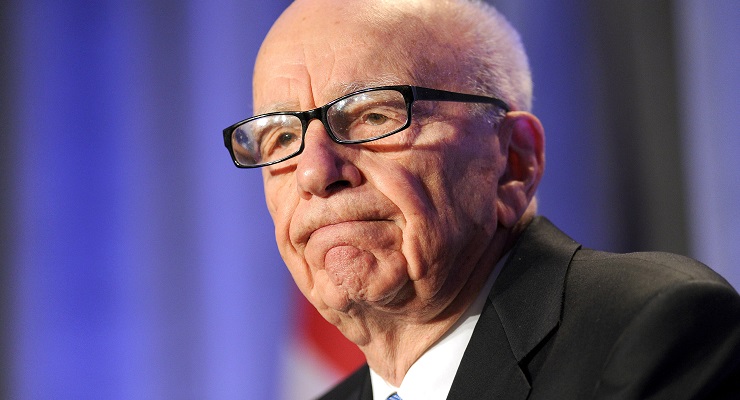

After almost 70 years running publicly listed media companies, does Rupert Murdoch have one final big deal up his sleeve to cement the Murdoch family legacy and sew up his preferred succession plan

Murdoch-watching has gone into overdrive since Friday’s announcement that the boards of News Corp and Fox Corp are exploring a Murdoch family proposal to merge the companies.

Rupert Murdoch, 91, reluctantly agreed to fully split his beloved News Corp back in June 2013 when 21st Century Fox was spun out via a demerger agreement in the wake of the News of the World phone-hacking scandal.

However, once 21st Century Fox sold its entertainment assets to Disney for US$71.3 billion in 2018, the logic for running two mid-sized listed media companies became harder to justify, especially with only one heir apparent left standing.

Rupert’s eldest son Lachlan Murdoch is CEO of Fox Corp and co-executive chairman of the company with his father, while at News Corp he is the co-chairman but serving in a non-executive capacity while both his father and chief executive Robert Thompson draw multimillion-dollar executive salaries.

The other son, James Murdoch, completely left the Fox business after the Disney sale and then quit the News Corp board in 2020 over editorial differences related to climate change, leaving Lachlan unchallenged to share power with his father. These days, James is conspicuously hosting Biden fundraisers at his New York pad, confirming his political differences with the Fox News line.

As for the drivers behind a potential merger, one close Murdoch watcher observed yesterday:

The merger is probably scale driven and that makes sense. There’s limited downside. And for Lachlan post Rupert, only one chessboard to worry about is easier than two! Also don’t forget human factors: Rupert is probably bored after his divorce, so with nothing to do, it’s back to work!

If the two businesses come together, it will be interesting to see what they call the business and who secures the board seats, including within the family, given that the Murdoch Trust has also separately requested the merger talks, along with Rupert individually.

Rupert’s eldest daughter from his first marriage, Sydney-based Prudence Macleod, has never worked in the business but has one of the four trust votes shared by Rupert’s adult children. His second daughter, Elizabeth, served on neither the News Corp or any of the Fox boards, even after News Corp paid US$470 million to buy her Shine Group production business in 2011.

Any merger of News Corp and Fox Corp will likely see Lachlan as the most senior day-to-day executive with the 61-year-old chief executive of News Corp, Robert Thomson, expected to retire after being paid more than $200 million to run the business since the 2013 demerger.

But forget the dynastic stuff for a moment and focus on the underlying business logic. To put it simply, the two Murdoch companies have missed the bus on the biggest media development for decades — streaming video pioneered by Netflix.

Streaming is now in every media group’s armoury — except Fox Corp and News Corp. It is an offering in the 65%-owned pay TV business Foxtel through its sports stream called Kayo and the general entertainment offering Binge. But if you go to the Foxtel dashboard, so are Netflix, HBO, Paramount+, Disney+ and other streams from various foreign media companies.

Having sold its production crown jewels to Disney, Fox (and Foxtel in Australia) doesn’t have access to or produce enough of its own programming to justify a few hours of its own original stream each day, let alone a week or a year.

And that’s why recombining the empire’s two arms looks like an attempt to scale up and stay in touch with a media landscape that has evolved away from the Murdochs’ dreams of power and influence.

Netflix has around 220 million paid subscribers and is about to start an advertising-based streaming offer. Disney now has around 221 million paid subscribers (including ESPN), while smaller rivals Discovery, HBO and Paramount have around 100 million between them.

Compare that with Apple, which has a staggering 860 million subscribers to its music, Apple TV, cloud storage and other services offerings, although this would include some double counting. Apple also has a rapidly growing digital ad business.

Amazon has around 200 million Prime subscribers and a rapidly growing online ad business. And through Google and YouTube, Alphabet has money-vacuuming businesses that no other media company possesses. YouTube alone now has revenues running neck and neck with Netflix at around US$28 billion to US$30 billion a year. Alphabet’s overall revenues now exceed US$250 billion a year.

These companies and their offerings will drag more money away from the TV businesses of Fox in the US, including Fox News, from Foxtel here and from the company’s newspapers around the world. Probably only the Dow Jones Co looks like it will prosper as a growing business data and information service.

With only one child still working in the family-controlled businesses and Rupert preparing for life after he departs, it makes sense to put the empire back together.

However, it won’t be an easy sell, especially as both companies make a controversial push into the Australian and US gambling markets. The combined company will be a much bigger target for advertising bans and divestment movements, and Rupert will probably need to keep it listed on the ASX to avoid potential regulatory opposition on foreign investment grounds.

He’s probably plotting a merger with the Devil’s interests when he finally goes to hell.

Would Rupert even be accepted into Hell? Surely the devil has some standards.

That’s why he is still above ground – persona non grata down below.

How exactly did Lachlan allow his old man to miss streaming as a threat.

It reminds me of Fairfax missing the internet’s potential impact .

Not so sharp after all chaps.

Perhaps after Rupert departs, Lachlan will have a mid life crisis, marry an old b-list actress, sell off all his father’s assets and build a mega-super-rich yacht and sail the world free of care while making occasional comments causing people to question his mental capacity.

Then Lachlan and James Packer could re-unite, start a mobile telco company together called, oh I don’t know, Dumb-Tel? And offer mobile phones pre-installed with the full suite of crazy frog ringtones. It’s a sure winner in this day and age!

There’s a profit in re-merging? Or a tax break to ensure he continues to pay no tax

Mr Murdoch has decided that ozzies will continue to gamble … until the cows come home … and he can easily merge all TAB warring states and factions into one big pool and take up to 15pc of all the wagering pool …. not a bad return ad infinitum and clever thinking if you think about it …. go u good thing