If there’s one lesson investors and lenders to licensed banks should have learnt over the past fortnight, it’s don’t trust Western governments as far as you can throw them.

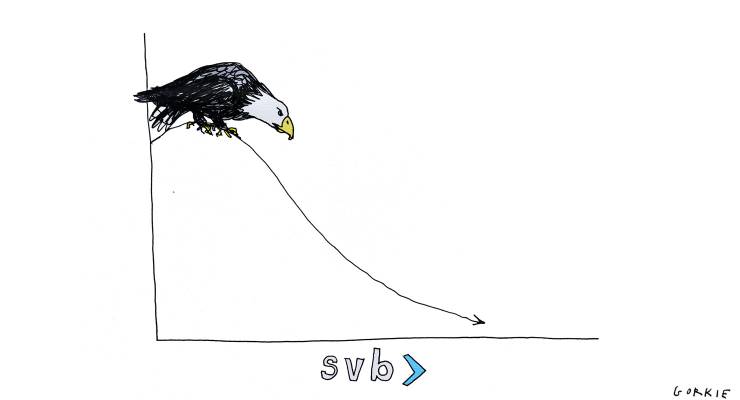

The tens of thousands of shareholders in Silicon Valley Bank (SVB) were collectively sitting on a public company worth US$15.8 billion when the stock last traded at US$267.39 on March 7 — and then bang, government intervention rendered it worthless three days later.

Sure, a big share of the blame rests with flighty venture capitalists and the tech sector, which led the charge in withdrawing US$42 billion of deposits in just 24 hours.

After summarily closing Silicon Valley Bank on Friday, March 10, by the Sunday night, the US government was suddenly up for guaranteeing all US bank deposits and allowing US banks to borrow unlimited amounts from the Federal Reserve against its government bond holdings at 100 cents in the dollar. Why on earth wasn’t this offered to Silicon Valley Bank as well?

The same applies to the 11 big US banks that happily deposited US$30 billion with fellow Californian bank First Republic in order to meet the demands of its own bank run.

If they were prepared to do this for one bank, then why not Silicon Valley Bank, which had a market capitalisation of US$45 billion when its shares peaked at around US$760 in 2021?

On the books

When a public company collapses, it is always useful to look at the last published audited accounts to see how far off the truth they were.

SVB ran on a calendar year and reported a modest US$293 million loss in 2022, which was a big turnaround on the US$1.44 billion net profit in 2021.

The auditors KPMG signed the final accounts that claimed it had US$2.26 billion in cash, US$3.3 billion in long-term debt, and US$16 billion of shareholders’ equity, which was slightly above the closing market cap when it last traded.

Rather than relying on press coverage, it is better to read the formal documents filed by a company with the regulators. On March 3, SVB filed this 133-page proxy statement with the US Securities and Exchange Commission (SEC) ahead of what was intended to be a fully virtual AGM to be held on April 27.

Everything seemed OK, but then on March 8 the company announced a US$2.25 billion capital raising, comprising a US$500 million placement to a fund called General Atlantic, plus a US$1.25 billion offer of ordinary shares and a US$500 million offer of what the Americans call depository shares, or preference shares in the Australian vernacular.

Almost as a postscript, it then added the following bombshell at the bottom of the one-page capital-raising announcement:

Additionally, earlier today, SVB completed the sale of substantially all of its available for sale securities portfolio. SVB sold approximately US$21 billion of securities, which will result in an after tax loss of approximately US$1.8 billion in the first quarter of 2023.

There was far more detail in this 77-page prospectus, but, crucially, the underwriting of the capital raising was not locked in and the announcement triggered the avalanche of withdrawals that killed the bank.

This then led to the briefest “it’s all over” announcement you’ll ever see, with long-serving SVB CEO Gregory W Becker informing the SEC:

On March 10 2023, SVB Financial Group’s (the ‘Company’) wholly owned subsidiary, Silicon Valley Bank (the ‘Bank’) was closed by the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation was appointed as receiver. The Company is no longer the parent company of the Bank. The Company has terminated its previously announced equity offerings.

While there is little sympathy for banks or the Silicon Valley crowd, surely the US government could have tried saving the bank rather than shutting it overnight. And why were depositors guaranteed 100 cents in the dollar while shareholders and bondholders were wiped out?

Then you’ve got the scandal of Credit Suisse being forced by the Swiss government into a shotgun wedding with arch-rival UBS, an outcome that will maximise the global redundancies and further reduce competition in the finance sector.

Competitors such as Australia’s Macquarie Group should have been given an opportunity to bid for Credit Suisse, and the Swiss government should not have completely wiped out US$17 billion worth of Credit Suisse hybrid security holders while throwing a few bones to the regular shareholders.

