NSW Labor’s first budget in government for over a decade claims to “confront the housing crisis”. It does so without any noteworthy increase in funding for social housing, leaving the state to perpetuate its long-running failure to invest in it.

In fact, it may be repeating what the last Labor government in NSW did when a federal Labor government poured money into social housing: let the feds do all the work.

The Minns government’s budget mentions housing a lot, with nearly 20 announcements about new spending. But it pays to look carefully at the dot points — more carefully than the public servant who allowed the “Faster Planning Program” to contain an announcement of “NSW Budget 2023-24 budget.nsw.gov.au”.

That planning program is nearly $40 million to accelerate the much-criticised approvals process for development in the state, including “$5.6 million on artificial intelligence to make planning systems more efficient” and improve building standards.

There’s also a $220 million essential housing package for a variety of spending — debt financing, housing services for First Peoples, social housing maintenance, mental health housing, and homelessness services. And the government will establish “Homes NSW, to deliver better outcomes for public and social housing tenants, deliver more affordable and social housing and reduce the number of homeless people in NSW”.

Labor is also going ahead with a “housing and productivity contribution” levy on developers to fund infrastructure required for new housing — transport, schools, health services, police services.

All of these are valuable investments, and they put substance to Premier Chris Minns’ push for higher-density housing sooner. Well done. But where’s the social and affordable housing funding? There’s $300 million in Landcom dividends that will be reinvested so it can build exactly “1,409 affordable homes”. The time period? The next 16 years. Or fewer than 100 a year.

And how much for social housing? Step forward the feds: NSW is “permanently expanding the number of social housing dwellings by around 1,500 through the $610.1 million Commonwealth social housing accelerator program”. In the housing announcement itself, the feds again: “[The] Commonwealth’s $610 million social housing accelerator program will permanently increase social housing by around 1,500 dwellings.”

That funding is NSW’s portion of the $2 billion extra that Prime Minister Anthony Albanese announced earlier in the year in an effort to get his housing fund through the Senate. There’s been no concomitant increase in state funding, or seemingly any increase at all. If the feds are funding an extra 1,500 dwellings, what’s NSW doing?

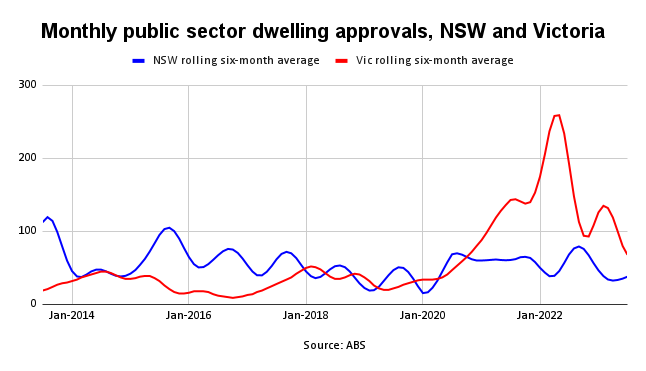

The performance of the NSW government in recent years on social housing has been abominable. In the 12 months to June this year, an average of 46 publicly built dwellings were approved each month in trend terms. Approvals isn’t a great indicator — approvals don’t equal construction. The approval process can be lumpy, and it doesn’t tell us how much old social housing stock is being removed from the market — but it can give us a good indication of how active state governments are, especially if you use trend data. In the 12 months to June 2022, NSW did a little better at an average of 57 a month. In 2020-21, with the pandemic raging, it was 60 a month. In 2019-20, it was just 42.

Let’s compare Victoria: in 2019-20, the Andrews government built just 37 dwellings a month on average (that was slightly better than 35 a month in 2018-19). But as part of a substantial commitment to social housing by that government, the number leapt to 108 a month in 2020-21, then to more than 190 the following year. In 2022-23, it settled back to 93 a month.

The Andrews government has dramatically lifted its game on social housing (but remember these are just new dwelling approvals; many are replacing older stock, so the net addition is smaller), such that even a quieter 12 months last financial year was twice the level of NSW.

Back during the financial crisis, NSW and Victoria received substantial funding from the Rudd government for social housing, leading to a brief boom in social housing approvals (and construction). In both states, that was followed by an extended slump as both governments cut back on funding.

At one stage in NSW, the number of public dwelling approvals fell below 20 a month; in Victoria, they fell into single digits. It’s called cost-shifting, when states take advantage of Commonwealth spending in the same area to cut back their funding. Is NSW now doing the same thing to the Albanese government?

And this comes after previous Coalition governments in NSW engaged in their own version of “social cleansing” by flogging off any public housing that was in desirable locations in Sydney, so there is a lot of ground to make up in NSW. Minns’ minimalist approach will not cut it.

Absolutely. Andrews and has government are throwing out the number of 800,000 public housing units over the next ten years. 80,000 per year. Currently they are doing 93 per month or 1,116 per year. Maybe you should look at this crap before comparing it to anyone else.

