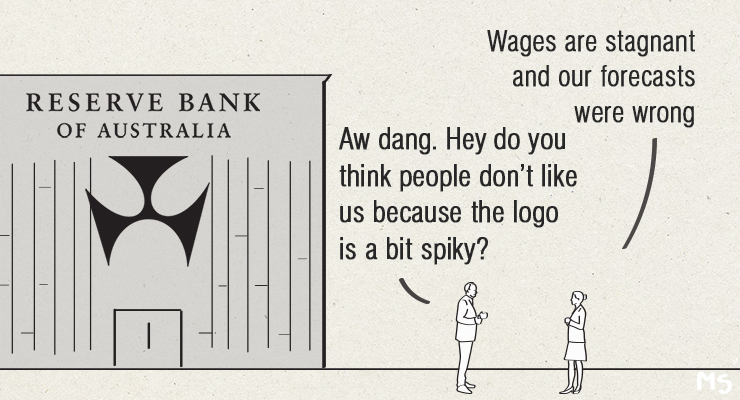

The Reserve Bank abandoned the last elements of its focus on wages growth, declaring it was a mistake to link its pandemic-era forecasts about interest rate rises to wage rises, as part of a broader admission that it should not have put such a long timeframe on its interest rate forecasts in 2020-21.

That mistake has condemned millions of Australian workers and their families — especially lower-paid workers in essential areas such as health, aged care and services, and renters — to again being the underclass of economic growth while older asset-holders enjoy the benefits.

The bank’s internal review of its “forward guidance” during the pandemic acknowledges its constant statements that interest rates were unlikely to rise before 2024, when the bank expected inflation to be back in its 2-3% target band, “led to considerable reputational damage to the bank. When the cash rate was increased in May 2022, many people saw the bank as having broken ‘its promise’.”

Now, the bank says:

A less specific timeframe, or one covering a shorter horizon, would have been preferable. Given the outlook was highly uncertain, the board could have given more consideration to potential upside scenarios, including scenarios that could warrant the board raising the cash rate earlier than anticipated.

The bank’s admission its actions led to people being misled will be cold comfort to borrowers who based key life decisions such as purchasing a home on the belief that interest rates would remain at near-zero levels for three years.

Even so, the broader context for the RBA’s miscommunication (at best) or breach of faith (at worst) shouldn’t be ignored: its more fundamental problem was that it (understandably) misread the nature of the economic impact of the pandemic in an era when working from home and e-commerce had changed employment and consumer demand, and (less understandably) failed to realise how much massive government stimulus via JobKeeper and JobSeeker increases would prop up demand.

More strident than its acknowledgment of the reputational cost of its miscommunication on timing, however, is its dismissal of wages growth as an important indicator.

For a time between 2018 and 2021, the RBA was the only important economic policymaking body that recognised the importance of ending years of wage stagnation for Australian workers, and wages growth became an important part of its forward guidance for when inflation would be high enough to warrant an increase in interest rates.

… The board regularly referred to the outlook for wages as an important indicator for assessing whether or not inflation would be ‘sustainably in the target range’. Over time, it became incorporated into the board’s state-based forward guidance and was a key criterion discussed in the decision to raise rates in May 2022.

Now the bank regrets that: “This further complicated the messaging, with many commentators interpreting the board as having a wages target … This focus on wages could have also down-weighted other important factors that can drive inflation. Some criticised the board for relying on liaison data on wages rather than more conventional indicators.

Well, that would be us here at Crikey, who have consistently expressed scepticism about both the RBA and the government’s wages growth forecasts, and suggested the bank’s liaison program with business gave the bank an absurdly optimistic view of wages growth when both businesses and the Coalition were dedicated to screwing down wages as far as possible with the help of a bargaining system tilted against workers.

The most recent wages growth figures, for the September quarter, were released today, and only reached 3.1% annual growth — the highest figure in years — because of the Fair Work Commission’s midyear decision to grant a $40 a week minimum wage increase for low-paid workers, which according to the Australian Bureau of Statistics “was a significant contributor to hourly wage rate increases in the retail trade, administrative and support services, accommodation and food services, public administration and safety and healthcare and social assistance industries”.