For the Swiss, putting UBS and Credit Suisse together is the equivalent of CBA, Westpac, NAB, ANZ and Macquarie Group all being rolled into one Australian mega-bank.

‘Fire!’

While Credit Suisse had a series of missteps and management shake-ups, Silicon Valley Bank had been steadily run by Becker since 2011. He did very little wrong, except leaving the bank overly exposed to US government bonds. However, it was the central banks that foolishly left official interest rates near zero for too long before then brutally jacking them up to snuff out the inevitable outbreak of global inflation — which they also largely caused.

Who goes broke buying the safest bonds in the world? A bank relying too heavily on ruthless venture capitalists for deposits, it seems.

It is extraordinary that SVB’s clients were able to withdraw US$42 billion in 24 hours. When Blackstone, the world’s biggest private equity firm and largest private owner of property, suffered a spike in withdrawals from its biggest property fund, it simply suspended redemptions.

Sure, this caused a few headlines and hit the Blackstone share price, but it remains alive and well to this day, unlike SVB.

The great irony of the US government shutting SVB overnight is that it caused a surge in US bond prices, as the yield on US two-year bonds crashed from 5.07% to 3.8% in a week. If only SVB had waited another week to sell its adviser Goldman Sachs that US$21 billion portfolio of bonds, they might have got out for a profit.

While some alt-right “journalists” at the likes of Fox News, Sky News and The Daily Mail tried to pin SVB’s collapse on diversity, wokeness and some donations by individual directors to the Democrats, the governance was actually pretty good.

The 12-person board comprised 11 independent directors (see profiles on page 21 of the proxy statement) and a long-serving CEO, which is unusual for a US company. Sure, there probably could have been a couple of extra actual bankers on the board to ask the hard questions of management, but in the end, they simply got done by the age-old challenge of banking: how do you manage your risks when borrowing short and lending long?

It’s not easy when someone screams the equivalent of fire in a theatre on Twitter and there’s a virtual stampede from the very people you were set up to support. And it’s even harder when the US government treats you differently than everyone else in the banking sector.

Gosh, do you think so? That’s very mild language for the bank convicted in June 2022 for failing for years to prevent money laundering by a Bulgarian cocaine trafficking gang, ordered in March 2022 to pay damages of more than half a billion dollars because of a long-running fraud committed by a former Credit Suisse adviser and subject to many allegations in February 2022 of illegally handling dirty money over decades when 18,000 account details worth about US$100 billion were leaked. That’s just last year. In 2021 things were not much better with various scandals, a loss of US$1.75 billion and a rapidly sinking share price. Credit Suisse, notorious Swiss banksters.

In the real world, that is scandalous.

In the banking world, it’s just slight missteps

Why on earth wasn’t Silicon Valley Bank bailed out by the US government?

Perhaps because many of us can remember back to 2008 when banks the world over were bailed out by governments. The banks had made truly mad decisions but no-one went to jail or suffered any pain worse than a wrist slap with a wet lettuce leaf. People lost their homes – but hey – the banks survived.

Enough already.

It’s called ‘moral hazard’, so as not to encourage lax governance….

FDIC is there to protect depositors, not shareholders or hybrid holders.

The only reason SVB had that market cap was because of the lack of transparency in its book.

depositors need to be protected – investors are gamblers who should know the risks

I don’t care about the shareholders. They wanted all of the riches of owning a bank but none of the responsibilities.

They definitely should have been wiped out and I don’t have that much sympathy for depositors – they put their money into a bank called Silicon Valley Bank. If you were writing a parody and you wanted to invent a bank that would definitely think they were better than the old way of doing things and took stupid risks, you’d call it Silicon Valley Bank.

You should care. You might unwittingly be a shareholder through your superannuation account.

You wouldn’t need to care if your super fund was a defined benefit one.

Also an issue of Chief finance &/or risk officers within SVB and investor groups/companies doing their own analysis and even stress testing for risks.

Finance 101, bonds or security interest rates rise, their value declines, hence, more focus should have been applied by investors and choices made; it’s a free market.

Also, political ‘catering’ where second tier banks like SVB avoided regulation applied to first tier banks (under Trump?), gave more wriggle room but also more risk.

It’s only proper that shareholders that by definition take an equity risk lose that equity if the business collapses. Deposit holders are a completely different animal and if you believe in the principle of capitalism, unfortunately that means from time to time businesses collapse and everyone needs to understand the difference between equity and debt. Also, to be fair to the government and the reserve bank/central bank they have other goals and aspirations in regard to safeguarding the economy which must be taken into account as well