You could also mention the increased taxes on short-stay properties. What will happen here is anyone’s guess, but expect push-back from the My-Investment-Property-Is-Sacred crowd, and a possible walk-back of the policy. I share John Falconer’s cynicism here. There are many promises, but sweet nothings don’t get people a roof over their heads.

While nobody in power wants to see an oversupply and thus reduction of real prices, the construction of housing (and other infrastructure) cannot even be done fast enough to meet demand.

That’s one problem – you can’t solve the housing crisis without massively increasing the supply, and making housing more affordable by definition means putting downward pressure on prices in real terms. So voters who own properties might need to get used to the thought that their automatic growth in wealth might start slowing a bit. How about some kind of Nobel Prize for the first politician honest enough to tell house-owners in Sydney that their houses need to stop climbing in value?

You put it in a nutshell, Andrew. Can you imagine a politician saying: “Look, for your kids to be able to afford a home, the price of the house(s) you own will have to stagnate for quite a few years or even go a little backwards. So stop being such greedy ****s and let us implement policies to make that happen”. The politician who said that would deserve a VC, the Golden Colon for a gutsy effort, a Platinum Vertebrae for showing backbone, and a good outplacement service to find them a new job.

That might even be sellable.

But the reality is that the real cost of housing needs to be slashed anywhere from 40% (in “affordable” locations) to 80% (Sydney & Melbourne).

It is very difficult to see any way this happens in a manageable fashion.

Agreed drsmithy. It’ll take a lot of time to unwind this ball of barbed wire. Perhaps we could start with a poli that says housing is a basic right?

Norman Lindsay, through his creation Albert the Magic Pudding, had this sorted over a century ago. Albert showed that house prices become more affordable over time even as they proved to be a great investment. Large numbers of “Quiet Australians” believe him to this day.

The automatic growth in wealth only works if you’re an investor. If you only own one house you still need to buy another to replace it if you sell, therefore the growth in ‘wealth’ is chimerical because you still have to pay what the market requires.

Thus, once again, the ludicrous notion that people’s wealth resides (sorry, awful pun) in the value of their homes that is peddled by everyone from realestate agents to politicians is a complete furphy.

Value of any material good is determined by what someone is prepared to pay for it, not its intrinsic worth.

We live in a free market economy so if someone will pay more than you for anything, you lose.

Housing will only become affordable if house prices drop relative to every other expenditure, and if wages etc remain the same. And we all know wages will always face downward pressure because that’s the way Big Biz likes it and governments like Big Biz.

Unless government intervenes to put a freeze on house prices, nothing will change.

Ergo, nothing will change because we will all scream our tits off if anyone suggests that our houses should be valued at less than they are now, in the belief that the government is deliberately making us poorer. Cue Murdoch, the real estate and developer lobby, etc, etc.

Australia is stuffed.

There’s also legitimate questions to be asked about whether we actually CAN meet the level of supply required to the pumped demand.

Yes, sorry for not being clearer, that was kind of my point.

What would it take to get an article querying why in the midst of a housing crisis this large we remain so invested in models which effectively rely on a system of small scale private providers (“social” housing) or worse still developers (“affordable” housing) to deliver public outcomes.

The refusal of governments to invest publicly in markedly increasing PUBLIC housing stock, which could put shovels in the ground at scale tomorrow and make the biggest difference to the most important end of the market needs to be called into question. Even with wall to wall Labor governments there is still this unspoken neoliberal mindset as to how governments actually participate in the housing market, and I’ve heard precious little critique of the situation from anywhere in the media either.

So now we have the Vic ALP set to pull down and rebuild the entire public housing stock at massive expense, but only increase it by 1,000 homes total over a 30 year timeframe. All while redeveloping adjacent land for PRIVATE housing at market rates. This is very obviously not a model to bring prices down at the most critical end of the market, nor improve the chances of people struggling to get a leg up into property ownership.

It’s questionable whether substantial investment in public housing could get any greater volume of housing built than private industry currently does (our construction rate is, unbelievably, quite high by international standards – albeit clearly at the cost of quality), but creating a larger percentage of public housing in the overall mix should certain serve to put a downward pressure on rents.

As I (and some others) keep saying, little improvement will be made without first significantly moderating demand for a period of several years (probably on the order of a decade). We demonstrably cannot build fast enough (ignoring the perennially unasked question of whether or not we should) to keep up with current levels.

But the fundamental problem is nobody in power wants to dramatically reduce the real price of housing, which is ultimately the only outcome that will solve the problem.

As I understand it there is actually a question mark over whether any of it will be rebuilt as public housing stock.

My partner works in parenting and family support for Melbourne Council; about 2/3 of the people she works with live in public housing. Last night she tells me those folks have been given leaflets (along with bikkies and lollies to take the edge off the blow, presumably), telling them they’re to be relocated over a period of eighteen months, commencing in SIX TO EIGHT WEEKS.

This was news to her entire department in Council. Doesn’t bode too well