As we approach Tuesday’s federal budget, the economic situation is one in which Labor supporters ought to be looking forward to some major progress. Australia has effectively reached full employment (when there are roughly as many employment vacancies as jobseekers) for the first time in 50 years. As a result, the number of recipients of JobSeeker benefits has fallen sharply, meaning the cost of increasing those benefits is less than it has been in many years.

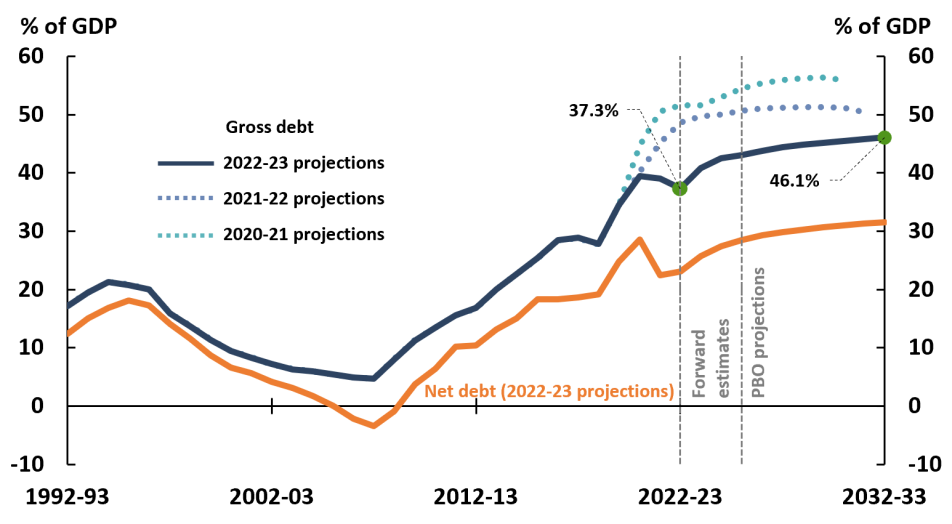

Windfall tax revenues have returned the “headline” budget starting point to surplus. In real terms, the situation is even better than that. Because the rate of interest on public debt is below the inflation rate, the real value of debt is declining automatically. The ratio of public debt to GDP is falling even faster, and is far below the level considered acceptable in most developed countries. The sharp increase in the debt-GDP ratio — foreseen as recently as a year ago — now looks modest, if it happens at all.

The government has flagged some increases in resource rent taxes that will improve the budget position a little further. There is plenty of room to raise more revenue, thanks to the failure of the previous government to close loopholes. Superannuation concessions, negative gearing, franking credits and a wide variety of tax rorts could be closed off, allowing us to meet vital needs in health, education and aged care.

Most importantly, the picture would change radically if the budget included a progressive reform of income tax scales, to take effect in 2025-26, after the next election. This would keep faith with the 2022 promise to implement Morrison’s stage three tax cuts on schedule, and let voters decide whether they want to make them permanent.

We will see nothing like this. In rhetoric that smacks of deception, self-deception or both, the government has hyped up the increase in nominal interest payments as a major burden on the budget. This in turn is a reason for failing to meet basic needs (although $240 million could be found for a vanity stadium project in Hobart).

The budget measures floated are the kind we might expect from a tired conservative government that has run out of ideas and is trying to buy some time. To see them as the leading measures in the first full budget of a new Labor government is truly depressing.

This is most obvious in relation to JobSeeker. Needing independent Senator David Pocock’s vote for its industrial relations legislation, the Labor government resorted to the favourite expedient of a tired government: establishing a committee. But when the grandly named Economic Inclusion Advisory Committee came back with an answer everyone expected — that JobSeeker benefits are too low to live on — the government reacted with shellshocked surprise.

After a string of leaks suggesting that an increase would be too unpopular to countenance, there was a retreat to a half-baked compromise, providing an increase to people over 55, who presumably can’t be stigmatised as undeserving. Similarly half-baked is a proposal to partially reverse the Gillard government’s decision to push single parents onto JobSeeker.

Then there’s the “energy bill relief”. The fact that real wages are falling is a major economic problem. But rather than address the actual issue, the government has promoted a framing in terms of “cost of living” pressures, tying it to last year’s disruptions in energy markets, which are still feeding their way into electricity bills. The response is a convoluted system of handouts, packaged into reduced electricity bills.

A short-term handout is rarely an optimal response to economic problems, except when it is needed as a stimulus to slumping demand. But if one was needed, the government could have followed the example of its predecessors and extended the low and middle income tax offset for yet another year. Such a measure could have laid the basis for a proper reform of the income tax system, including modification of the stage three tax cuts.

There’s still time for a turnaround. The leaks we have seen so far may turn out to be nothing more than test balloons. But so far, this government has been one that regularly disappoints its supporters, even after preparing for disappointment.

