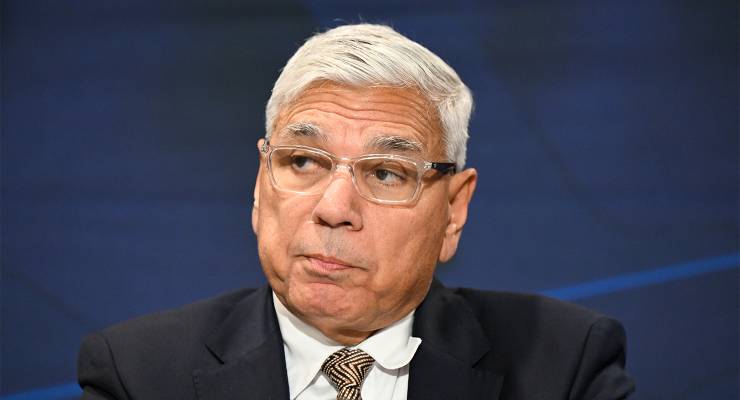

A mining exploration company chaired by Nyunggai Warren Mundine has failed to raise even one-fifth of the $10 million sought from the public and must return money to investors.

After missing, for the second time, its deadline to complete its initial public offering, Fuse Minerals must now return all funds to those investors seeking to exit.

The company has raised just $1.86 million, its latest disclosures reveal, well short of the $6 million minimum it requires to complete the raising and float on the ASX. That’s despite the company having already, on December 4, extended its initial two-week initial public offer (IPO) period by almost two months, due to lack of interest.

Chaired by Mundine, who has heavily spruiked the capital raising, Fuse Minerals has never earned a cent in revenue or conducted any substantial minerals exploration.

The Klaxon this week revealed further serious concerns with Fuse Minerals, including that it owns only one of the nine exploration licences listed in its prospectus — and that its own “independent expert” has warned it’s in danger of collapse.

The Fuse Minerals prospectus states the company has three “projects”, two in Western Australia and one in Queensland, and nine exploration “tenements”. Yet close analysis of the prospectus shows the company owns just one of those exploration licences. Most are owned by companies controlled by Fuse Minerals directors and two are not licences but applications for licences.

The highly complex, 402-page prospectus for Fuse Minerals shows that, if the float proceeds, Fuse will acquire a string of exploration licences owned by private companies controlled by Fuse Minerals directors.

Meanwhile, Fuse Minerals seems to be targeting ordinary, so-called “mum and dad” investors.

‘Big believer in mining’

Mundine and Senator Jacinta Nampijinpa Price were the two main faces of the campaign against an Indigenous Voice to Parliament last year, which made false claims of being a “grassroots” campaign of “ordinary Australians” when it was in fact a highly sophisticated operation bankrolled by a handful of wealthy figures.

Political donations data released by the Australian Electoral Commission (AEC) earlier this month shows “Advance”, the outfit at the heart of the “No” campaign, received $5.2 million in funding in the year to June 30, 2023.

Just weeks after the October 14 referendum, Mundine posted to social media that he was chairman of exploration company Fuse Minerals and was seeking to raise up to $10 million from the public in an initial public offering (IPO), at 20c a share.

“I’m a big believer of mining industry and what it does for Australia’s prosperity. That’s why I’m chairman of Fuse Minerals,” Mundine announced.

Potential investors were invited to join Mundine “for a lunch in Perth” to hear about “the upcoming IPO of Fuse Minerals” at an event to be held in Sydney on November 13, which he later said had been “sold out” forcing the company to book a bigger venue.

Fuse Minerals has now lodged a “second supplementary prospectus” — with the “close date” of the offer now extended to March 28 — yet it appears the float is unlikely to proceed. Its failure to raise sufficient funds and gain approval to float on the ASX means the company is now legally required to offer investors their money back, despite its latest extension of the raising.

“In accordance with section 724(2) of the Corporations Act, if you applied for shares under the prospectus … you may withdraw your application and be repaid your application moneys,” Fuse Minerals says. Investors have until February 26 to notify the company and recover their funds.

‘Big wig’ investors

The latest revelations draw into question media reports the IPO was backed by a string of major entities.

On November 19, the day before the Fuse Minerals offer opened, the Australian Financial Review reported Fuse Minerals was “backed by a host of mining big wigs”.

