The best news about tonight’s budget may be the forecasts of the bottom line. There’s not a surplus in sight. That means the debt keeps rising — but it also means Australia might have finally abandoned its absurd obsession with generating surpluses at all costs.

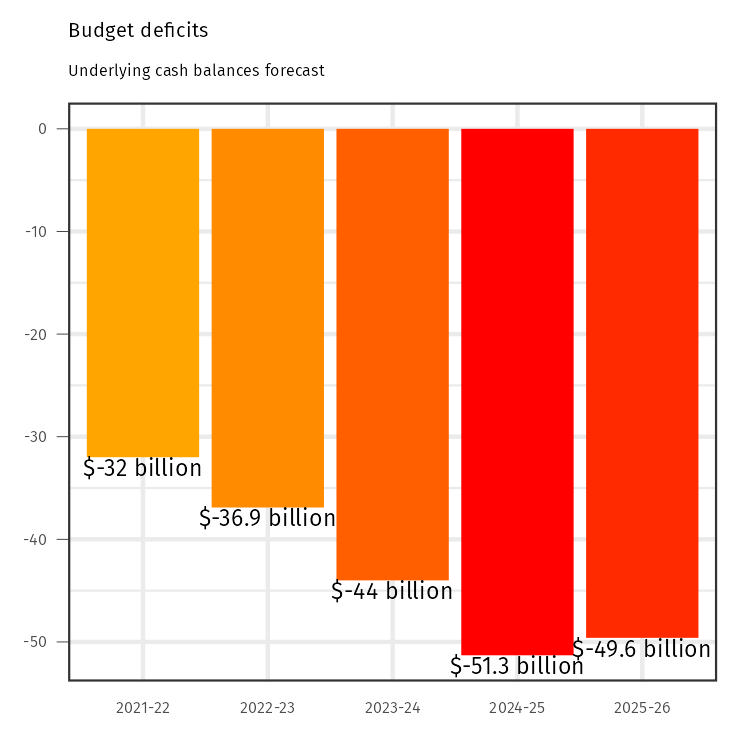

In fact, the budget balance is forecast to deteriorate over the next four years, as the next chart shows. Debt will rise to more than a trillion dollars. That would have been a politically risky set of numbers to publish, not so long ago. That Treasurer Jim Chalmers feels confident in doing so might mark a seachange in Australian politics.

The surplus obsession stretches back to the era of Peter Costello. He presided over “rivers of gold” as unexpected revenue came in, and used it to keep the budget in the black and pay off debt. The longevity of the Howard government and the economic vitality of the 2000-07 era contributed to the sense that this was really the only way to run a country.

Wayne Swan inherited the job from Peter Costello, and on the day he moved into the treasurer’s suite in Parliament House, Chalmers was on his staff. In his 2016 book, Chalmers talks about seeing a scrawl on the whiteboard in that office, left by Costello’s staff: Kevin’07 = Recession’08. They dodged that by spending up big during the GFC, but then pivoted to running tight budgets. Chalmers writes at length about how proud he was of running a really tough, tight budget (even doing so as unemployment lifted and inflation dived).

The legacy of Costello flowed through Swan and appeared to live on in Chalmers, especially as he made pre-budget pronouncements about cuts and saving. I was worried he would be like a general fighting the last war. Insisting on surpluses — even when they are not needed — puts the economy at risk. Chalmers is already projecting the unemployment rate to rise, from 3.5% to 4.5%. If he pushed even harder on the budget bottom line, cutting more and taxing harder, the rise in unemployment would be even greater.

For these reasons, to discover the budget is devoid of projected surpluses is a relief. Conceding that economic reality trumps sheer bloody will is a vital step in the maturation of any treasurer.

The treasurer’s mantra: accept what you can’t control

In any given year, the change in the budget bottom line caused by the winds of change dwarfs that caused by policy decisions. A flood here, a war there, a massive global energy shortage that lifts coal prices to three times their forecast level, and suddenly you can find yourself hundreds of billions of dollars ahead of or behind where you expected.

These things you can’t control — known as “parameter variations” — improved revenues by a staggering $57 billion in 2022-23, compared to what was forecast pre-election. Policy changes added just $1.4 billion. You simply can’t compensate for that sort of change by tweaking pension indexation or cutting a few rural grant schemes. It means treasurers need to accept that much is beyond their control. Be zen-like. Don’t promise surpluses that fate will make impossible to deliver.

