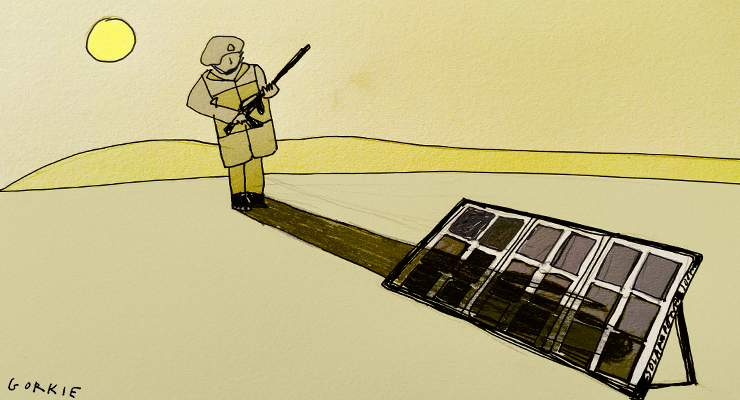

China’s vice-grip on solar panel and EV battery industries could spell doom for the global effort to reverse climate change if simmering geopolitical tensions boil over, experts say. Meanwhile, the Albanese government is acting fast to reduce over-reliance on China, a senior minister tells Crikey.

A war in Taiwan, “whether Australia was a participant or not”, could completely derail the world’s efforts to decarbonise, Allan Behm, director of the international and security affairs program at The Australia Institute, told Crikey.

“If the rising geostrategic tensions — principally generated by China and the US as they jostle for supremacy — were to go unchecked, global climate action could well fall by the wayside,” Behm said, “along with any semblance of a working ‘rules-based order’ such as the World Trade Organization, United Nations Convention on the Law of the Sea and many other international institutions that maintain peace and stability.

“And if Australia were to become belligerent over Taiwan, all bets would be off.”

Australia’s zero emissions technology supplies almost completely depend on it staying in China’s good books. Australia imports 90% of its solar panels from China, slightly ahead of China’s 80% share of the world’s solar panels — set to strengthen to more than 95% in the coming years, according to a 2022 report from the IEA.

It is a major cause for concern for the government. In September, Climate and Energy Minister Chris Bowen told a forum hosted by the Centre for Strategic and International Studies in Washington DC that China’s renewable “monopoly” was a “clear vulnerability” for Australia and a “potential risk to energy security the world over”.

China also holds a powerful monopoly over lithium-ion batteries, crucial for Australia’s surging electric vehicle uptake, controlling just shy of two-thirds (59%) of the world’s lithium production capacity.

And yet there is a major opportunity to reduce this reliance — Australia is home to nearly half of the world’s lithium (47%), with exports contributing up to $9.4 billion to our bottom line this financial year.

Executive director of the Center for China Analysis at Asia Society Bates Gill said China’s vice grip on Australia’s renewable technology should ring loud alarm bells.

“A major crisis with China, such as war across the Taiwan Strait, would be highly, highly disruptive to supply chains across nearly all sectors,” he warned.

“Given China’s current dominance in producing and exporting solar panels as well as other green energy products such as lithium-ion batteries, their supplies would surely be disrupted.”

Trade Minister Don Farrell told Crikey the Albanese government was working hard to diversify overreliance on any one trade partner, declaring it “the central plank of the Albanese government’s trade policy strategy”.

“We are building international partnerships on green trade and investment in key areas like hydrogen and critical minerals to drive Australia’s ambition to become a renewable energy superpower,” Farrell said, citing the new Singapore-Australia green economy agreement (GEA).

But Farrell said the government was also working hard on “actively engaging with trading partners to deepen economic ties, particularly in our region”, an apparent reference to Foreign Affairs Minister Penny Wong’s tour of Asia last year.

Behm said that Wong’s trip — which included Australia’s first ministerial visit to China in three years — showed the government’s intention to clean up the Coalition’s diplomatic mess to secure Australia’s “national and regional economic prosperity, social stability and regional security”.

And it’s not hard to see why. Beijing has proven itself more than game to retaliate using its supply chains.

The former Coalition government’s hardline stance with Beijing began when Australia blocked Chinese telco Huawei from accessing the 5G network on national security grounds, but relations iced over completely when then prime minister Scott Morrison publicly and repeatedly called for an independent investigation into the origin of COVID-19 at the start of the pandemic.

The diplomatic bungle infuriated Beijing and prompted a slew of warnings from China about the Australian government damaging its bilateral relationship “beyond repair”.

“The Morrison government’s adventurism to fiddle with this mutually beneficial comprehensive strategic partnership is in defiance of rational thought and common sense,” read an editorial in the Chinese state media newspaper Global Times in April 2020.

