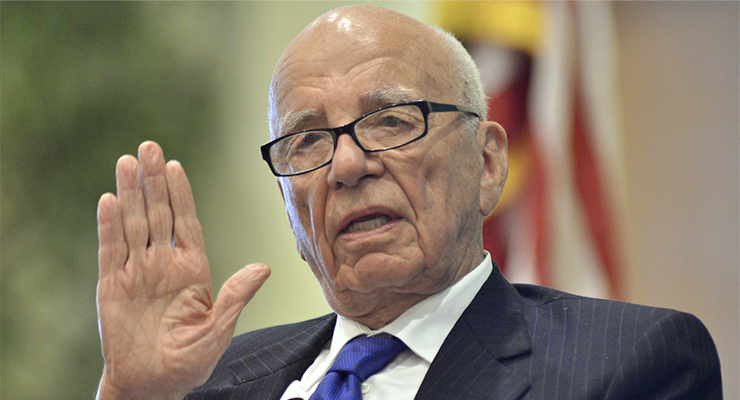

It seems not even a new girlfriend and photographs of the 91-year-old media tycoon living it up somewhere in the Caribbean could sway the cold hearts of News Corp’s minority shareholders into supporting the recombination of the two arms of the Murdoch empire.

Rupert Murdoch has stopped an assessment of a potential merger of Fox Corp and News Corp, which have been separate for nearly a decade, officially notifying the boards of both companies that the proposal was being withdrawn. The news was relayed in a press release after US trading had ended at 4pm Tuesday on Wednesday morning in Australia.

“In withdrawing the proposal, Mr Murdoch indicated that he and Lachlan K Murdoch have determined that a combination is not optimal for shareholders of News Corp and FOX at this time,” News Corp said in a filing with the US Securities and Exchange Commission.

“As a result of this action, the special committee of the board of directors of News Corp has been dissolved. The board would like to express its appreciation for the special committee’s efforts on this matter.”

No further comment or explanation was given as to why Rupert Murdoch withdrew the proposal. The fact that he withdrew the proposal, along with son Lachlan, indicates it was their idea and didn’t have the support of the boards of either company.

Fox released a similar statement.

Recent media coverage from the United Kingdom has focussed on the generational tensions inside the family and the Murdoch Family Trust regarding Rupert and Lachlan’s proposal to recombine the companies, which split in June 2013 into News Corp and what eventually became Fox Corp.

The family trust is the key control vehicle for the empire, allowing Rupert and his elder children — Lachlan, James and Elizabeth and Prudence — to control the two companies with around 15% of the votes but nearly 40% of the voting shares. The recombining proposal needed support from both types of shareholders: the voters like the Murdochs, and the non-voters like small investors and institutions of varying size.

For the first time in years, this gave non-voting shareholders equal footing with the Murdochs and the family trust, which had long dominated votes taken at annual meetings on directors, motions on climate change, changes to the voting system, political donations and news coverage. All motions considered adverse to the interests of the Murdochs were voted down by the trust, while all pay and other deals favourable to the Murdochs and the management teams of both companies — especially News Corp — were approved.

But in the case of the remerging of the two companies, non-Murdoch shareholders had an equal footing and a voice, which some used publicly to oppose the proposal without changes to the asset holdings, such as calls to sell the 61% stake in Australian property listings business REA — Lachlan’s big success story for the family.

There were also calls to spin off or sell the Australian newspapers, the UK newspapers, the 65% cable TV business, Foxtel, or even float off the most successful part of the News Corp empire, Dow Jones and The Wall Street Journal, which is now becoming a revenue and earnings powerhouse for News and the family.

US analysts wonder if the proposal has been put off, not abandoned, because of the phrase in both statements that it was “not optimal for shareholders and Fox at this time”, which suggests there may be a time when it becomes “optimal” in the minds of the Murdochs, the boards of both companies and some other leading non-family shareholders.

The statements do not say the proposal will not be revisited — just what amounts to a postponement.

No issues around potential fallout from Dominion voting-machine lawsuit?

“That was no girlfriend, that was my nurse.”?

You’d think a man with that much wealth would be able to afford a nicer suit.

It might be hard to explain to US shareholders who aren’t related to the Moloch family why they have to pour so much money into an Australian broadsheet newsletter for the Friends of Pell.

He does appear to be losing his touch.