What’s bizarre about this dismissal of wages growth is that it comes after governor Philip Lowe began warning of a wage-price spiral after the most recent RBA board meeting, an outcome that Australian workers can only dream of as they endure the biggest falls in real wages in decades.

But it marks the full reversion of the RBA into neoliberal orthodoxy after a dangerous period in which it actually focused on economic outcomes for workers and the impacts of a heavily skewed economic policymaking apparatus on the real economy.

Are you OK with the RBA “apologising” now for its “miscommunication”? Let us know by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

The RBA Board should resign en masse or be sacked by the relevant Minister. Their lack of foresight or insight on wages reflect their cossetted outlook and place in the scheme of things. They don’t understand industrial relations and the fact that the absence of collective bargaining accompanies low wage growth and the legislation of the FWA and the actions of the FWC and other bodies like the APSC is nothing short of a protection racket for business to keep wages historically low while profits are rising.

I agree they should be sacked. Lowe gets a salary which would allow him to buy a house, that hundreds of thousands of Australians would love to have, each year and still have enough left over for canapes. I also suspect he rarely sees economy seats on his flights. The only group he could be jealous of are the various defence force chiefs and the Governor. That said, I disagree that the board do not understand industrial relations, they understand it really well, because their origins are from the highest levels of business and finance, and they side with the corporates each and every day. So, the latest statement must be credited for finally being honest. Interesting it is now involving itself, not so obliquely, into politics. Saying pay rises for workers a renot important (they have money saved from not going on international jaunts for 2 years so they can pay higher interest, food, health and energy costs) has been timed to cast doubt on the governments IR reform and has used the $40 pay right to argue against other low pay workers getting an increase. I’m sure they will be silent in a couple of years when they receive the tax changes that Labor stupidly supports.

Yes this is a good response and analysis. I think you are correct but remember if something is wrong it is up to the relevant agency, in this case, the Reserve Bank, to detail all the reasons. They may and do understand industrial relations by virtue of their membership of the Big boys and girls club, CEOs and senior execs, etc, but it is still incumbent on them to detail and critically analyse how the workings of the industrial relations system impact the movement of wages. They simply don’t reference this and their analysis is therefore dishonest. This is all I am alluding to. The fact that,as you say, they are finally honest about wages, does not excuse their previous dishonesty over a great many years in not identifying the problems of wage rise non-movements over this long period of time.

RBA doubling down on losing credibility, eh?

Yes a failed organisation

trying to re-write history and cocking that up too

so at that point prediction and forecasting is well beyond their capability

Accept your inadequacy and move aside post haste

Luv that trying to rewrite history and cocking that up bit Hilarious

I make sense of the language by thinking of it in terms of democratic permissibility. If the RBA just came out and said their main goal is to drive business and enrich the shareholders, they wouldn’t be seen as for for purpose by the wider democratic body. Politicians and pundits would rightly join in on the outrage and members would be sacked.

But if instead it’s framed as helping workers by balancing the ability of businesses to succeed with the workers being able to earn a decent living, then the shareholders can be enriched and the poor exploited with only idealistic lefties objecting, and they can bleat on about inequality without anything actually changing.

So it’s win-win for the shareholder class to pretend that business is really about the little guy getting their due because it never happens and suppresses any wider populist anger over how unequal the current deal is.

Forward guidance on the direction of monetary policy is important. Whilst the bank got it terribly wrong, it should be remembered that amongst the most vocal of critics of the bank were also those calling for more rapid and aggressive action in withdrawing monetary stimulus (and low interest rates were just one of those measures – there were others). If nothing else, the bank’s policy failures were both consistent and wrong, and that should be sufficient to remove any suggestion of “bad faith”.

The “persistence” of inflationary pressures after the global supply chain perfect storm isn’t that persistent at all. The war in Ukraine and China’s zero-Covid policy are still having ongoing effects, and the delay in visa processing after two years of border closure might have some minor connection with current labour supply shortages…

The RBA management and Board over the past decade could not be more incompetent. At some stage major change has to be made.

But, having said that I think it is through the whole business community as well. It appears that incompetence is endemic throughout where we only promote those that agree and not challenge.

The one’s that challenge ensured that decisions were properly anilysed and not just acted because the boss said so.