Australia made its biggest ever superannuation contribution earlier this year, stuffing $50 billion into retirement savings in a three-month period for the first time ever. Then *poof* it vanished. The markets ate it.

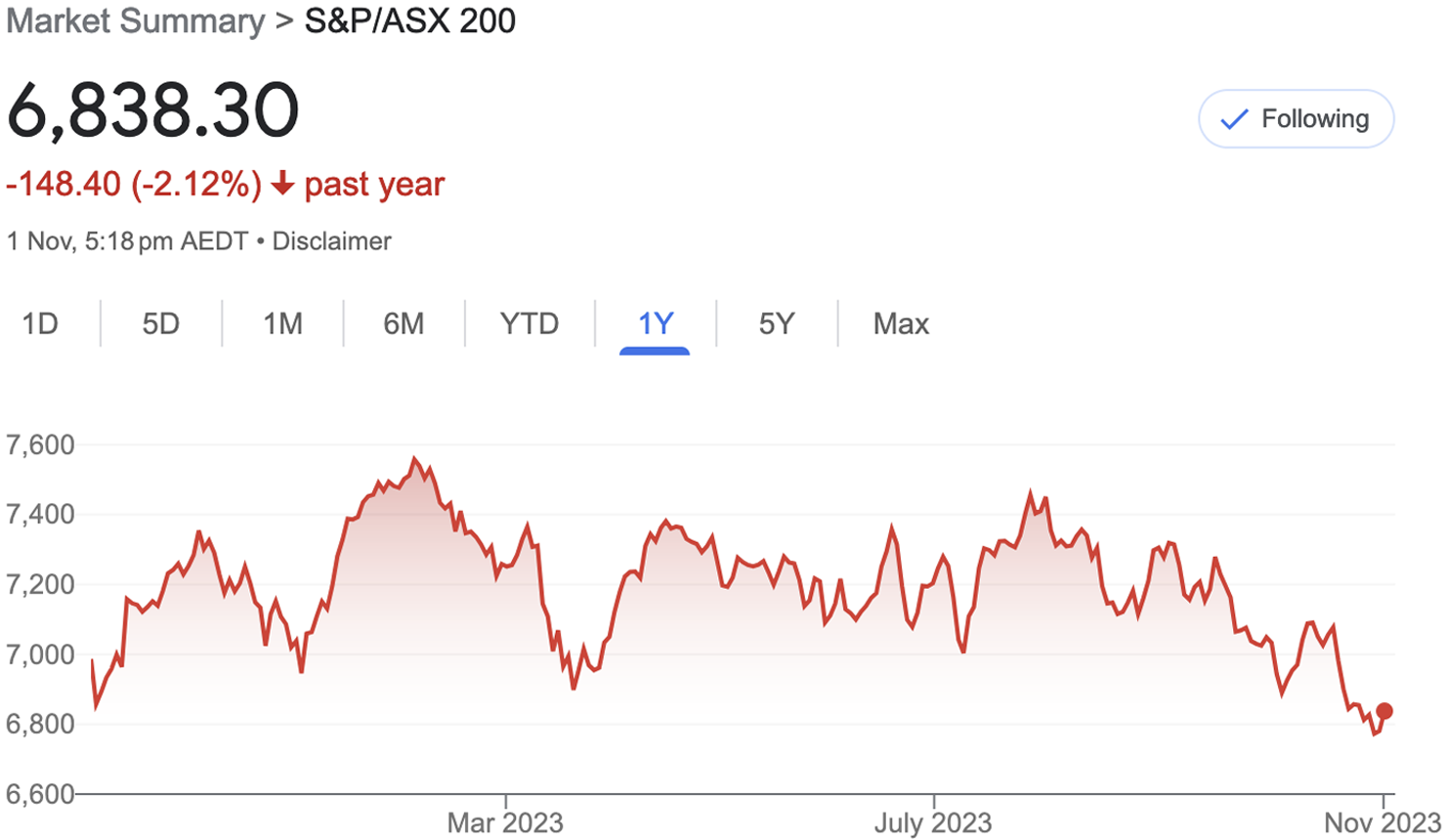

The ASX 200 was at almost 7,600 in February. Now it’s at around 6,800, a fall of 9%. Markets around the world have fallen as central banks tightened up, reducing loose capital in the global financial system. Stocks and bonds alike are down.

The total value of Australia’s superannuation has tumbled as markets have fallen. It was $3.5 trillion when the official data came out for June 30, but now I’d guess a value of $3.4 trillion is more likely, or even less. About $100 billion of value, up in smoke.

