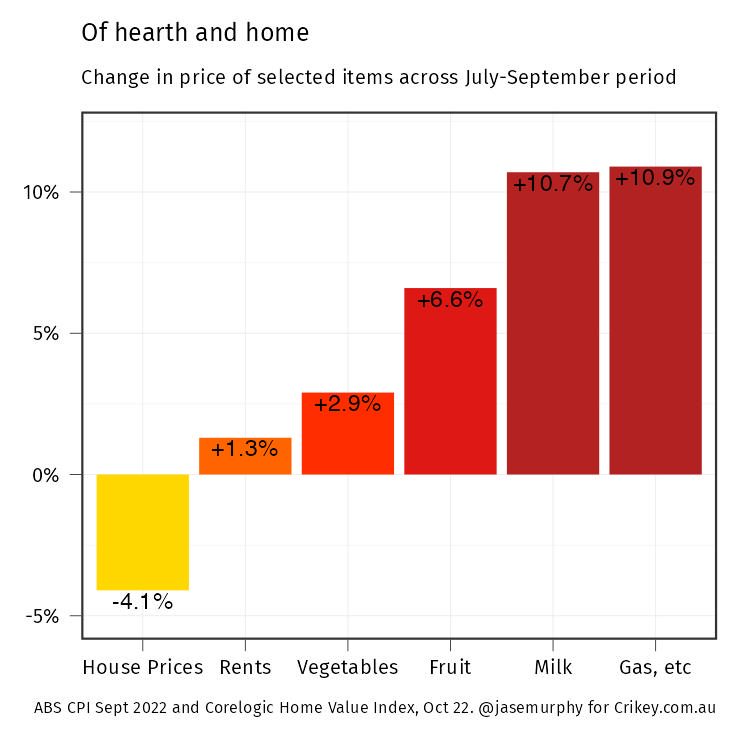

House prices are pretty much the only prices falling across Australia which is something like irony, considering they are not part of the consumer price index the RBA is targeting.

Expect rising CPI and falling house prices to continue — RBA governor Philip Lowe confirmed it on Tuesday when he raised official interest rates by 0.25% and lifted forecasts for consumer price inflation.

Consumer prices are expected to rise by 8% this year. The previous forecast was 7.8%, so inflation is continuing to worsen, despite the RBA’s actions. That rate of price growth will compound quickly.

We had inflation of 3.5% in 2021 and a forecast 4.3% in 2023. Compounding the inflation across the three years means something that cost $1 at the start of 2021 will cost $1.17 by the end of 2023, if it rises by the average rate of inflation. Another way of looking at it is every dollar will lose 17% of its buying power in three years.

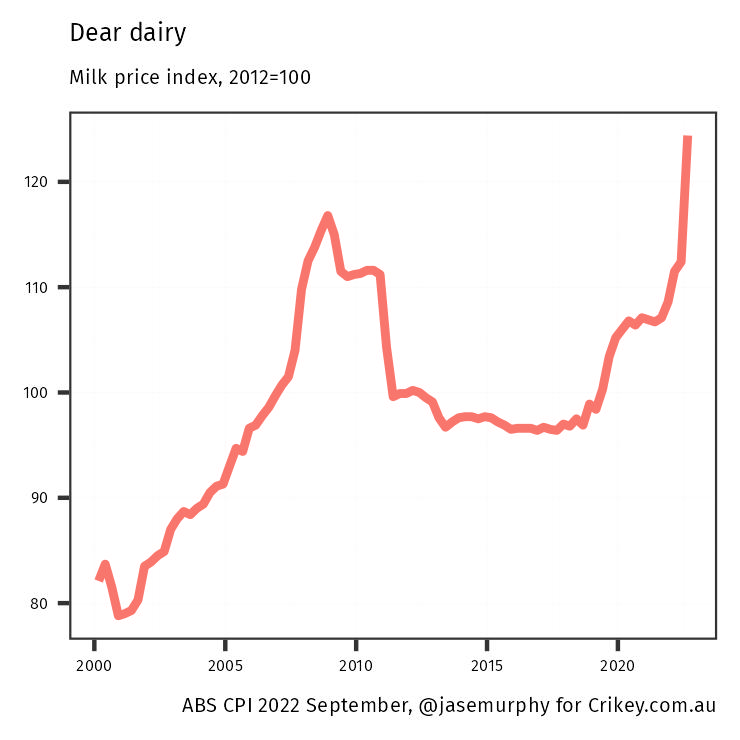

One of the fastest price rises so far has been milk. In late 2021 I was buying two litres of full cream milk for $2.39. Now Woolworths’ cheapest two-litre milk costs $3.10. That’s a 30% increase over the past year. As the next chart shows, the official CPI confirms milk prices have shot up, albeit after a 10-year lull.

“At our meeting, we discussed how the higher interest rates are putting pressure on family budgets, just at the time that high petrol prices and grocery bills are also squeezing budgets,” Lowe said on Tuesday, after raising rates. “We are conscious of this and are certainly taking it into account.”

Fruit and vegetables are also rising fast, as are gas and other household fuels. Rents are rising too — average rents are shown in the table below. They are rising less than advertised rents, because not all leases come up every year. But the price of buying a house is going the other way.

House price falls are greatest in Sydney, down 8.6% over the past year. At the other end of the spectrum is rural South Australia, where prices are up 20% over the past year. But markets are quiet this year, with far fewer properties up for sale than usual.