Indeed it has. It was interesting to hear on ABC RN Breakfast this morning how Chalmers went about this. Paraphrasing somewhat, he went grovelling to the fossil fuel corporations and begged them for something, anything, he could present as some sort of increase. They eventually took pity on the poor chap and said they would allow him to make the minor adjustments he is now talking about, so long as he promised to never darken their door again. This is the last time they will tolerate it. He thanked them for their gracious condescension and went away very pleased with himself for not getting torn to bits like Rudd back in the day. Meanwhile of course the irreplaceable resources that belong to the people of Australia are still being, near enough, given away by the government.

Oh yes. Albanese and Chalmers will be delighted with that description. They might well print it out and pin it on their office wall. It is obviously their ambition to be seen as a tired conservative government with no ideas; they’ve planned for it, worked for it and consistently promised it for years and now they’re delivering it. We cannot say we were not told. This is a government whose sole concern is to appeal to those voters who admire and are reassured by tired conservative governments bereft of ideas. It’s not as though other voters, who want something more from Labor, are going to vote Liberal, is it?

Albanese and Chalmers certainly worked hard to superglue the ALP to the Stage 3 tax cuts. I think that there would be more chance of Morrison getting a job promoting EVs than the ALP going to the next election promising to repeal the already in place cuts.

Maybe those other voters will realise it’s time to stop voting for the major parties… We can only hope.

Having denied that supply side factors are causing our inflation this budget is based on a false premise and also beds in neoleralism. So the poor still get hammered and inflation will be untouched. Whoopee.

Neo-liberalism sadly still rampant in Australia. The government seems quite willing to save money by keeping up steady downward pressure on the rate of the Jobseeker payment, rather than going after all the businesses that rorted Jobkeeper, a massive corporate welfare handout, that went way over budget under the watch of the previous treasurer, Josh Frydenberg. It is about time the government viewed welfare as an opportunity to invest in potential future taxpayer’s for the good of the country. The current rate of Jobseeker would make it extremely hard to afford the data and digital devices to engage with the modern economy, especially after all their benefit has gone on paying for food, rent and utilities just to survive.

Factors ignored by media and Labor supporters i.e. two decades of right wing ‘free market’ finance and political media agitprop, wedging Labor in whether in opposition or government while right wing media cartel dog whistles unions, youth, minority groups, immigrants etc.; we witnessed how both Rudd and Gillard governments were treated by our media cartel in the noughties for the LNP then to come back for a decade…. Labor is being overly cautious in a conservative nation.

On Jobkeeper, one does not agree on increase only for 55+ age, but with working age cohort on a steady demographic decline (padded out with temps e.g. students & WHVs), employment opportunities will only improve as the baby boomer bubble transition into a very crowded retiree cohort i.e. increasing old age dependency ratios till mid century (reflecting permanent population vs. temporary churnover of younger), OECD data trend here https://data.oecd.org/chart/74O4

On electoral demographics, including regions not just cities, our electors are ageing and more in retirement with short term horizons but dominate the above median age vote (that is more conservative and targeted to be so), and has been the domain of the LNP, includes paring off old Labor voters….

Even if the jobseeker rate goes up it is still falling at the rate of 7% p.a. And while the figures are slaves to whatever the current definitions of ‘unemployed’ and ‘job advertisement’ are – at the whim of pollies – it’s all pretty meaningless. Changes to these over the last few decades have made it impossible for even the decision makers to know what is actually happening on the ground, so their ability to make good decisions to benefit real people is compromised. I don’t know the definition of ‘survival’, but the black (i.e. unofficial) economy is booming thanks to peoples’ prediliction to survive. I doubt Albo’s mum was pushed beyond the limit the way today’s single, renting, parents are. A serious reappraisal of priorities is well in order. Overdue, in fact. Focussed on poverty. As everyone knows. For pity’s sake stop voting for the same old garbage.

People!

Oh it might come down a bit by accident via all the unemployment the recession the RBA’s decided we have to have will cause, Michael. Just enough to please the RBA while leaving the other two thirds of inflation and its cause untouched and unspoken. Gives privatise the profits and socialise the losses a whole new meaning, doesn’t it?

this government has been one that regularly disappoints its supporters, even after preparing for disappointment – yep … although I suspect that many of these “supporters” and now “former supporters”

“ As we approach Tuesday’s federal budget, the economic situation is one in which Labor supporters ought to be looking forward to some major progress”

Well, maybe the poor dear rusted ons. Everybody else held their nose and got Labor through on preferences, purely on a lesser evil basis, with fingers crossed and prayers said for a minority government so they couldn’t behave exactly as they’re behaving, John. We expected sweet FA from a Labor majority government and that’s what we’re getting.