A big fall in wealth is helping do the Reserve Bank of Australia’s (RBA) job for it. Mortgagee households were having their incomes crimped, but retiree households weren’t. Some were, in fact, making more money than before from interest. That encourages spending, which is precisely what the RBA is trying to avoid.

What discourages spending is looking in your super account and finding it contains far less money than you expected.

Losing so much money in the markets is anguish-inducing. But it has a positive effect on a macro-economic level. Spending is curtailed. Wealth is a huge driver of spending, so falling wealth should put business owners in a position where they have fewer customers coming in the door and less motivation to raise prices. It could even mean the RBA has to hike rates fewer times than if the markets hadn’t fallen apart. (Although they are still likely to hike on Melbourne Cup Day.)

We own the world

Australian super is invested all over the world now. It used to be primarily in Aussie equities, but super funds have diversified in recent years as the humble ASX (All Ordinaries total value: $2.3 trillion) started to look a little small for our staggering pool of retirement savings (value: $3.5 trillion).

Australian super trustees have been shovelling money offshore, especially into US stocks, including the tech stocks that have delivered so much price growth in recent years. You wanted your super to be partly invested in Apple and Microsoft in recent years — and for many of us, it was.

Super funds’ foreign investments have fallen recently, but at the same time they have enjoyed exchange rate movements that have made the investments look better. If Australian Super buys A$1 million of Facebook stock and the stock falls by 10% but then the Aussie dollar depreciates by 10%, the Aussie dollar value of the investment is still a million. (Australian super funds use some currency hedging, but not much because our dollar is naturally hedged; it tends to fall when markets go bad, protecting the value of offshore assets.)

Where’s all the money coming from?

The fact Australians are putting so much into super is curious for those of us who follow the daily laments on the cost of living. Where’s all that money coming from?

The main answer is employers. The superannuation guarantee has risen from 9% to 10.5% in the period covered by the most recent data (it’s risen again since, to 11% on July 1). That means employers are putting more into super for every hour worked. Speaking of hours worked, there’s a lot more of them. Australia’s labour market is tight right now, with women in particular working far more than pre-pandemic. A lot of part-time workers now have all the shifts they want and more as underemployment falls.

What’s more, wages are rising. Not as much as prices, to be sure, but that doesn’t matter for super contributions. Employers are putting in a higher percentage of a higher number for more hours per week and that is responsible for a big part of the surge in super contributions we are seeing.

The other part is individuals making their own contributions and those are also at record highs. It’s harder to speculate where that money is coming from but cash left over from pandemic-era transfers seems a likely candidate. The government gave billions to small business owners; now that things have stabilised they may be withdrawing the money from their business and sticking it in their super.

Either way, that money has evaporated for now but the market is likely to bounce eventually. The stock market is at almost a record low compared to GDP. This ratio is known as the Buffett Indicator — legendary investor Warren Buffett has used it as a marker of when to invest. It doesn’t tell you when the market will bounce back but it does suggest it could do so from here.

How are you feeling about your super? Is it shaky or sturdy? Let us know by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

Really, do people still think like this. Is there no island we can use to quarantine economists for a few years whilst the grown ups can have a conversation

If all the economists in the world were laid end to end they wouldn’t reach a conclusion.

The graph shows hours worked in the economy. It should say paid hours worked in the economy. Unpaid hours contribute hugely to the economy and women undertake the majority of that work. This undervalues the contribution that women make

Still think most Australians do not understand superannuation in Oz, with too many deferring to or assuming property or ‘bricks & mortar’ are ‘safe’, even if declining real terms + cost value (& no daily feedback on price ex. Core Logic ‘hedonic index’)?

Any investment will rise and fall over time, but Australians have such a short term focus, they ignore that it’s the long term trends and income that matter; on a share portfolio expect short medium term swings of up to +/- 20% it’s not unusual.

Now we are starting to see the outcomes of super with boomers who have accumulated substantive balances retiring, but those younger following will have had a whole career to do the same, and enjoy the benefits. not just cashed up boomer retirees.

The ASX200 has increased ~2.2x since 2000.

An average house in an average regional town has increased 4-5x in the same time period.

A house on a block big enough to subdivide in a major city could be 10x or more in the same time period.

The majority of people, much like the vast majority of boomers, will retire with superannuation amounts that could only be generously described as inadequate. A small fraction will be comfortable and a tiny percentage are making out like bandits.

“It hurts to see there’s less money in your superannuation account than you expected. But on the bright side, it is helping the economy overall.”

Didn’t we hear this from the LNP for many years while they stole from the poor and gave to the rich?