Rising consumer prices and falling house prices accompany a worsening outlook for economic growth. The budget printed forecasts for economic growth of just 2% next calendar year. The RBA is even more pessimistic. It sees growth falling to 1.5%.

How does it work?

It’s one of the ironies of monetary policy that to make consumer prices fall, we must lift the price of a mortgage. Interest repayments aren’t in the CPI, so raising them doesn’t take the RBA further from its goal. That’s a free kick for the central bank, but it doesn’t get everything going its way. If along the way it crushes housing prices, that doesn’t achieve the RBA’s goal of lower consumer price inflation, because (most) house prices aren’t part of the CPI basket either.

The only house prices that are in the CPI are the actual house component of newly built homes. All second-hand goods are excluded from the CPI, so established house trades are not included, and land is also excluded because it’s not consumable, it’s an asset.

Why do we fight inflation? To protect people’s economic well-being. To stop prices rising, we stop people spending. To do that, we must crush their wealth and squeeze their household budgets. It certainly is a roundabout way to protect people’s economic well-being.

If macroeconomics had proper laboratories, perhaps economists could figure out a better approach. But there are no true laboratories, just a few mathematical models. When we look at national economies, the ones that fight inflation with interest rate rises are doing better than those who don’t. Risk-averse, we stick to the devil we know. Rate rises it is across the developed world.

Who gets hit?

Rising interest rates hit families in many ways. Higher mortgage payments are a big deal for some borrowers — a 2.75% increase on the average new owner-occupier mortgage of $600,000 adds $850 a month to repayments, assuming a 30-year loan. It’s more than $1100 a month extra in NSW where the average new mortgage has been $800,000.

Some borrowers are paying $1100 a month more than the bank asks for. They don’t need to reduce their consumption to fund the repayment rises. Others might not be stuffing their mortgage offset accounts but could be saving in other ways. They will probably keep spending as much as ever too, so they don’t help the RBA achieve its goal. But for most households, more mortgage repayments means less left over for other things. We trim our spending, buying cheaper things and fewer of them.

What I’ve described above is the obvious way that interest rate rises work. There is also a less obvious way: falling house prices make families less wealthy. That latter effect is actually very significant.

A recent study by the RBA found that if employment fell by 8% and house prices fell by 40% (i.e. a model of a major crisis) most of the effect on household consumption would come from the latter. Falling wealth makes people spend less. And the households for whom the decrease in spending would be greatest would be those who have the most housing wealth — older households.

To be clear, that isn’t the exact scenario as a house price fall caused by rising rates, and it is just a model, but it does illustrate that it is not only young households who get hit when house prices fall. Older homeowners are also bearing some of the burden.

Almost everyone is being made worse off, and interest rate rises are not over yet. There is still one more RBA meeting this year before it takes January off. Markets are pricing in a decent chance of a rate rise at that meeting, and several more in 2023.

It could be a long time before house prices bottom and inflation is back under control.

ok. How does that work? These ‘older households’ should consist mostly of older home-owners who have paid off their mortgage. Unless they are selling their house the change in house prices, up or down, does not affect them in the slightest. And even if they are selling, they still need to live somewhere and the price of the house they buy next should have changed much the same. So what’s the problem? Does the RBA model assume that all or most ‘older households’ are funding their spending by mortgaging the house to the hilt, so that falling house values would really hurt?

Seems to me all the panic over falling house prices is highly exaggerated and mostly imaginary. The only ones who get really caught out are recent house buyers facing negative equity, who merit some sympathy, and speculators who bet on rising prices of investment properties; not so much sympathy. And of course the state governments who depend far too much on their income from the bloody awful stamp duty.

Will nobody think of the most worthy victims – real estate touts?

Poor things probably believed their own hype of ever rising house prices and are now really negatively rich.

So Lowe acknowledges that inflation is hitting things like groceries and petrol the hardest, we can throw in rents, electricity and gas as well, things we can safely call non-discretionary- yet his response is to tell us all to “spend less”. How exactly are we to do that?

“ Another way of looking at it is every dollar will lose 17% of its buying power in three years.”

Hands up who’s fed up with this type of worthless speculation? IIRC several economists incorrectly predicted the end to the housing bubble a number of times over the last decade. And now we have someone brave or stupid enough to predict the price of milk 3 years hence. The ‘attention seeking’ wars have to stop. If we were to pay attention to the graph in the article we’d probably be betting on a drop in price off a soon to be reached peak. Anyway, I think I lot of the current high cost of living is due to price gouging facilitated by supply constraints and much arming waving about ‘inflation’

Correction required:

But for most households with mortgages, more mortgage repayments means less left over for other things. Something like only 35% of households have mortgages. The others either fully own their home (no mortgage) or rent (no mortgage, but rents are rising because of a supply shortage). Home owning retirees, with savings in the bank on which they are trying to live, are probably quite happy to see savings account interest rates with a 3 in front of them. After two years of interests on savings as low as 0.05%, they can do with some respite.

It also seems that the media are letting the RBA off lightly at the moment. Apart from meaningless figures quoted as to how much extra “you mortgage payments” there is no real analysis. Certainly, I see no one discussing the RBA’s comments in 2021 that interest rates were unlikely to rise until 2024. Just how wrong was the RBA’s forecasting, and can we be sure that it’s any better now? At the same time, popular media reporting of that matter generally said ” your mortgage rate won’t rise for three years”.