The budget has a couple of big moving parts. Revenue and spending are both forecast to rise as a per cent of GDP. The net result is a worsening bottom line (despite Chalmers insisting the big theme of the budget is “spending restraint”!).

This is not to deny that Chalmers is naturally frugal and wants to move toward a balanced budget. As debt rises and interest rates do too, the interest paid on debt gets bigger and bigger. Eventually, we want to reduce our debt in real terms. But doing so at the expense of the real economy, doing so on the back of families with unemployed parents, doing so because the editor of The Australian wants you to? That’s not good for the country.

Perhaps Chalmers learnt something from his old boss’ shame, continually announcing and projecting surpluses but never delivering them. Swan ended his stint as treasurer in the red, and red-faced. Chalmers might get the budget bottom line back in the black eventually, but if he does so it will be by playing the long game.

Do you think it matters whether the budget is in surplus? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

Alan Kohler, “The New Daily” yesterday!

“Deficits and surpluses are about politics, not economics.

Since 1970-71, there have been 36 deficits totalling $795 billion and 17 surpluses totalling $176 billion.

If deficits were an economic problem rather than just political, Australia would be in serious economic trouble, and Japan would be in worse trouble, having had nothing but huge deficits for 30 years.

But they’re not, and we’re not.

“Deficits” and “debt” are actually the wrong words – the number simply represents the amount of government spending financed by bonds instead of taxes.

The “deficit” is not a loss, like a company’s, but represents the money the government is injecting into the private economy. The bonds are private savings to be returned later rather than taxes that citizens only get back as government services and pensions.

Wrong way, go back!Yes, I hear you say, but what about the interest? Well that’s just a further annual injection of cash into the private economy, usually financed by more bonds, and anyway almost half of it now goes to the Reserve Bank, which comes back to government.

Last month Jim Chalmers said this week’s budget would be “the beginning … of a big national conversation about our economic challenges (and) the structural position of the budget going forward …”.

Good. But he has got off to a bad start by whinging about the debt and deficits he has inherited and telling us in his July economic statement that “interest payments on government debt will be the fastest-growing area of government spending – faster than the NDIS, aged care and hospital funding”.

Wrong way, go back! The amount of government spending, and how much of it is funded by taxes or bonds, is far less important than what it’s being spent on.

That’s been demonstrated by the destruction of UK prime minister Liz Truss and her hapless chancellor Kwasi Kwarteng. It wasn’t the increase in the deficit that did it – it’s been bigger before – but the fact that the money was being wasted on unnecessary, ideological tax cuts.

Chalmers keeps talking about the five areas of government spending that are causing problems – NDIS, aged care, health, defence, interest. (He could also add climate change, preventing it and dealing with it.)

The first four of the items on his list represent good, necessary spending, and the fifth is simply a function of the other four.

Politicians, especially conservatives, but also economically literate lefties like Jim Chalmers, too often take the easy path of hammering their opponents with debt and deficit.

Chalmers is about to bring down a budget that has no surpluses in the forward estimates, only deficits and debt.

His “big national conversation” needs to be about why that’s OK, and a good start would be to stop whingeing about the debt and interest. Instead he should channel Wayne Swan’s line that “the politics were bad, but the economics were good”.

There’s also the distinction between recurrent expenditures and investment. Investment and debt are good in business. They used to be good in government too (think Curtin’s Snowy, Menzies’ universities etc.). The anarchist neoliberals have fudged the distinction as part of their campaign against government.

See also my comment on ‘deficits’ after Keane’s other piece ‘Labor embraces a world of bigger government’.

Liked, but please don’t call neoliberals anarchists when you mean unprincipled wreckers or something.

Anarchists are the ones waiting to save us from capitalism, if we’re ever ready to stop trying to keep score in a rigged game.

The trouble with ‘anarchist’ is that they don’t want rulers – which makes it hard to draw margins.

Nihilists was probably the word you were after

Some without only 9 toes, abiding Dude.

Same old same old. Again the “debt and deficit worries” are never far away with another Crikey bod having appeared to have swallowed the neoliberal kool aid. Groan-up economics indeed.

“Australia” was not obsessed with surpluses. It’s just that the LNP weaponised it from 2008 after the GFC stimulus package.

Embarrassing for whom, Effie?