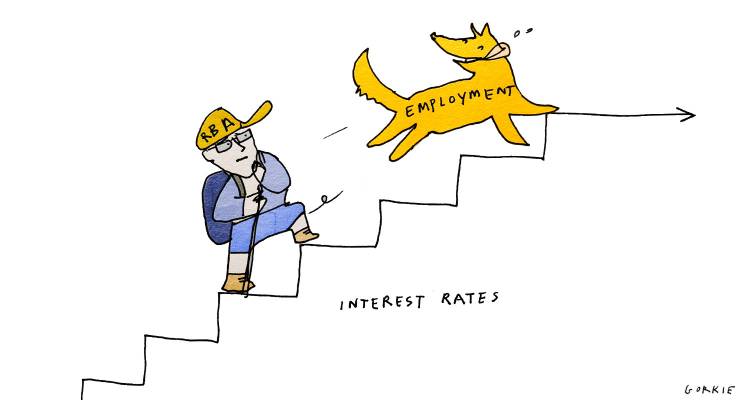

Earlier this week we reflected on NAB’s expectation that by the time the Reserve Bank had finished lifting rates, hundreds of thousands of people would have lost their jobs. Then, at 11.30am yesterday, the May jobs report from the Australian Bureau of Statistics emerged to make dills of us all, with a far stronger result than expected.

Employment topped 14 million for the first time ever, and the jobless rate fell to 3.6% from 3.7% in April, when economists claimed to detect signs of a weakening in the jobs market. In all, 465,000 jobs were created in the year to May (though the number of unemployed “only” fell by 55,000 in that time, meaning many of those jobs either went to immigrants or graduating students).

Within minutes, the hawks of the Financial Review were predicting/demanding another rate rise, presumably on the basis that if 12 rate hikes in 13 months, including four by 50 points, hadn’t pushed unemployment up, then by God a few more would do the trick.

But the RBA, which seems bereft of ideas about what to do, knows that going much further with rate rises will send the economy into recession, or even cause a sudden crunch that will exact a terrible toll in terms of jobs, small businesses and borrowers. And it will wear the blame for decades to come.

Perhaps New Zealand offers a glimpse of the future for Australia: its economy has been pushed into a recession by aggressive rate rises by its hardline central bank, but its labour market remains strong, with unemployment at 3.4%. NZ inflation is still running at a headline rate of 6.7%, down from a peak of 7.3%.

That’s a more likely outcome than the US, where the world’s major central bank thinks it has the US economy on track for the much-vaunted “soft landing” (older readers might recall much of the Hawke-Keating cabinet parroting its expectation of a “soft landing” in 1990, ahead of a savage, generation-scarring recession). US headline inflation is now at 4% and producer prices have started falling on a monthly basis. Sometime later this year, consumer inflation could fall to around 3% if oil prices continue to slide like they are doing now.

While the US Federal Reserve prefers another inflation measure (so-called PCE inflation), the 4% headline reading for the May consumer price index (and 5.3% for core CPI) is clearly too high for the bank’s liking. But headline inflation has fallen from 9.1% in June last year, so all those rate rises are clearly working. And the Fed has now lifted its economic forecasts — its GDP forecast for this year has been lifted from an anaemic and near-recessionary 0.4% to 1%. It expects unemployment — 3.7% in May — will rise to just 4.1% this year and 4.5% in 2024 next year.

Here, CPI was 7% in the March quarter with the monthly indicator at 6.8%, including the impact of the restoration of the halving of the fuel excise for six months last year. It was 6.5% without that. Inflation looks to have peaked at 7.8% last year (8.4% for the monthly indicator, in December).

But for inflation hawks, there are still far too many Australians in jobs, so the “rate rise looms” headlines will continue for months yet.

There we go, in black and white – the real motivation for the rate rises – to drive unemployment up and shift the balance of power from the workers and small business owners – back to the employers. Trickle down economics at work again. We could do with some vision on the Reserve Bank Board instead of rote old fashioned economic theory which hasn’t been working for the average Aussie for a long time.

i think it’s “trickle up” economics – where every last drop of our blood, sweat and tears are suctioned upward into the greedy maws of the corporations and their lackeys

Worth point out is that this is fairly new economic theory.

Old fashioned economic theory said that getting unemployment to an effective 0% (ie: “full employment”) was one of Government’s most important responsibilities.

“In all, 465,000 jobs were created in the year to May (though the number of unemployed “only” fell by 55,000 in that time, meaning many of those jobs either went to immigrants or graduating students).”

Surely a good deal of these jobs “creation” is from “churn” as in contracts that are renewed and from employees moving from one place of work to another. Politicians love to recite these figures but in reality there is often little net new job creation.

How many ’employed’ have a secure 38 hr/week job? The definition of ’employed’ seems rubbery these days, so how does anyone know what is really happening? But I do know that usury is winning: its team holds all the cards.

Yes, the bloodsucking leeches of the AFR. What a pack of low lifes.

Another point to add. The prior precondition for the RBA staying its hand on interest rate increases has been that income growth has been largely anchored to rises in house prices, and house prices were inversely anchored to growth in the non-housing and non-mining related economy which is to say growth in credit, and inflationary stasis was anchored to both growth in non-inflationary non-domestic South Asian increases in the output of goods untethered to local wages growth anchoring our own domestic demand growth untethering from wages growth, but amplifying the inverse correlations in growth in non-domestic South Asian output and accordant decrease in domestic GDP per capita.

This was until income growth became linked to actual increases in wages, which had regrettably become untethered from their formerly inverse relationship to growth in inflation. Under such conditions the RBA can only stay its hand on rates if it wishes to untether income growth from house prices, and support from growth in non-domestic output, which it can only do by concurrently anchoring growth in house prices to growth in the mining related economy, and untethering growth in credit from growth in the mining related economy.

If the latter is not possible, then clearly the RBA will find itself anchored to the former precondition of tethering income to house prices and credit growth to growth in the mining economy or where that growth is not sufficient to maintain growth in incomes, then to the non-mining economy and growth in non-domestic South Asian output.

Either way, RBA officials will have all paid their houses off before you find your next job.