers at the point of transaction — with a property tax.

It’s a major and complex undertaking, not least because it involves tinkering with a major income source for the government.

Across Australia, local and state governments derived more than a fifth of their tax revenue in the 2020-21 financial year from stamp duty.

The $23.9 billion in revenue collected by those governments was a 25% yearly jump to a new historic high, according to the most recent figures from the Bureau of Statistics (ABS).

The premier finally introduced his bill to reform the stamp duty system on Wednesday, and the complexity of the issue was made immediately apparent — including by the fact that the policy has been watered down significantly compared with what Perrottet suggested two years ago.

In Perrottet’s original pitch, any home buyer would have been able to choose between paying stamp duty or a land tax — and if the choice was the latter, the home would be subject to that tax going forward.

This week’s bill proposes a far narrower approach, giving first-home buyers the option of paying the tax instead of stamp duty, but only if the property is worth less than $1.5 million.

AMP Capital chief economist Shane Oliver said the government likely opted for the narrower option because it was cheaper.

“If you have a $1.2 million property in NSW, the stamp duty is going to be something like $50,000,” Oliver told Crikey.

“Whereas the land tax in the same year would be something like $2600. The land tax would be forever, and eventually should equate the value of the stamp duty.

“But in the first year, the government misses out on $50,000 in revenue and replaces it with $2600, and it obviously becomes a big issue.”

Oliver said the approach initially proposed by Perrottet was in his opinion the “ideal way”, and is the path that’s being eyed in other places, including the ACT.

One reason Oliver thinks the new approach is worse is because it doesn’t incentivise “empty nesters”, whose kids have flown the coop, to vacate their big homes to make way for younger families.

Those people wouldn’t be able to take advantage of the new reform if they thought of downsizing because they wouldn’t be first-home buyers.

“They’ll still have to pay this massive stamp duty cost and that’s seen as a hurdle to moving,” Oliver said.

Perrottet has promoted his bill as a way to allow more people to enter the property market.

“For many people, choosing the annual property fee won’t just remove one of the biggest up-front barriers to buying a home — it will also mean a significant tax saving if they go on to sell their first home in the short-to-medium term to meet the needs of a growing family or a job in a new location,” he wrote in an opinion piece for The Sydney Morning Herald earlier in the week.

Perrottet’s bill won’t pass easily. Labor has strongly opposed the legislation, labelling it a “forever tax” on homes, with plans to make the reform an election issue in March.

Still, the government, which is in minority, has a good chance of passing the legislation through the lower house with the support of the crossbench.

Independent MPs Alex Greenwich and Greg Piper both told Crikey they would back it when it comes to a vote, which is likely to be next week.

Even still, upper house MPs are seeking to put the bill through an inquiry before voting on it, which would mean another delay.

Upper house crossbenchers, including MPs from the Greens, Animal Justice Party and the Shooters, Fishers and Farmers Party, all told Crikey on Thursday morning they believed the bill would head to a committee.

Labor doesn’t want it to go to a committee, wishing instead to simply vote it down. But upper house MPs from the party acknowledged it was likely they wouldn’t get their way.

If it goes to a committee, that will make it difficult for Perrottet’s government to live up to the promise of having the reform in place by January.

What do you think of Perrottet’s stamp duty plan? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

“El Pero” was also Treasurer when icare was ‘melted down for scrap’.

Land tax is well worth considering since it represents a simple means of wealth distribution – very difficult to avoid by the rich. Income tax is now a creaky, inefficient, easily-avoided method for funding governments. Maybe time to stop relying on it?

It’s not wealth redistribution. Everyone owns land who owns a house. The long-term nature of it discourages people from getting a foothold in the mortgage market. It is a sneaky way using sneaky logic, which you see to have fallen for, in attempting to forever stimulate the property market. It is the real estate equivalent of the payday lender’s motto and is thus short term. It is the equivalent of a junkie putting his guitar in hock to buy the next hit of smack.

You sound like the VIZ character, Student Grant who, so sure that the revolution was coming tomorrow, failed to make preparation for afterwards – like a certain sad old trot writer in the bunker.

Think of the Aesop fable of the Ant & Grasshopper – even the Jimminy Cricket/Walt Disney version would do so long as you ignore its altered saccharine ending.

Or perhaps the more contemporary fable of GoT – Winter is Coming!

Ha, Ha!! Hilarious. But am I wrong?

Politics wins over policy again.

It’s small wonder little ever gets done in this country.

This just kicks the can of grossly overpriced housing down the road, to be dealt with at another time.

This is all about keeping the cost of housing high to keep speculators and developers happy at the expense of everyone else.

” Perrottet has promoted his bill as a way to allow more people to enter the property market.”

This is just an admission on the part of government that the policies they have been pursuing are a monumental failure.

” Across Australia, local and state governments derived more than a fifth of their tax revenue in the 2020-21 financial year from stamp duty.”

What and who is going to make up the shortfalls in revenue until the property tax regime catches up in approximately 25 years Higher or new taxes no doubt.

What if the property market crashes and government is left with a land tax hole in the ground , from which they will not be able to retrieve as much revenue ?

Governments have proven they can’t manage the windfall revenue increases they have been receiving over the last 20 years of massive house price escalation.

Any house sold with a land tax agreement will forever be subject to land tax even if the prospective buyer wants to pay stamp duty up front.

This proposal has more holes in it than a piece of Swiss cheese

IT NEEDS TO GO TO COMITTEE.

nO .It needs to be buried.

Land tax. The forever tax. This works the same way as a defined benefit superannuation pension. Instead of $550,000 lump sum, you get $50,000/year till you die. So if you live another 11 years after you retire you win. If you live 20 years or even 30 years after you retire then you have won comprehensively, seeing as they are CPI indexed as this one will be. This is why governments have got rid of perpetual pension payments and opted for Keating’s and Howard’s rip-off accumulation interest based super plans. The same with this tax. Its revenue over time will be a stream to the government, a boon for the property industry and short change buyers.