“Street Talk understands Regal Partners and Gina Rinehart’s son John Hancock have come on to cornerstone the raise alongside a commodity discovery fund out of Amsterdam and a Strata-investments-owned natural resource fund out of Bangkok,” the report said.

No source was cited for those claims.

Mundine and the other Fuse Minerals directors, Todd Axford, Vernon Tidy and Stephen Pearson, have repeatedly refused to comment when contacted by The Klaxon.

As chair Mundine is responsible for corporate governance and ethics of the company. He is also its only “independent director”.

Fuse Minerals launched its prospectus on November 20, with a “close date” of December 4 and “expected listing date” on the ASX of December 18.

It shows Mundine was paid an advance of “$55,250 plus GST” on March 11, 2023, when he was appointed chair, and “on admission” to the ASX would be paid $120,000 a year for the part-time role.

The prospectus shows Mundine was issued 500,000 shares and 2 million options in the company.

If the raising fails, those holdings will be effectively worthless.

Fuse Minerals lodged the “second supplementary prospectus” with corporate regulator the Australian Securities and Investments Commission (ASIC) last month.

Dated January 24, it states the “closing date” of the offer has been extended to March 24, with an “expected listing date” on the ASX of April 15. The original closing date of the offer was December 4, two weeks after the prospectus was issued on November 20, and the expected ASX listing date was December 18.

Fees and shares

Under the prospectus, Fuse Minerals had sought to raise between a minimum of $6 million and a maximum of $10 million, at 20c a share. Capital raisings above $10 million attract more stringent disclosure obligations.

The second supplementary prospectus states that at January 24 Fuse Minerals had received applications for “approximately 9,295,000 shares”, which at 20c a share amounts to approximately $1.86 million.

It also states: “The board of the company confirms that the joint lead managers of the offer have received firm bids for an additional 16,120,000 of shares for which formal applications have not yet been received by the company”.

No information is provided about those “firm bids”, or why they had not become “formal applications” for shares.

The “joint lead managers”, that is, the entities appointed by Fuse Minerals to manage the IPO, are Unified Capital Partners and Defender Asset Management.

The failure of Fuse Minerals to raise adequate funds is despite it offering sales commissions of 6% of every dollar raised from the public.

If the raising is successful, Defender Asset Management is to be paid a “selling fee” of 6% of all funds raised by Defender, “plus a corporate advisory fee of $100,000 (excluding GST)”.

Unified Capital Partners is to be paid a “management and selling fee” of 6% of all funds raised under the offer, less the “selling fee” paid to Defender.

If the float is successful, Unified Capital Partners will also be issued with “broker options” in Fuse Minerals, equating to 5% of the “fully paid ordinary shares on issue”, the prospectus states.

The November 19 Australian Financial Review article states the raising “represents Tony Davis and Mark Gray’s first IPO since leaving Shaw and Partners in June and establishing UCP”.

Fuse Minerals was created on September 14, 2021. Its prospectus shows that as at June 30 last year it had a stated “historical net current asset position” of just $178,749.

An “independent, limited assurance report” dated November 10, 2023 — the same day the prospectus was lodged with ASIC — warned Fuse Minerals was at risk of collapse. Ernst & Young partner Ryan Fisk wrote the company’s financial position meant there was “doubt about Fuse’s ability to continue as a going concern”.

When you throw your sisters and brothers under a train for a piece of cake and the piece of cake doesn’t materialise, you end up with less than you started with.

Paydirt.

It wasnt so much a piece of cake, as it was 30 pieces of silver.

Mudine’s a d*ck. Turncoat, his self-interest is so raw and close to the surface I simply cannot take the man seriously.

Of course he opposed the voice as a concept. As a person making a handsome income under the current regime the last thing he wanted was a new broom upsetting his cosy arrangements. Totally self interested. The libs were happy to use him in anti voice messaging but when that war was won they dumped him quick smart.

If it really is that close to the surface then it would be easy and low-cost to mine.

Poor Mundine, played like a fiddle, he might have to get a real job like everyone else.

Why would anyone invest with serial turncoat. The man was President of ALP and ended up running for the Liberals.

A game of chancer.

And the Liberal Democrat nutters! Failed all 3 times to get his butt into a cushy job.

Trifecta for Warren. Failed supporter of genuine 1st Nations causes, failed politician, now failed entrepeneur.