At the time, Morrison dismissed any worry, saying Australia’s relationship with China was “mutually beneficial”. He added he saw “no reason” why its lucrative trade industry “would alter in the future”.

But it did. The $1.2 billion wine export industry was slashed to a $200 million fraction of its former glory amid strict tariffs of between 116–218% on each bottle, and the unofficial ban on Australian coal exports to China saw a 2020 peak of 4.26 million tonnes dwindle to zero by 2021. Russian cargoes replaced Australian supply.

It cannot happen again, Behm warned, as the clock runs down on Australia’s last chance to stop climate change.

“Australia and China have a deep interest in mitigation and adaptation as key responses to climate change, an interest that we were working on bilaterally two decades ago,” he said. “Australia’s and China’s ability to work on this will depend on our trade in minerals like lithium and nickel and rare earths to make our world a better place for coming generations.”

And why do we depend on China? Because one JW Howard drove the solar manufacturing business there. UNSW was the key centre of the development of photovoltaics. We had the finest silicon, the best designs, but a government owned by coal.

Costs and scale are the answer.

Do you mean very cheap labour?

Costs. End to end. Labour is just one component.

So what can be done to mitigate the risk??

How about starting up some industry here!

Make PV panels in Australia. Tindo Solar in Adelaide already does it. Let’s see all govt projects that need PV buy only Australian made panels.

There are Australian players in the inverter and battery market too. Let’s support them and build their capacity. Have the govt buy a stake in these companies if necessary to expand capacity. Support these home grown companies, and we won’t be so reliant.

Scale and cost is the issue with manufacturing in Australia. It’s not only the manufacturing costs its the end to end costs.

Which is why it needs support Lex.

It won’t happen on its own, but you know what? The federal government subsidises fossil fuels to the tune of over $10billion p.a.

Imagine if they pulled up stumps on that, and decided to use it to support these newer industries.

We might just hit a critical scale.

Lex doesn’t want you to imagine anything except fear and kowtowing to China and its mate Russia.

We do need to stay in China’s good books, but they also need to stay in ours. They cannot otherwise supply 59% of the world’s lithium batteries when only 53% of the world’s lithium comes from countries other than Australia.

While we may mine it, we don’t have the knowledge or capacity to process the ore. It’s not just the Lithium either. Much more is required in batteries, electric motors etc including rare earths. China accounts for 63 percent of the world’s rare earth mining, 85 percent of rare earth processing, and 92 percent of rare earth magnet production. The latter is absolutely required for EV’s and many other things. If China decides to use the usual Western coercion methods (following the US methods) we will be the ones that suffer.

I wouldn’t be so down tempo on Australian energy storage research and production. Australia is very much in the game with many companies undertaking research and developing energy storage technology. We also have huge reserves of the all the required minerals.

The current share of Mineral Demand for an Energy Storage unit:

Graphite 58%

Nickel 18.6%

Cobalt 6,2%

Manganese 6%

Lead 6%

Lithium 4%

Other (Aluminium – Chromium – Copper – Vanadium – Zinc) 5%

The Pilgangoora lithium-tantalum project in the Pilbara, Western Australia is set to be one of the world’s biggest lithium mines,

Chalice Mining’s Julimar Project in WA is the largest nickel sulphide discovery globally in the last 20 years.

Australia has the worlds 2nd largest proven Spherical Graphite Reserve outside of Africa located in South Aust. – Battery Anodes. They plan to produce the anodes in a factory in Port Adelaide SA.

There are a number of Australian Companies developing here in Australia new battery technology such as lithium sodium and lithium sulfur energy storage

Lis Energy based in Brisbane with revolutionary lithium sulfur batteries that are lighter, cleaner and greener and deliver more than twice the energy density of lithium ion.

While we can design great things and mine the minerals, we simply lack the scale to compete on the world stage. Scale brings cost savings and competitiveness.

Mining is not processing. We do not have the capacity for the processing and manufacturing in Australia is a cottage industry in reality.

All of the Australian EV Charger companies are moving their manufacturing overseas. Why? Cost and scale.

Lex is also extremely pro-Putin.

Lex is usually anti-Australian. It’s as if Lex actually wants to cheer on anyone who’s against Australian interests.

Lex is also very vitriolic. Watch the venom spew against against anyone who criticises her/him.

Isn’t lithium old hat already? I thought sodium batteries were gonna blow up this year.

Indeed, adaption will go on.

Our weakness in internal environmental policy is the biggest impediment IMO.

Sodium might well blow up. It is even more reactive than Lithium.

As with Putin, you can’t put all your eggs in one bastard.

How would we describe trump? Hero-leader of the Free World? Ethics are hard to find at the top. Far too hard.